- Analysts warn ZEC’s symmetrical triangle could break lower toward the $220–$282 zone.

- Parabolic breakdown mirrors BNB’s 2021 pattern, hinting at a 60% correction.

- Pump-and-dump concerns rise as questionable marketing pushes and exaggerated predictions circulate.

Zcash has fallen roughly 30% from its November peak of $750, slipping to the $552 range and raising fresh concerns that its explosive rally may be reversing. The drop follows a massive 1,500% surge since late September—an extreme move now showing clear signs of exhaustion. As traders reassess the sustainability of the run-up, analysts warn that ZEC may be setting up for a deeper retracement over the coming months.

Chart Patterns Highlight a Potential 50% Breakdown

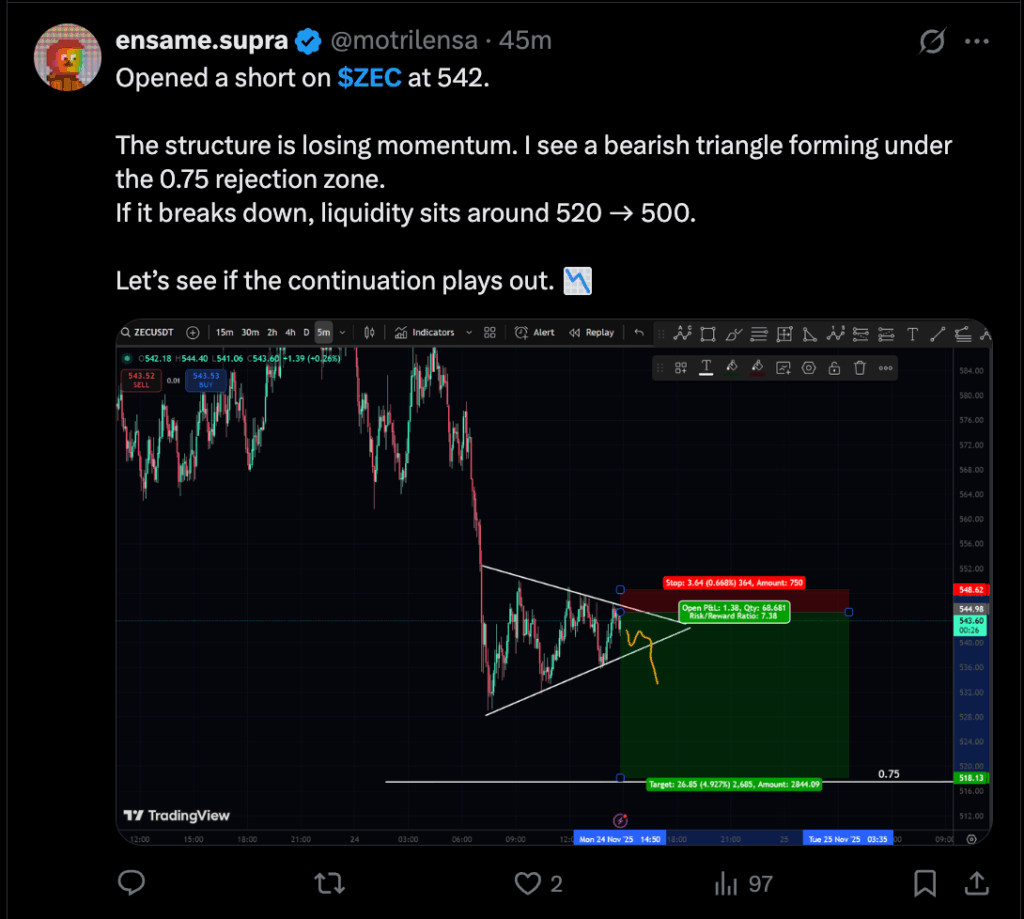

On the four-hour chart, ZEC is consolidating inside a symmetrical triangle—an indecision pattern that can break either direction. Although the token recently bounced from the 200-EMA support, broader market weakness makes a downside break more likely. If this occurs, technical projections point to a move toward $282, roughly 50% below current levels. This zone lines up with early-October resistance and the weekly 20-EMA, reinforcing its significance as a potential medium-term target.

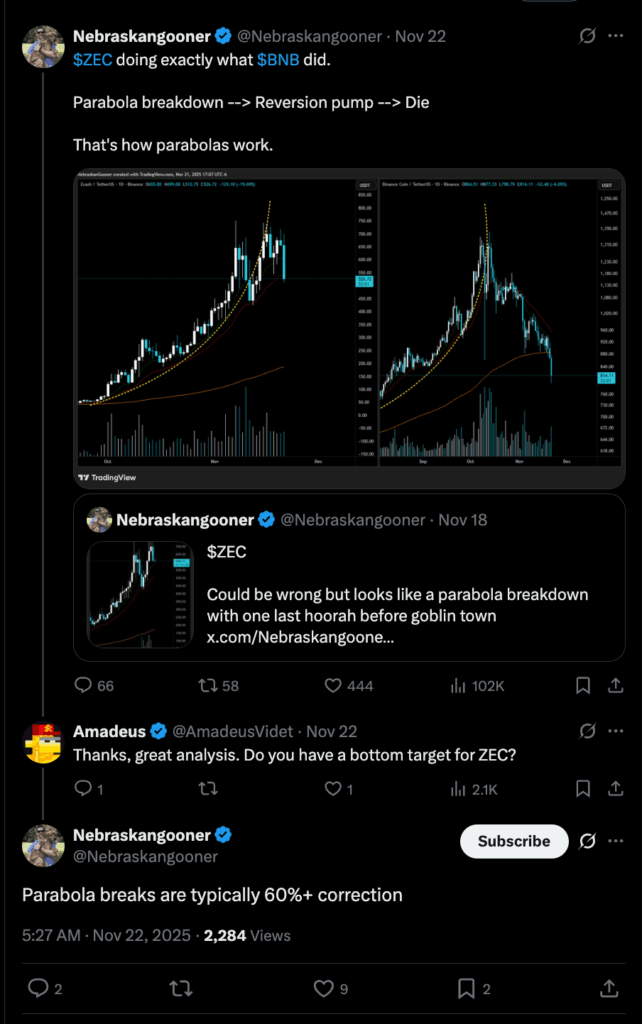

Parabolic Breakdown Mirrors BNB’s Historical Crash

Analysts are drawing parallels between ZEC’s recent parabola and the one BNB formed before its sharp decline in 2021. As ZEC failed to reclaim its parabolic trendline—similar to BNB’s breakdown—trader Nebraskangooner warns that a 60% correction remains on the table. This places ZEC’s potential downside target in the $220–$280 range if bearish momentum continues into early 2026.

Pump-and-Dump Accusations Intensify

Concerns intensified after screenshots surfaced showing marketing agencies promoting paid ZEC campaigns—adding fuel to claims that the rally may have been driven by coordinated hype. Analyst Rajat Soni highlighted fake viral headlines, including fabricated predictions that ZEC would hit $100,000, calling them attempts to create exit liquidity. Despite this, notable industry figures like Arthur Hayes and the Winklevoss twins remain long-term bullish, with Hayes even projecting a $10,000 target.