- Bitcoin and gold are reaching all-time highs due to the massive U.S. deficit spending and money printing, which devalues the dollar relative to assets with limited or fixed supplies.

- Bitcoin’s legitimacy is rapidly increasing, with over 74% of coins held by long-term investors (“HODLers”), and there’s potential for central banks to add bitcoin to their reserves alongside gold.

- In a world of devaluing currencies, having a reasonable allocation to hard assets like bitcoin and gold seems like a sensible investment strategy.

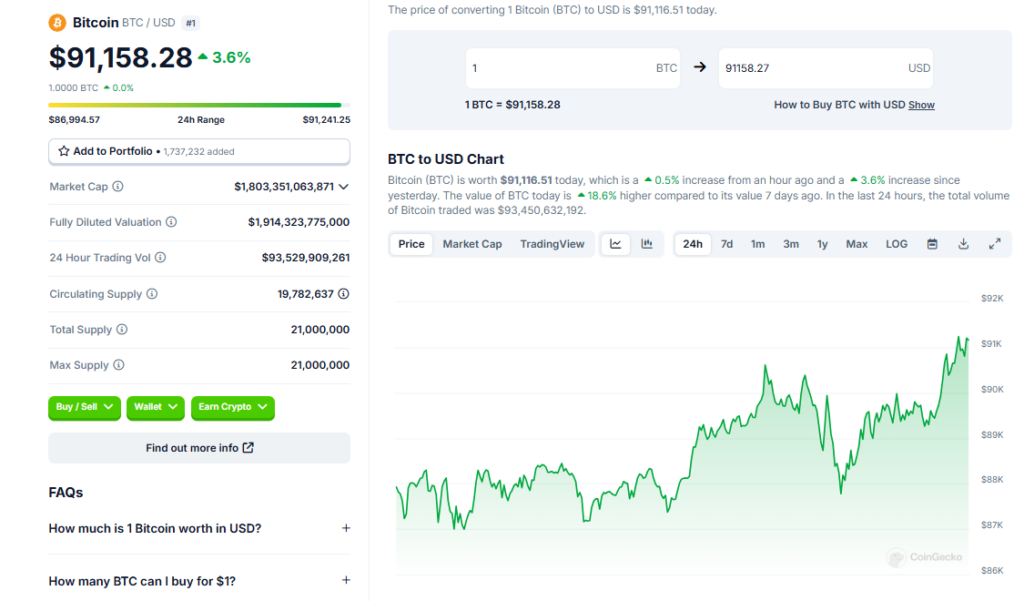

Rising prices of gold and bitcoin signal strong fundamentals that attract more investors, despite reaching all-time highs. Their limited supplies make them appealing stores of value compared to the U.S. dollar, which is declining due to massive government deficit spending and money printing.

U.S. Deficits Reach Record Levels

The U.S. deficit hit $3.1 trillion in 2020 due to the COVID-19 pandemic. Despite economic recovery, deficits remain over $1.8 trillion as the interest on the federal debt now exceeds the deficit itself. The bipartisan Committee for a Responsible Federal Budget projects deficits of $7.5-15.2 trillion under the Trump administration.

Money Printing Devalues the Dollar

Massive deficits require printing more dollars to pay off debt. Like personal finance, the government borrows and prints money to cover expenses exceeding income. This devalues the dollar compared to assets like gold and bitcoin which have fixed supplies.

Gold as Longstanding Hedge Against Currency Debasement

Gold has served as money for thousands of years. Since 1999 it has appreciated 10.4% annually, outpacing money supply growth of 6%. About 64% of central banks now plan to increase gold reserves as a hedge.

Bitcoin Gaining Legitimacy as Digital Store of Value

Bitcoin has gained traction as a currency and store of value despite crypto fraud. Its “hard money” attributes make it appealing: finite supply, increasing mining difficulty, and a secure decentralized network. Over 74% of bitcoin is now held long-term by “HODLers.”

Central Bank Adoption Could Boost Bitcoin

If central banks add bitcoin to reserves alongside gold, it would be a major endorsement. The Trump administration’s support for bitcoin’s sound money principles makes this possible. Hard assets like bitcoin and gold are critical in portfolios amid currency devaluation.

Conclusion

With massive deficit spending and money printing, allocating to scarce assets like bitcoin and gold seems prudent despite high prices. Their role as stores of value is increasing as the dollar declines.