• XRP’s “$9,000” price spike was a data glitch, not a real trade.

• No exchanges or blockchain records confirmed the move.

• Experts warn that data-feed errors remain a risk in crypto trading.

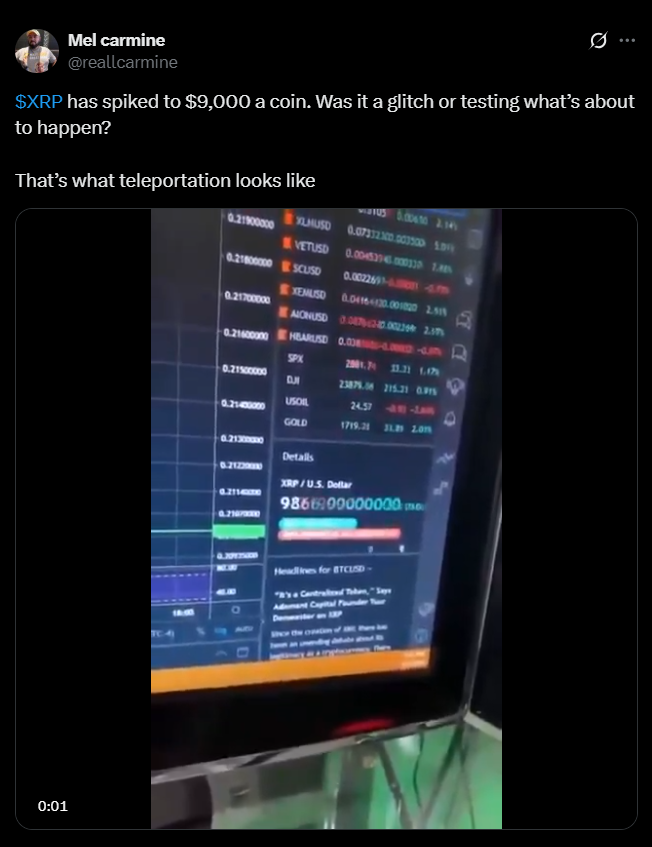

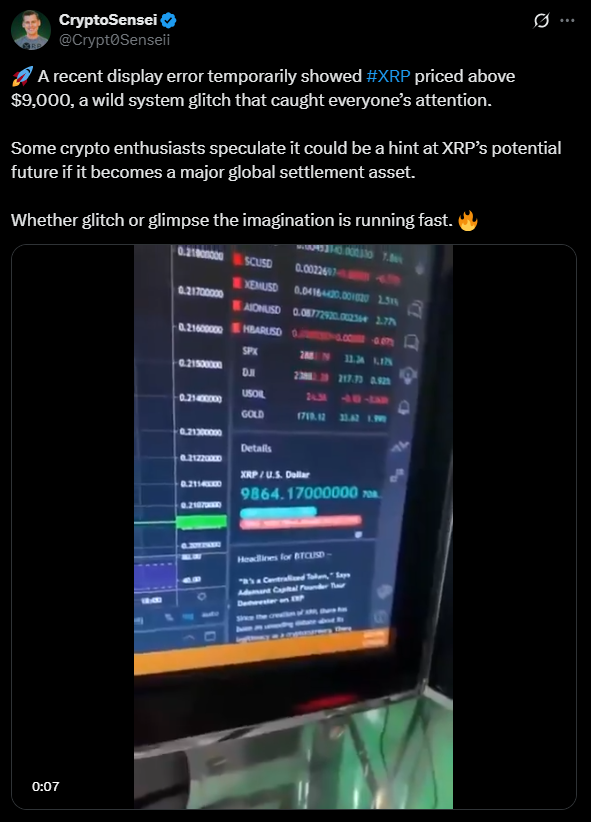

In an unexpected moment on October 29, 2025, the crypto world watched XRP flash an impossible price of $9,000 — a spike that lasted only a few seconds before vanishing. The bizarre jump, captured in a screen recording by crypto analyst John Squire, briefly showed XRP trading as high as $9,868, causing chaos across social media.

Despite the viral clip, there was no evidence of real trades at those prices. No exchange confirmed the move, and no on-chain transactions backed it up. Analysts quickly labeled it a technical glitch, not a genuine market event.

A Familiar Glitch for XRP

This isn’t the first time XRP’s price has appeared to “moon” overnight. The coin has a history of strange data-feed errors, including one in 2019 that displayed prices above $7,000 and another broadcast in 2021 showing it trading at $21,000. As recently as July 2025, a tracking platform briefly listed XRP at a staggering $691,667, further cementing its unlucky glitch streak.

Experts say these outlier readings are caused by faulty data aggregation or mislabeled price feeds that ripple through crypto-tracking systems. Since aggregators pull live pricing from multiple exchanges, even one corrupted input can send incorrect prices across the network.

How These Glitches Happen

Crypto price trackers rely on complex networks of real-time data streams from exchanges, liquidity pools, and trading APIs. If even one feed experiences a lag, mismatch, or bad identifier, it can instantly produce a false quote. In extreme cases, the incorrect price can cascade across other platforms before systems correct themselves.

According to analysts, no blockchain activity or order-book confirmations matched XRP’s alleged $9,000 value, confirming this was a transient pricing error, not an actual pump.

Why These Errors Matter

Even though the glitch didn’t reflect reality, such incidents can rattle trader confidence and disrupt algorithmic trading systems that rely on automated signals. A false quote like this could trigger panic buys or sells, leading to real financial consequences for traders acting on bad data.

It’s another reminder that data integrity in crypto remains a serious issue. With hundreds of exchanges feeding prices to global platforms, ensuring accuracy and reliability continues to be a major technical challenge for the industry.

Can It Happen Again?

Unfortunately, yes. Until data pipelines become more robust and coordinated across exchanges, these anomalies can — and likely will — happen again. The fragmented structure of the crypto ecosystem means a single faulty node can produce chain reactions that spread instantly.

For traders, the takeaway is clear: always verify unusual price action using official exchange data or blockchain explorers before reacting. In the volatile world of crypto, not every chart tells the truth.