- A break above $2.18 could send XRP soaring to $3.46.

- Overbought conditions hint at a potential drop to $1.50 if $1.98 breaks.

- Holding above $2.15–$2.20 is crucial for any bullish momentum.

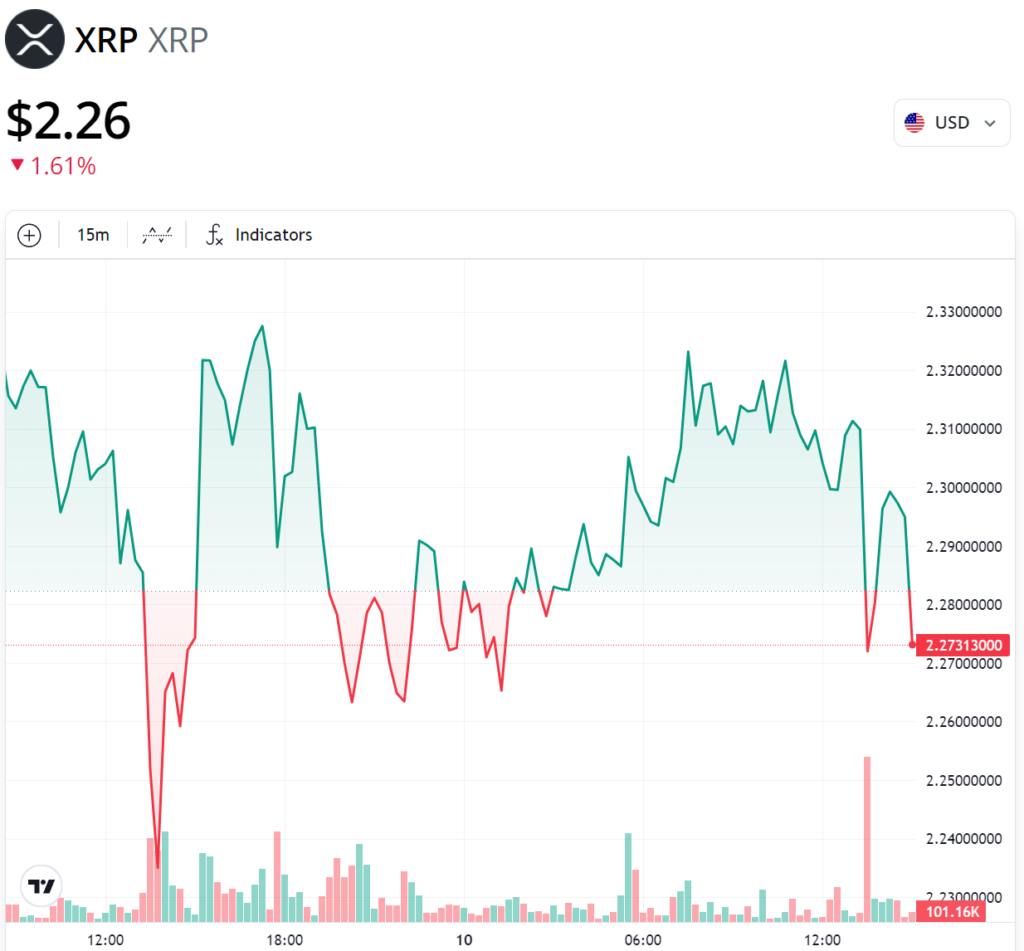

XRP has been on a rollercoaster recently, dropping 22.25% in the past month from a high of $2.90—its peak since January 2018—to as low as $2.26 on Jan. 10. Let’s break down the key drivers behind this decline and explore whether XRP’s price is headed for a deeper correction or a bullish rebound.

Symmetrical Triangle: A 40% Drop or a $3.46 Rally?

XRP’s daily chart is forming a symmetrical triangle pattern, signaling indecision in the market. This setup is marked by converging trendlines connecting higher lows and lower highs, with a significant breakout potential in either direction.

Currently, XRP is trading near the triangle’s upper trendline. If history repeats, this could result in a move down toward the lower trendline around $2.05, coinciding with the 50-day EMA (red wave). A decisive breakdown below this trendline could trigger a drop to $1.36—a staggering 40% decline from current levels.

Conversely, if XRP breaks above the triangle’s upper boundary near $2.18, it could rally to $3.46, calculated by adding the triangle’s maximum height to the breakout point.

However, the market is currently leaning bearish, with the richest XRP holders (those holding at least 1 million tokens) reducing their holdings to 90.50 billion XRP, a record low compared to 100 billion XRP last year.

XRP Testing $1.50

Zooming out to the weekly timeframe, XRP has been stuck in a $1.98–$3.03 consolidation range. After bouncing off the $1.98 support, its upward momentum has slowed, with a 4% decline in the current weekly session.

Adding to the bearish signals, XRP’s weekly RSI remains above the overbought threshold of 70, increasing the risk of a deeper correction. If bears take control, XRP could retest $1.98 and potentially fall further to the 20-week EMA (purple wave) near $1.50—a level previously seen during overbought conditions.

The $3 Rebound: Is It Still Possible?

If XRP holds above its $1.98 support, a rebound toward $3 remains on the table. This target aligns with the bullish outlook of prominent trader Valeriya, who points to $2.91 as a key level where seller liquidity is concentrated.

Valeriya emphasizes that the $2.15–$2.20 range is critical:

- If XRP holds this support zone, aggressive growth toward $2.91 and beyond could follow.

- If the zone breaks, the price could dip below $2.00 in search of liquidity.

The next few weeks could be pivotal for XRP, with its trajectory hinging on whether it holds critical support or succumbs to bearish pressure. For traders, all eyes are on $2.15—XRP’s decision-making zone.