- XRP has dropped around 7–8% across multiple timeframes, but long-term catalysts remain strong.

- The XRP ETF and Ripple’s SEC settlement create room for future institutional and global adoption.

- Current price levels may offer a solid entry point for both new and existing investors.

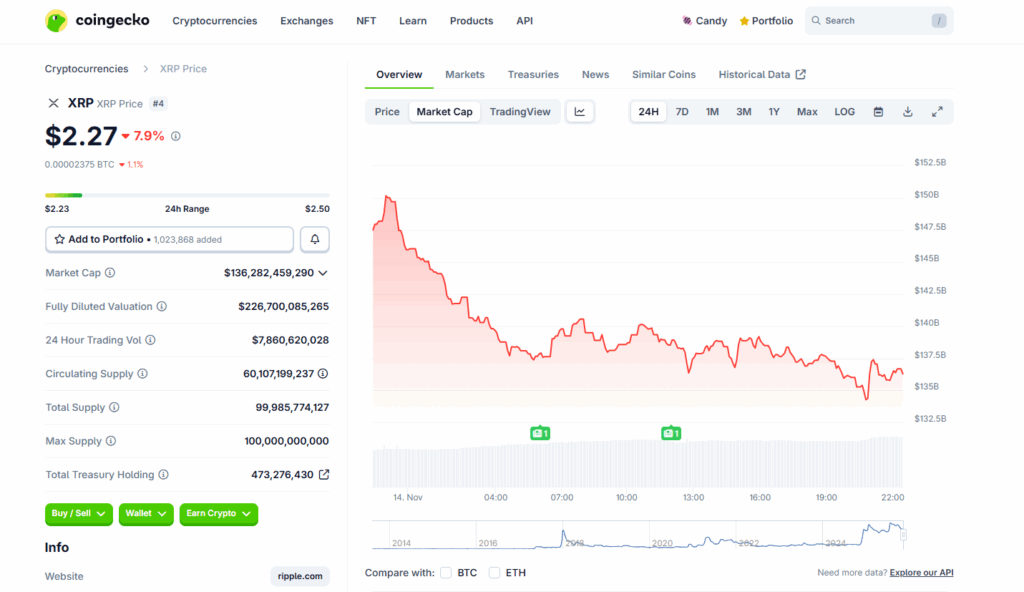

XRP has been dragged down with the rest of the market this week, dipping around 7% in just 24 hours and falling more than 8% over both the 14-day and 30-day charts. The sharp correction has stirred some worry about XRP sinking below the $2 mark again, even though 2025 has mostly been a strong, bullish year for the asset. With the market turning shaky, investors are asking the same question: is this dip a warning sign… or the kind of opportunity long-term holders usually wait for?

Why XRP’s Price Drop Isn’t Necessarily a Red Flag

Even with this downturn, XRP’s broader momentum hasn’t disappeared. Ripple’s settlement with the SEC earlier this year removed the biggest legal cloud hanging over the project, letting XRP finally break free from years of uncertainty. That ruling helped XRP smash a new all-time high of $3.65 back in July, showing just how much buyers were waiting on clarity. A temporary correction doesn’t erase that kind of momentum — it just makes short-term swings feel sharper.

The XRP ETF Could Become a Major Price Driver

Another reason some investors are still optimistic is the recent launch of the first U.S.-based XRP ETF. ETFs have already fueled huge inflows for Bitcoin and Ethereum throughout 2025. While the current market slump might be masking its impact, ETF access tends to attract bigger institutional players over time — not instantly. As the market settles, the ETF could easily become one of XRP’s strongest catalysts moving forward.

Adoption Is Still Growing Behind the Scenes

On top of that, Ripple’s XRP Ledger continues gaining traction for cross-border payments. Banks and financial institutions across the world have already begun using XRP technology to streamline remittances. That adoption isn’t slowing down because of a price dip. If anything, it expands during bear phases while developers and enterprises build quietly in the background.

So… Is This Actually a Good Time To Buy?

For new investors, the current price levels might be one of the better entry points available this year. And for older holders, dips like this make it easier to lower overall cost basis — something long-term investors love to take advantage of. The market volatility won’t last forever, and XRP historically performs strongest right after periods of cooling and correction. If the broader crypto environment recovers, XRP could be one of the tokens that rebounds the quickest.