- XRP surged nearly 70% in July, but resistance around $3.3–$3.4 has slowed momentum, leaving the bulls waiting for a stronger breakout.

- Technicals point to possible targets at $4.08, $5.19, and $6.3, though weak buying volume and high profit-taking potential among holders could stall progress.

- On-chain data shows 93.5% of supply in profit and NUPL still below euphoric levels, suggesting room for upside—but whale activity and market sentiment remain key risks.

Ripple’s XRP came out swinging in July, ripping higher by nearly 70% and dragging the price from $2.17 all the way up to $3.65. That was the kind of move bulls love to see. But the last few weeks have been less kind—the momentum has cooled, and XRP’s been stuck, bumping its head against resistance again and again.

The $3.3 level has proven to be a stubborn wall. Without a clear push from Bitcoin to lead the pack, XRP bulls have been left fighting uphill. Even so, some analysts still paint a hopeful picture, projecting a run toward $4.97 by 2025. That’s just a shade under the token’s all-time highs, and in crypto terms, only a 36% climb. Manageable… if conditions line up.

Weekly Charts Still Suggest Strength

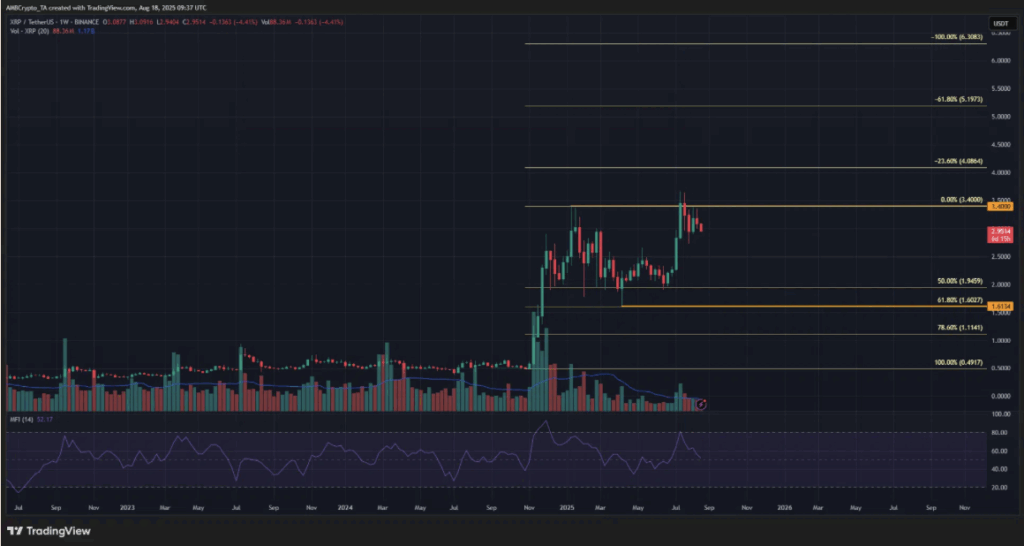

The weekly chart offers some optimism. Mid-July saw XRP crack through $3.4, signaling a break in structure that often suggests more upside is waiting. Recent retests around $2.8–$3.02 have held as support, which is a healthy sign. Technicals like Fibonacci retracement levels now point toward $4.08, $5.19, and possibly $6.3 as next big targets.

Still, signals are mixed. The Money Flow Index (MFI) has slipped closer to neutral at 50, hinting that buying pressure’s weakened. Trading volume has also sunk toward average levels—far from the kind of frenzy you’d need to propel a clean break into $5 territory.

On-Chain Metrics Paint a Cautious Picture

Glassnode data shows 93.5% of XRP’s supply is currently in profit, a stat not seen since April 2021 when prices topped at $1.84. On the surface, this sounds bullish. But it also means temptation to take profits is higher, which could weigh on momentum.

The Net Unrealized Profit/Loss (NUPL) metric, which often signals euphoric tops, still sits a safe distance from danger zones. That’s encouraging. Yet a sudden drop in whale holdings or a swing toward distribution could be an early warning sign that the rally’s running out of gas.

Can $5 Really Happen This Cycle?

So where does that leave us? Right now, XRP looks like it’s holding ground more than anything. The structure is bullish, longer-term charts suggest more upside, and the $5 target isn’t outlandish. But without stronger buying volume and some help from broader market sentiment, XRP could spend a while consolidating before making its next real push.

The next few months will tell us if July was just a temporary spark—or the start of a run that finally carries Ripple past $5 for the first time ever.