- Vincent Van Code claims XRP may become inaccessible to retail buyers by 2030, shifting toward institutional-only usage.

- He argues banks and financial firms could eventually hold most of the circulating supply as XRP evolves into a settlement-layer asset.

- Reduced retail access and tighter supply could significantly influence long-term market pricing and overall XRP dynamics.

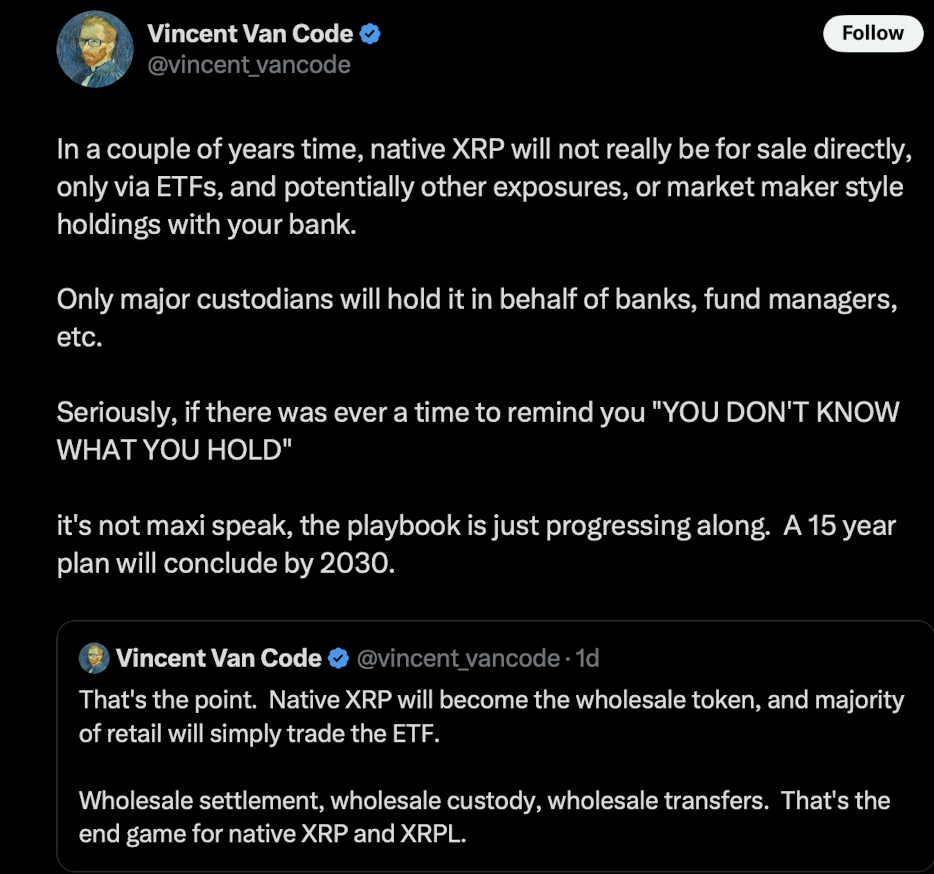

Vincent Van Code, a software engineer known for building multiple AI-driven startups, dropped a pretty controversial take on where XRP might be heading over the next decade. According to him, by the time we reach the end of the 2030s—maybe even sooner—retail traders may no longer be able to buy native XRP directly on open markets. Instead, he believes XRP could become something closer to a wholesale asset, mainly used by institutions rather than everyday holders. It’s a big claim, and naturally, it sparked a ton of debate.

Current XRPScan data shows around 65.2 billion XRP circulating today. With the total supply capped at 100 billion and over 14 million tokens already burned, that leaves fewer than 35 billion XRP still available to be released. Even with that supply remaining, Van Code argues that the structure of how XRP enters markets could shift dramatically before any of that leftover supply ever hits retail exchanges.

XRP slowly drifting toward a wholesale asset model

Van Code’s comments came right after Bitwise announced its new XRP ETF, which will trade under the ticker “XRP.” That ticker choice—same name as the actual asset—sparked confusion about how analysts, traders, and media will differentiate between the fund and the token. But for Van Code, this wasn’t just a branding oddity. He tied it to a broader trend that he believes the industry has quietly been moving toward.

His view is that XRP is gradually being positioned for institutional-level functions: settlement layers, custody rails, large-value transfers, and similar high-volume financial roles. If that shift continues, he says retail buyers may eventually get exposure to XRP only through ETFs, trusts, or other packaged products—not through direct token purchases. It’s less about limiting access and more about how the financial system tends to consolidate assets used for large-scale settlement.

According to him, this direction isn’t accidental. He believes it fits into the long-term design of how XRP was meant to integrate into global financial infrastructure.

Institutions could end up controlling most of the supply

Under Van Code’s outlook, major financial institutions—banks, asset managers, liquidity desks, specialized digital-asset treasuries—could end up holding the majority of all XRP in circulation. Over time, the bulk of XRP could sit inside institutional custody, with only a small slice remaining in the hands of early private holders who refuse to sell. This idea isn’t new: parts of the XRP community have long speculated that cross-border settlement would require massive pools of XRP, pulling large volumes of the token into corporate hands.

Van Code places this shift on a 15-year timeline, projecting that the structural realignment could be finished around 2030. He also noted that many current developments—including institutional custody expansion and settlement-focused partnerships—fit neatly into this trajectory.

What reduced circulating supply might mean for future pricing

A separate analysis recently explored how XRP’s price might evolve if circulating supply shrinks dramatically. It suggested that if institutions or staking mechanisms end up absorbing around 80% of available supply, XRP could theoretically move into a price range between roughly $41.67 and $83.33. Van Code didn’t give a price prediction himself, but his thesis implies similar consequences: limited retail access, concentrated supply in deep institutional pockets, and tighter overall circulation—all of which could reshape market dynamics in a major way.

For now, his view remains speculative, but it highlights a growing conversation about whether XRP’s long-term purpose leans more toward retail speculation or toward becoming a backbone asset for global financial operations.