- Whales dumped 160M XRP in two weeks, pushing the market into an overbought zone and raising retracement risks.

- Futures trading volumes are cooling, suggesting consolidation and a possible retest near $3.00 support.

- If buyers defend support, XRP’s Fibonacci targets at $3.80 and $4.49 remain in play for the next bullish move.

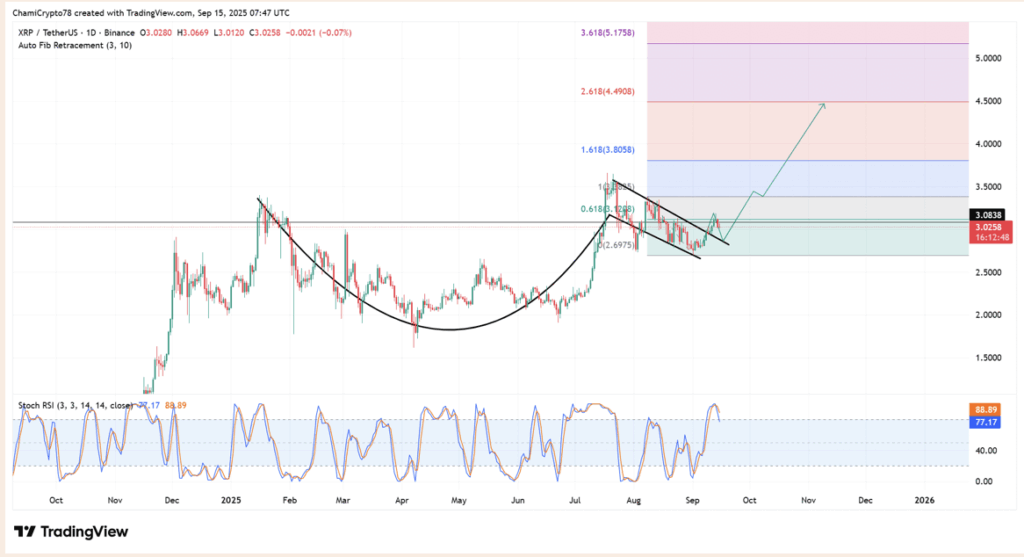

XRP just went through two turbulent weeks, with whales unloading roughly 160 million tokens into the market. That kind of concentrated selling usually stirs up volatility and puts pressure on liquidity. Right now, the Stoch RSI sits near 88.89, flashing extreme overbought conditions—a sign that momentum might be due for a cool-off.

Historically, big whale exits have triggered quick corrections, especially if retail demand can’t keep up with the extra supply. Still, whale profit-taking doesn’t always kill a rally—it can also clear weak hands and set the stage for continuation. The real question now: is this distribution phase just noise, or the start of a deeper reset?

Will XRP Retest $3 Handle Before Pushing Higher?

On the charts, XRP has been forming a clean cup-and-handle pattern, with a breakout pushing through a descending channel. That’s a bullish setup, but profit-taking pressure is already visible. A pullback toward the handle’s upper boundary looks increasingly likely.

If buyers step in and defend that retest, Fibonacci levels point to upside targets around $3.80 and even $4.49. If not, the bullish picture weakens and momentum could stall. With the Stoch RSI deep in overbought territory, the odds of a short retracement look stronger before any new leg upward.

XRP Futures Volume Cools as Traders Wait for Confirmation

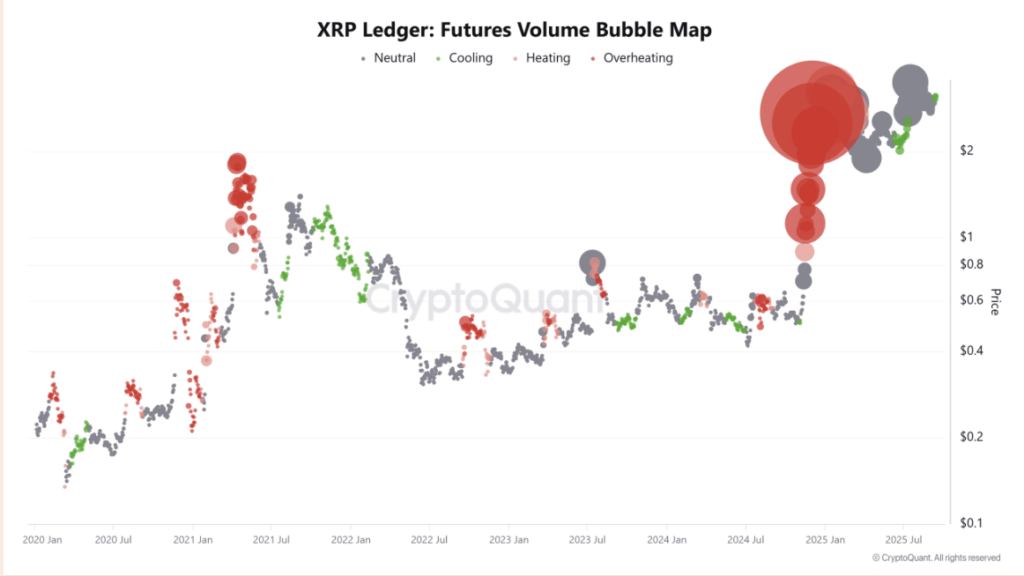

Derivatives data shows that XRP’s Futures Volume Bubble Map has cooled off since the breakout. This usually happens when traders pause to lock in gains or wait for fresh confirmation before committing again. Cooling volumes don’t necessarily mean a reversal—it often points to consolidation.

During phases like this, the market tends to retest broken resistance levels to validate them as new support. If that support holds, it strengthens the bullish setup. If not, XRP could be stuck in sideways consolidation longer, delaying the run toward higher Fibonacci targets.

Balanced Funding Rates Suggest a Cautious Market

Open Interest-weighted funding rates currently sit at 0.0079%, showing that leveraged traders are playing it neutral. This balanced stance reduces the risk of sudden liquidation cascades but also reveals hesitation. Traders are clearly waiting to see if XRP can confirm its breakout before going heavier on either side.

When funding rates tilt decisively—whether long or short—they usually amplify the move that follows. For now, the market is cautious but not panicking, leaving room for either continuation or extended consolidation.

Is XRP’s Correction Just a Reset for Bigger Breakout?

Whale selling and overbought conditions have injected short-term caution into the market, but XRP’s broader cup-and-handle formation still looks intact. A likely retest of the handle’s upper boundary will decide the next phase.

If buyers defend that level, the path toward $3.80 and $4.49 remains open, framing the recent pullback as more of a reset than a reversal. But if the retest fails, XRP could be forced into a longer consolidation before making another serious attempt higher.