- XRP recorded 2.59 million transactions in a single day, its highest in 3 months.

- Price remains bullish, holding above $3 and key moving averages despite a recent dip.

- Strong network utility suggests XRP’s next big rally could be fueled by more than speculation.

On July 24, XRP hit a huge on-chain milestone, clocking 2.59 million transactions — the highest in the past three months. Even though the price has been a bit shaky, this spike in network activity points to growing utility and user engagement across the board.

Price Action Still Favors Bulls

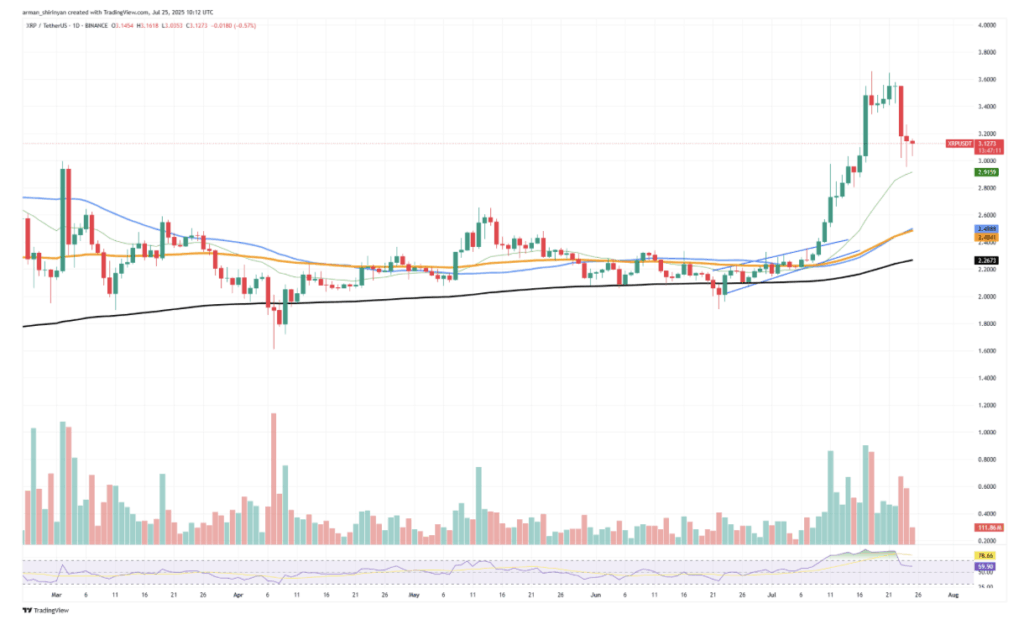

Looking at the charts, XRP recently broke out of a long consolidation phase. It shot past the $3 barrier earlier this month, tapped above $3.60, and then cooled down to around $3.14. Despite this pullback, the overall structure still leans bullish. The price is holding above the 50, 100, and 200 EMAs — all of which are lined up in a classic continuation pattern, hinting at more upside potential if momentum returns.

Volume during the last rally was strong, backing up the move. But the real story? It’s in the on-chain stats. XRP’s network reportedly processed over 20.6 million transactions in a single day — the highest number recorded this year. That’s not just noise; it’s a sign of real demand, whether it’s cross-border payments, institutional activity, or retail users pushing transactions through.

Utility Growing as Price Cools

What’s notable is that this surge in activity happened while the price corrected. It shows XRP isn’t just riding on speculative hype — its network is being used. The previous resistance zone at $2.99 has now flipped into strong support. As long as this holds, the bullish structure remains intact. A renewed rally could easily follow once the RSI resets from overbought territory.

What to Watch Next

XRP is evolving both in price and in actual utility. With on-chain activity hitting multi-month highs and price holding above major support levels, the next bullish leg might be setting up quietly. Traders are keeping a close eye on whether momentum picks up again — because if it does, a push back toward $3.60 or even $4 could be on the table.