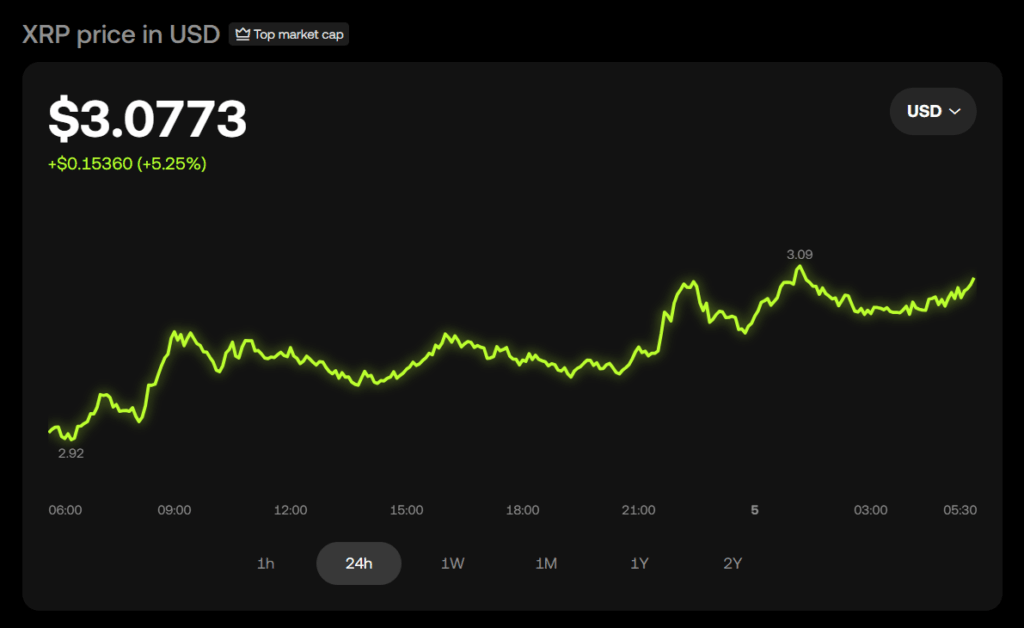

- XRP hit a new all-time high of $3.65 in July but has since corrected to the $2.80–$2.90 range.

- Bold predictions calling for $10 or higher ignore market realities, including XRP’s large circulating supply and massive market cap requirements.

- XRP would need to triple its market cap to reach $10—a feat unlikely in the near term given current investor and institutional dynamics.

Ripple’s XRP recently hit a major milestone, reaching a new all-time high of $3.65 in July—its highest price in nearly seven years. The token hovered above the $3 mark for weeks, sparking a flurry of bold price predictions ranging from $8 and $10, all the way to an eye-popping $500. However, as investor enthusiasm peaked, XRP corrected to the $2.80–$2.90 range due to profit-taking and broader market fatigue.

As is often the case during bullish runs, lofty predictions became headline fuel, raising expectations among retail traders. When XRP held above $3.40, the chatter of it touching double digits intensified. But as with most euphoric forecasts, reality caught up—and the sell pressure quickly reminded everyone that market sentiment doesn’t always follow predictions.

Why XRP Hitting $10 Isn’t Likely Soon

Despite the bullish dreams floating around, the odds of XRP hitting $10 in the near term remain low. To reach that target, XRP would need to pump nearly 250% from current levels. But more importantly, its market cap would need to jump to a whopping $590 billion—over three times what it is today. This isn’t a minor stretch, especially when Ethereum, despite being far more dominant, still sits below that figure at around $426 billion.

Market dynamics just don’t support this level of growth for XRP yet. While it’s made huge strides and reclaimed much of its former relevance, it still lacks the scarcity and sustained institutional demand that would be needed to justify a price above $10 in the short-term window.

Tokenomics and Market Cap Reality Check

XRP has 59 billion tokens in circulation and a current market cap of $177 billion. Unlike Bitcoin, it doesn’t benefit from scarcity as a natural price driver. That makes massive upside movements more difficult to sustain without consistent, large-scale buying pressure.

Even if it did see a resurgence in institutional interest, that alone may not be enough to triple its valuation. With institutional liquidity already stretched across Ethereum, Bitcoin, and other high-cap assets, XRP would have to outperform the entire altcoin sector in an aggressive fashion to reach the $10 mark anytime soon.