- Jake Claver predicts XRP could reach $2,000 by early 2026, citing macroeconomic trends and financial settlement use cases.

- Factors like regulatory pressure on Tether, geopolitical instability, and XRP’s real-time settlement speed could boost demand.

- Despite potential, hitting $2,000 would require XRP’s market cap to exceed $120 trillion—an extreme scenario by all metrics.

Predictions about XRP reaching $2,000 are making serious waves, and Jake Claver, CEO of Digital Ascension Group, is one of the bold voices behind this call. He believes XRP could hit that massive milestone by early 2026. His price forecast hinges on several major factors—macroeconomic trends, regulatory crackdowns, and XRP’s growing role in financial settlements.

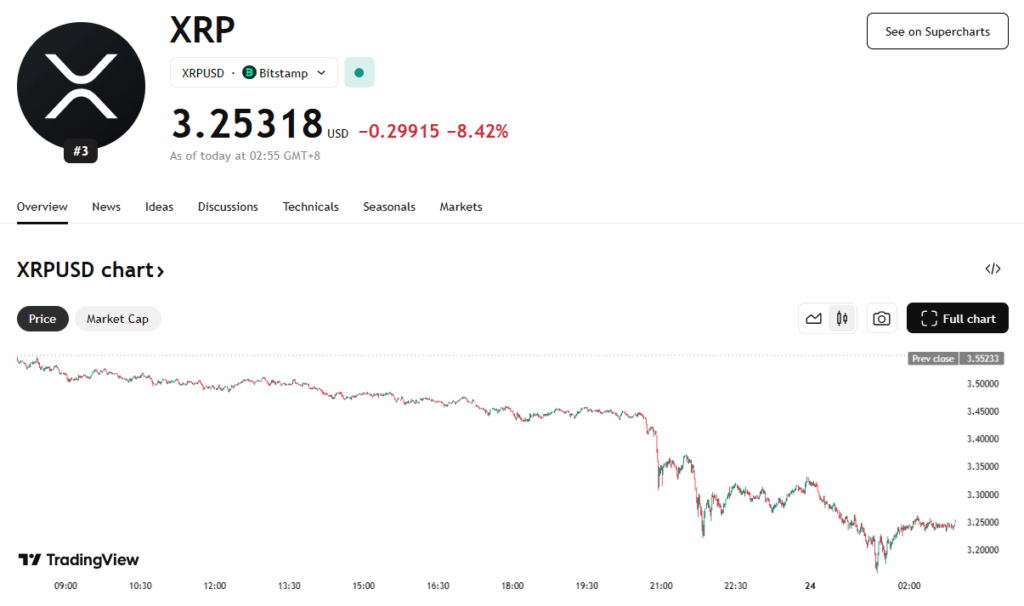

While the idea sounds extreme, Claver’s thesis suggests it’s possible if the stars align. To reach $2,000 from its current $3.45 level, XRP would need to rise over 43,000%—a leap not seen in any major crypto to date. Still, Ripple’s role in cross-border payments and real-time settlements is being spotlighted, especially as crypto regulation heats up.

Could Utility and Regulation Trigger XRP’s Explosion?

Claver’s prediction leans heavily on the potential for macroeconomic changes to drive liquidity into XRP. Specifically, he highlights the unwinding of “reverse carry trades”—a strategy where investors borrow at low interest in one currency and invest in higher-yielding assets elsewhere. If those strategies unwind, digital assets like XRP could benefit from an influx of capital.

He also sees growing scrutiny of Tether as a possible tailwind. With regulatory bodies like the SEC and CFTC circling, XRP could be viewed as a more transparent alternative in the stablecoin-heavy settlement space. The recent passage of the GENIUS Act could accelerate hearings and investigations that shift market sentiment toward Ripple.

Additionally, geopolitical tensions—particularly rising oil prices due to Middle East conflicts—have increased economic uncertainty. Claver argues this kind of environment pushes investors toward alternative stores of value, and XRP may gain ground as a result.

XRP’s Speed in Settlements Gives It a Real-World Edge

What really sets XRP apart is its role in settlement infrastructure. Traditional financial systems take a full business day—or longer—to process transactions, especially on weekends. In contrast, XRP processes transactions in just 20 to 40 minutes. That kind of speed can be a game-changer during peak demand or market stress.

Projects like DTCC and R3’s Project ION are working on overhauling legacy settlement processes, and XRP may become the bridge asset that powers these new platforms. Financial institutions are actively exploring real-time, cross-platform settlements, and XRP is well-positioned to meet that demand.

Why $2,000 Is Still a Wild Long Shot

As exciting as Claver’s predictions sound, they require a reality check. At $3.45 today, pushing XRP to $1,500 or $2,000 would mean skyrocketing its market cap to unprecedented levels. Hitting $1,500 would give XRP a market cap of $90 trillion—about four times larger than the entire global gold market. At $2,000, it would hit $120 trillion, more than all the world’s circulating money.

For context, an investor holding 1,000 XRP today would see their $3,450 investment swell to $1.5–$2 million—an almost unfathomable return. It’s a bold forecast, and while not impossible, it would require a seismic shift in how global finance operates.

Final Takeaway: Speculation vs. Macro Trends

Claver’s XRP price prediction isn’t rooted in fantasy—it draws on current macro shifts, regulatory sentiment, and tangible advancements in financial infrastructure. XRP is increasingly used for real-world applications, and regulation may boost its standing. However, hitting the $2,000 mark would require market dynamics beyond anything the crypto space has ever seen.