- XRP failed to hold its early January breakout above $2.30

- Broader market weakness and macro uncertainty are weighing on price

- Current forecasts don’t support a $2.60 move in February

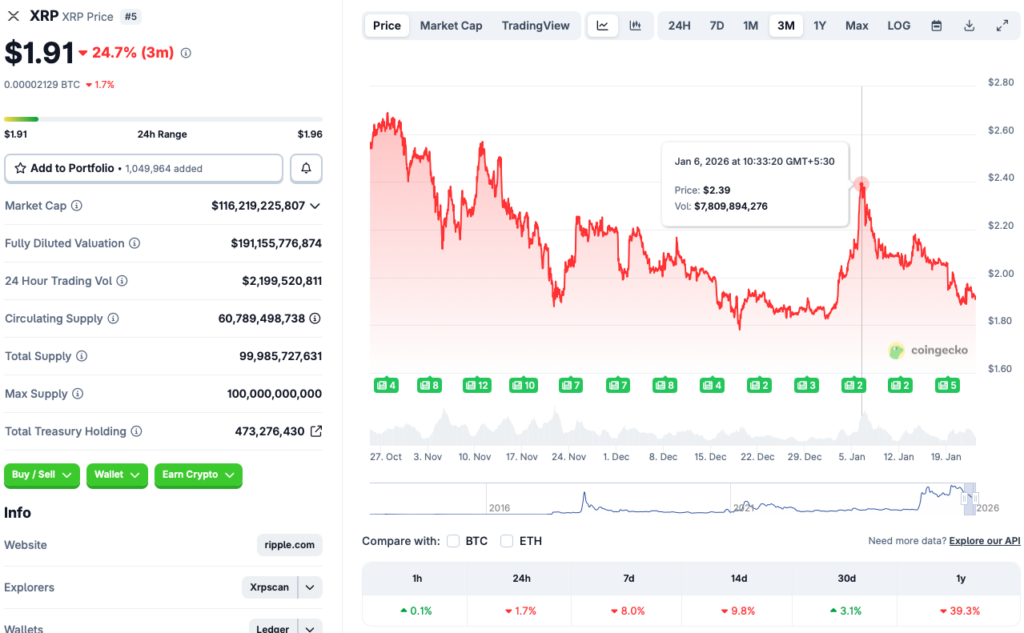

XRP tried to stage a breakout earlier this month, but momentum faded almost as quickly as it appeared. According to Coingecko data, after climbing to around $2.39 in early January, the token has slipped back toward the $1.90 range and continues to struggle holding the $2 level. Short-term performance has weakened across most timeframes, even though XRP has managed to stay modestly positive on a monthly basis. The big question now is whether February offers a real shot at reclaiming higher ground, or if this range-bound behavior continues.

Why XRP Lost Its Breakout Attempt

XRP’s pullback isn’t happening in isolation. The broader crypto market has been under pressure after Bitcoin failed to hold its mid-January rally and slipped back below key psychological levels. When BTC weakens, liquidity thins quickly, and altcoins usually follow. XRP has simply been moving with that tide rather than carving out its own path.

Macro headlines didn’t help. Trade tensions tied to U.S. policy added to risk-off sentiment, even though some of those tariff threats were later rolled back. That brief relief wasn’t enough to spark sustained upside across crypto markets.

Safe Havens Still Competing for Capital

Another headwind for XRP is where capital is choosing to hide. Gold and silver briefly dipped after tariff headlines cooled, but both quickly recovered and continued pushing higher. That resilience suggests investors are still prioritizing safety over growth. When precious metals attract steady inflows, it often means crypto rallies face extra friction.

For XRP specifically, that environment makes it harder to attract the kind of follow-through buying needed to clear higher resistance zones.

What the Forecasts Are Saying About February

Near-term price models remain cautious. Some projections suggest XRP could push toward the low $2.10 area mid-month before losing steam and drifting back toward current levels. The $2.60 target looks ambitious under present conditions, especially without a broader market shift or a fresh catalyst unique to XRP.

Technically, XRP would need to reclaim and hold above the $2 level first, then build volume through the mid-$2.30 range before $2.60 even becomes a realistic discussion.

The Path Forward

XRP isn’t broken, but it is constrained. As long as the wider market remains defensive and liquidity stays selective, upside may continue to stall. A stronger Bitcoin recovery or a clear shift away from safe-haven assets would likely be required to change that dynamic.

For now, February looks more like a consolidation test than a breakout month. XRP holders may need patience before the next decisive move shows up on the chart.