- XRP has been down 6 of the last 7 weeks despite ETF inflows hitting $586M.

- Long-term holders sold heavily, but whales accumulated roughly $7.7B in XRP.

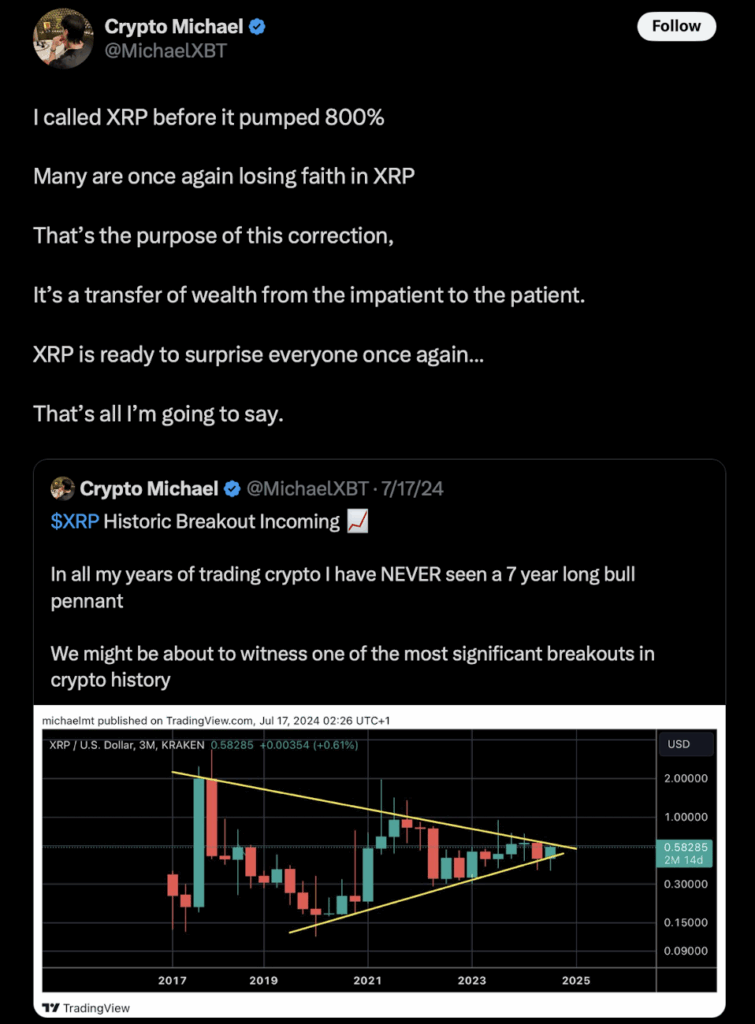

- Analyst MichaelXBT says the current pullback looks like a redistribution phase before another major upside move.

XRP has been under pretty heavy downside pressure these past few weeks, even while the broader market had little moments of recovery that looked promising for about five minutes at a time. Despite the slide, analyst MichaelXBT says the weakness isn’t necessarily a sign of collapse but more of a rotation — short-term holders letting go, long-term investors quietly scooping it up. He points back to earlier cycles where XRP did basically nothing for long stretches before suddenly launching upward, catching almost everyone off-guard.

Prices keep sliding despite ETF excitement

Across the last seven weeks, XRP finished in the red for six of them. The only bright spot was the week of Oct. 20, when it jumped around 10%, but the relief didn’t last long. Overall, the asset sank by more than 23% during that stretch, even though it managed to start the new week with an 8% bounce. What’s strange is that this continued decline came right after several XRP ETFs launched — and these funds have pulled in roughly $586 million since mid-November. Yet XRP still fell nearly 17% over the past month. So far, institutional demand isn’t showing up in spot price, likely because retail traders don’t seem too confident right now.

Analyst revisits the last time he called a major XRP rally

MichaelXBT recently touched on an analysis he made back in mid-2024, when XRP traded around $0.58 with barely any volatility. At the time, he said the chart was forming a multi-year consolidation pattern that looked like the calm before a big move. It turned out to be true: XRP climbed from about $0.50 in Nov. 2024 to around $3.66 by July 2025 — a gain north of 600%. Now he believes the asset may be entering a similar phase again, even if sentiment feels a bit heavier this time around.

Traders lose confidence as consolidation drags on

According to him, XRP has slipped back into another consolidation zone. The sideways action is wearing down trader morale, leading to more selling — even from long-term holders who don’t usually flinch. Glassnode data shows that profit-taking picked up earlier this year, with long-term holders unloading an estimated $375 million worth of XRP on July 24. That was the highest level in eight months, signaling that some big pockets are trimming risk while others are simply stepping aside.

Whales choose the opposite strategy — quietly loading up

In contrast to the retail crowd, the largest XRP holders appear to be taking advantage of the dip. Wallet analysis shows major holders accumulated about $7.7 billion in XRP between August and the most recent reporting period. This creates a clear divide: short-term investors reacting emotionally to price swings, and long-term players stacking their bags. MichaelXBT sees this as classic redistribution — the same sort of pattern that happened just before XRP’s breakout in late 2024, when weak holders sold into fear while whales increased their positioning.

A messy market now, but possibly a setup for the next big phase

The analyst didn’t give a fresh target this time, but he hinted that XRP could show another strong rally once the consolidation finishes. Earlier this year, he even said the next phase could be parabolic and later suggested XRP wouldn’t stay under $4 for long once momentum returned. Short-term sentiment is split, with many traders unsure whether to hold or exit, but his commentary implies the current correction might be laying the groundwork for a bigger trend — just like it has in past cycles. Here is where frustration and opportunity tend to collide.