- Spot XRP ETFs from Franklin Templeton and Grayscale went live as XRP jumped nearly 9%.

- Franklin’s XRPZ dominated early trading with over $6.4M in volume.

- Analysts expect the new ETFs to boost XRP liquidity and improve mainstream access.

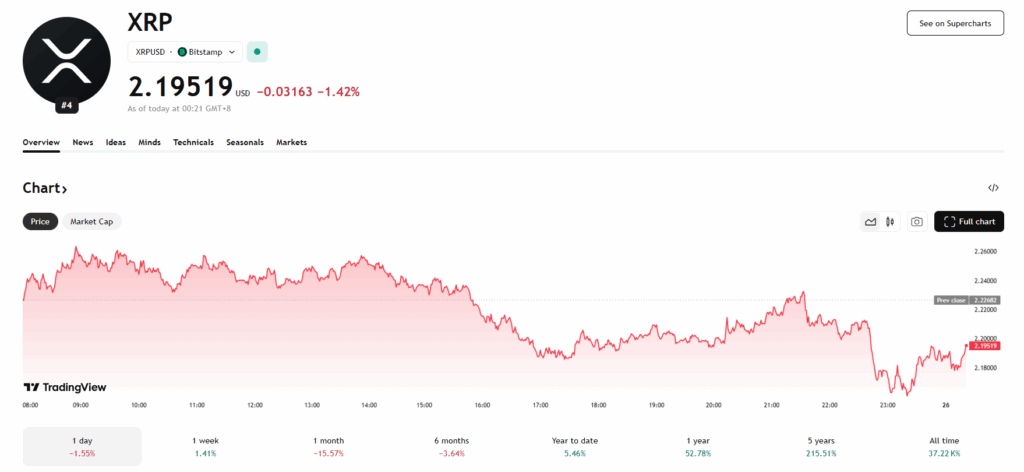

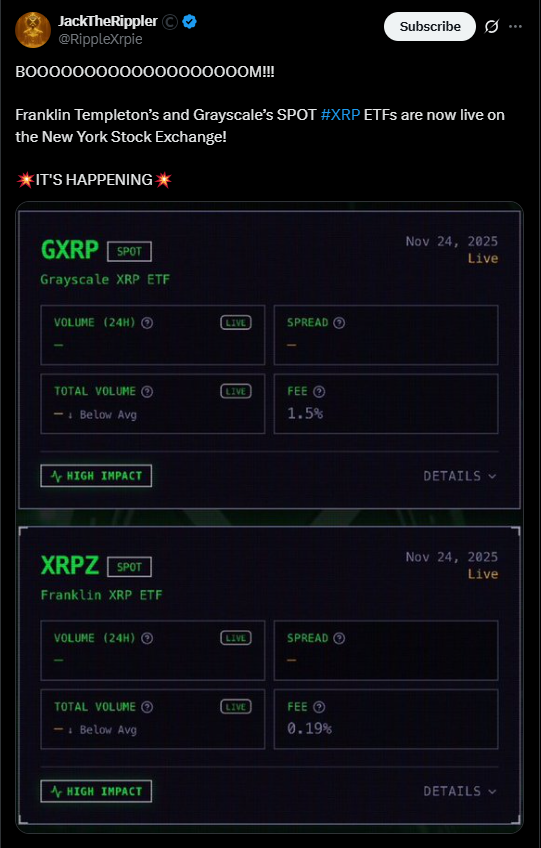

Spot XRP ETF products officially hit the New York Stock Exchange this Monday, giving both retail and institutional traders a fully regulated way to access XRP without dealing with wallets, exchanges, private keys—none of it. Franklin Templeton’s XRPZ and Grayscale’s GXRP went live right as XRP saw a sharp price jump, climbing around 9% in 24 hours. At the moment, XRP is hovering near $2.24, and the timing honestly couldn’t have been tighter for this rollout.

Franklin Templeton XRPZ Dominates Opening Session

Franklin Templeton wasted no time pulling ahead. In the first 90 minutes of trading, XRPZ saw about 283,102 shares change hands—roughly $6.47 million in volume. The ETF opened at $22.60 and pushed nearly 8.7% above that level as buyers piled in, clearly showing pent-up demand for a regulated on-ramp into the XRP market.

David Mann from Franklin Templeton called XRP “a foundational asset in global settlement infrastructure,” framing XRPZ as a cleaner, more transparent entry point for anyone watching the expanding XRP ecosystem. Meanwhile, Roger Bayston highlighted how blockchain incentives help bootstrap networks and said XRPZ should serve as a “foundational building block” inside diversified digital portfolios.

Grayscale Joins the Race With GXRP

Grayscale took a different approach, choosing to uplist its existing XRP fund directly onto NYSE Arca. With that move, it officially converted GXRP into a physically backed Spot XRP ETF. Grayscale launched it alongside GDOG, its new Dogecoin ETF, signaling a much bigger altcoin expansion strategy.

Krista Lynch, Senior VP at Grayscale, said GXRP gives investors “efficient tracking and straightforward exposure,” positioning it as a frictionless way to access XRP without managing the asset directly.

XRP Sees Relief Rally as Market Recovers

The timing of these launches couldn’t have been better for XRP’s chart. The token has clawed back about 5.2% over the past week after weeks of sell-offs. Even so, it’s still down roughly 13% this month while Bitcoin slipped to $82,175 — its lowest price since early April. Ethereum also dipped under $2,700 last week before rebounding slightly.

Still, analysts believe these NYSE-listed crypto ETFs will help stabilize XRP by deepening liquidity and attracting new investors who prefer regulated brokerage accounts over traditional crypto platforms. With four Spot XRP ETF products now active, competition is heating up fast — but Franklin’s early surge suggests strong enthusiasm from the traditional finance crowd.