- XRP trading volume rose 7.45% even as price dropped over 5%, diverging sharply from Bitcoin, Ethereum, and Solana, which all saw declines in both price and volume.

- Analysts suggest whales may be accumulating XRP, as rising inflows during price dips often signal strategic positioning rather than panic selling.

- With new spot XRP ETFs attracting attention and whale activity increasing, continued inflows could position XRP for a stronger recovery in the coming sessions.

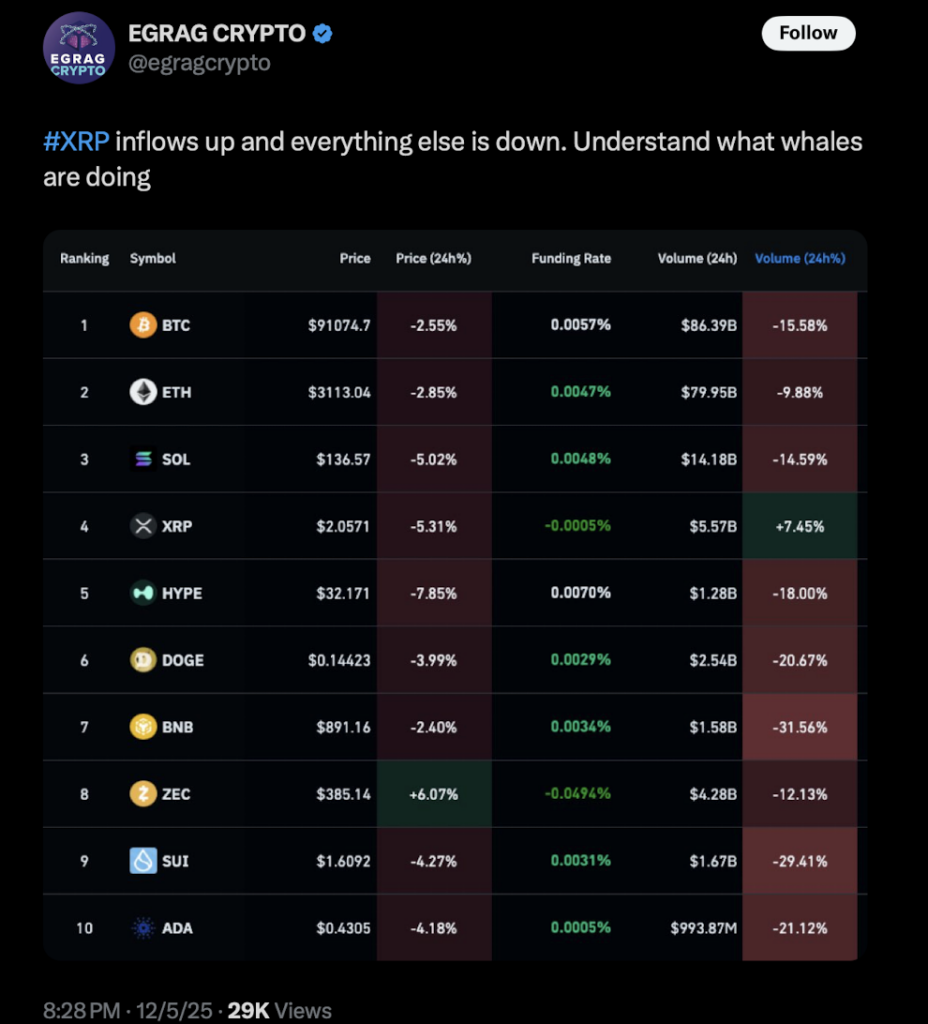

While nearly every major cryptocurrency spent the last 24 hours drowning in red candles, XRP did something… different. Crypto analyst EGRAG CRYPTO (@egragcrypto) posted a chart showing that XRP’s trading volume jumped 7.45%, even though the price dropped more than 5%.It was an unusual divergence — especially because Bitcoin, Ethereum, Solana, and pretty much the rest of the market saw both price and volume collapse at the same time.

Here’s how the numbers looked in EGRAG’s chart:

- Bitcoin: $91,074.7 (–2.55%), volume down 15.58%

- Ethereum: $3,113.04 (–2.85%), volume down 9.88%

- Solana: –5.02%, volume down 14.59%

- XRP: price down… volume up

When everything else gets quieter, but one asset suddenly gets louder, it usually means someone with size is stepping in.

Are Whales Scooping Up XRP in the Dip?

EGRAG pointed out the contrast immediately. XRP inflows were rising while almost every other chart showed outflows. He hinted — without saying it too directly — that whales might be accumulating. His comment, “Understand what whales are doing,” kind of said everything.

December already brought several noticeable whale transfers. And XRP’s daily trading volume hitting $5.57 billion(making it the fourth-highest overall, even beating DOGE and BNB) adds weight to the idea that large buyers are quietly setting up positions.

Rising volume during a falling price is one of the oldest accumulation signals. It means bigger investors are absorbing supply, not running away from it. The data lines up with that pattern almost perfectly.

This is exactly the kind of behavior traders look for when trying to catch early signs of liquidity shifts — especially in assets with deep markets and institutional presence, like XRP.

XRP’s Unique Position Could Be Strengthening Behind the Scenes

XRP has also been getting a lot more attention recently for reasons outside of whale behavior. Several asset managers have launched spot XRP ETFs over the past few weeks. These products are pulling in interest from both institutions and retail investors, even though the XRP price hasn’t reacted much yet.

But whales often move before the narrative becomes obvious. They accumulate first, then let the price catch up later.

EGRAG’s chart leans toward accumulation — not distribution. And that’s important because whale accumulation has historically preceded major XRP rebounds more often than not.

If these inflows continue and the volume divergence keeps widening, XRP could be positioning itself for a stronger recovery than the charts currently show.

Sometimes the earliest signals aren’t price-based… they’re hidden in the volume.