- XRP is holding a historically strong $1.80–$2.00 support zone that has fueled past rallies

- Onchain metrics suggest undervaluation, but also point to extended sideways movement

- Previous cycles show XRP tends to consolidate for long periods before explosive upside

XRP has consistently defended the $1.80–$2.00 range since December 2024, a level that aligns closely with its prior cycle highs. Historically, every major retest of this zone has resulted in rebounds ranging between 35% and 90%, reinforcing its importance as a long-term accumulation area. If the pattern holds, XRP could still push higher before the year ends, but the move is unlikely to be immediate.

Several analysts argue that price behavior around former all-time highs is not weakness, but structural strength. XRP’s ability to hold above this band suggests strong buyer conviction, even as momentum cools in the broader market.

Why Analysts Expect More Accumulation First

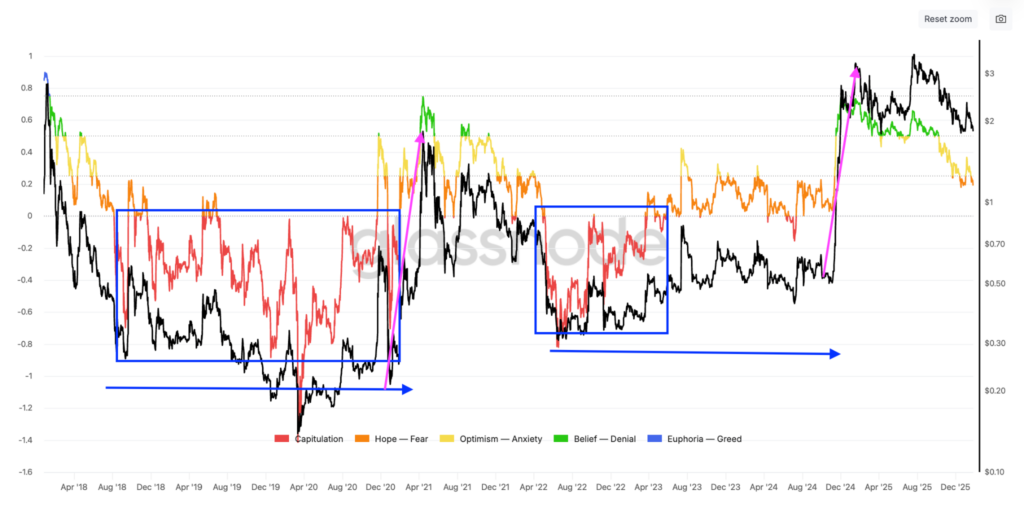

Technical analysts point to similarities with XRP’s 2017 and 2022 market structures. In both cases, the asset spent extended periods moving sideways near key resistance before breaking out aggressively. After slipping below its highs in 2022, XRP traded between $0.30 and $0.70 for more than three years before launching a 390% rally in late 2024.

Current chart patterns suggest XRP may repeat this behavior, consolidating around the $2 level before any sustained breakout. Analysts emphasize that time, not price, is the missing ingredient for the next major leg higher.

Onchain Data Backs the Consolidation Thesis

Onchain indicators reinforce the idea that XRP is early in a larger setup. The Net Unrealized Profit/Loss metric has entered a zone historically associated with cycle bottoms, which in prior cycles coincided with prolonged sideways price action. This phase typically allows weaker hands to exit while long-term holders accumulate.

The Market Value to Realized Value ratio also supports this view. At current levels, XRP appears significantly less overheated than during prior peaks, implying reduced selling pressure but also slower short-term upside. These conditions often precede strong rallies, but only after patience is tested.

What This Means for XRP’s Bigger Targets

While some analysts project long-term targets well into double digits, the path there likely involves consolidation rather than an immediate surge. XRP’s structure suggests that higher prices are possible, but only after sufficient accumulation around current levels.

For now, XRP looks less like an asset ready to explode and more like one quietly building a base. If history repeats, the wait may be frustrating, but the eventual move could be substantial.