- Analysts say current geopolitical instability could boost XRP’s adoption as a neutral bridge asset.

- XRP’s utility and independence from traditional systems position it well for global use cases.

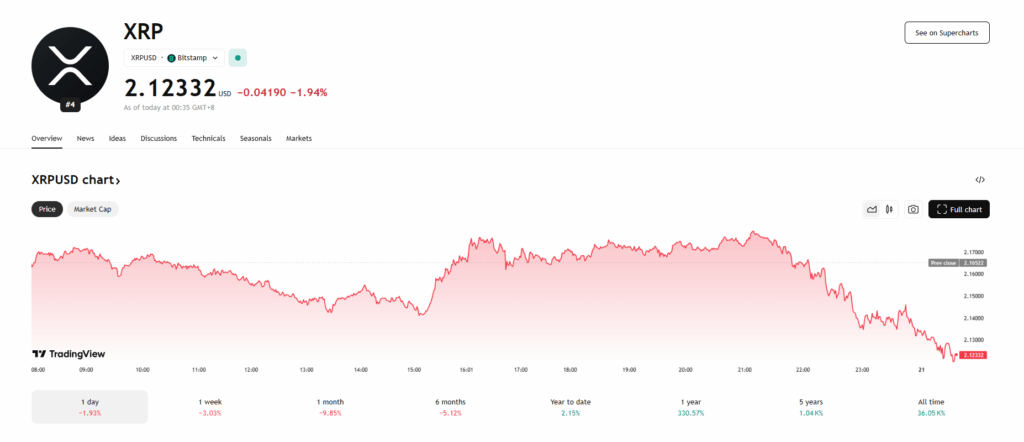

- Price analysts are forecasting a potential breakout, with $3.61 as a near-term target.

Ripple (XRP) might be stepping into one of its most game-changing chapters yet. While geopolitical unrest is shaking up financial systems across the board, some analysts think this chaos could actually open the door for XRP to thrive. With global markets scrambling for stability, Ripple could finally get the spotlight it’s been waiting for.

XRP’s Track Record Could Give It the Edge

Let’s not forget—XRP’s been through some rough waters. Between the SEC lawsuit led by Gary Gensler and the long battle over its legal status, it’s taken some serious punches. But Ripple didn’t fold. It came out swinging and ultimately came out on top. Since then, the project has been building quietly but steadily—partnering with major banks and even launching its own stablecoin, RLUSD.

Now, with economic tensions running high, analyst Versan from Black Swan Capitalist believes XRP is in the perfect position to rise. He shared on X (formerly Twitter) that current instability only increases the need for neutral bridge assets like XRP and XLM. These tokens don’t rely on centralized systems and aren’t as vulnerable to sanctions or political red tape.

Why Chaos Might Actually Help XRP

So, why now? Well, XRP offers a way to move value across borders without relying on traditional currencies like the U.S. dollar or the euro—both of which are under pressure lately. And in conflict zones or sanctioned areas, having a decentralized solution for currency swaps could be a huge advantage. In other words, while old systems are cracking, XRP is sitting there waiting to be the glue.

Versan summed it up: “Holding blockchain infrastructure with real utility isn’t speculation. It’s the price of entry into the new economy.” That’s a pretty bold claim—but one that resonates as global systems continue to show their flaws.

What’s the Price Outlook?

Now for the burning question: is XRP about to pop? According to Dark Defender, a well-known XRP chart analyst, it just might. He’s eyeing $3.61 in the short term, with a first stop at $2.22. The chart patterns, moving averages, and Fibonacci levels are all lining up in XRP’s favor. His verdict? “The cup is hot,” and the decision point is just around the corner.