- The Fed removed “reputational risk” from bank supervision rules, easing a major barrier for crypto adoption

- XRP rallied 6% on the news, thanks to its strong banking ties and real-world use cases

- The shift signals a friendlier U.S. regulatory climate that could fuel deeper blockchain-bank integration

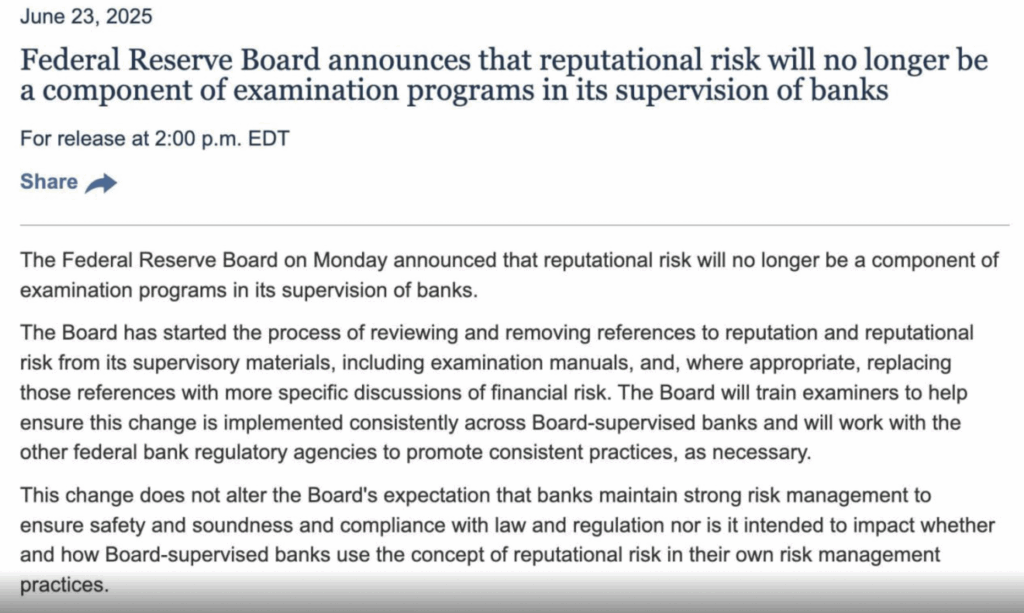

In a surprise move that’s got the crypto crowd buzzing, the Federal Reserve just made a policy pivot that’s being seen as a big win for the industry. On June 23, the Fed said it’ll no longer factor in “reputational risk” when supervising banks — and just like that, the mood across the markets shifted. XRP jumped around 6% on the news, now sitting at about $2.14. Not too shabby, considering where things were just a week ago.

For folks watching closely, this shift sounds small, but it’s not. “Reputational risk” has long been that fuzzy excuse used to keep banks away from crypto. Without it, doors might finally crack open for blockchain firms that have been boxed out for years.

Crypto Twitter’s Got Thoughts (Of Course)

Right after the Fed’s update dropped, crypto heads on X started buzzing. Amonyx (@amonbuy) called it a huge momentfor crypto-friendly banks, posting a screenshot of the Fed’s release. The key bit? Instead of judging banks based on what people might think (aka reputational drama), regulators will now focus more narrowly on financial risks.

That’s big. Because for ages, “reputational concerns” were the go-to excuse to deny banking services to crypto companies — even the legit ones. Now, with that off the table, it could mean way less resistance for institutions looking to work with digital asset platforms.

Why XRP’s Riding the Wave

Let’s talk XRP. It’s not random that XRP reacted so fast to this policy change. Unlike meme tokens or NFT collectibles, XRP’s core use case involves banks — cross-border settlements, remittances, financial rails… you name it. But U.S. banks have mostly kept their distance, and that “reputational risk” clause was one of the reasons why.

Now that the Fed’s dropped that language? Well, it’s kind of a green light. It doesn’t mean banks will all pile in tomorrow, but it clears a massive hurdle. XRP — and companies working with it — might finally have a shot at deeper financial integration in the States.

A Real Shift in the Regulatory Winds?

Now, don’t get it twisted. The Fed still expects banks to be careful — risk management, legal compliance, all that good stuff still applies. But the vibe is different now. The tone feels less anti-crypto, more open to innovation, and that matters a lot in this game.

XRP folks are hoping this signals a new chapter, one where regulators stop treating crypto like radioactive waste. And with the previous administration’s harsh stance fading into the rearview mirror, this latest update looks like part of a broader rethinking of how digital assets fit into traditional finance.