- Canary Capital’s spot XRP ETF launches November 13 under the ticker XRPF on Nasdaq.

- XRP broke out of a 7-year technical pattern, signaling potential bullish momentum.

- The ETF’s approval could attract institutional capital and spark future altcoin ETFs.

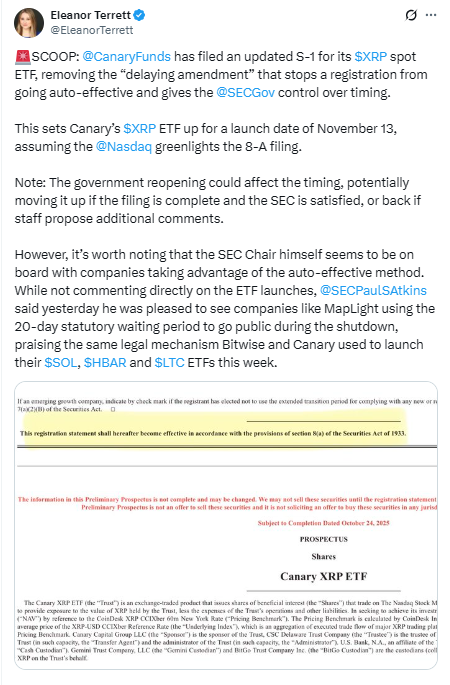

After months of waiting, Canary Capital has finally removed the last roadblock for its spot XRP ETF. The company confirmed that all SEC-related delays have been lifted, clearing the way for a November 13 launch. The ETF, trading under the ticker XRPF, will debut on Nasdaq and give investors direct exposure to XRP’s price—without needing to actually hold the token. It’s a major moment for crypto’s march into mainstream finance, especially as institutional demand for regulated digital asset products continues to grow.

From Filing to Trading: XRP’s New Chapter

Canary Capital’s final filings confirm the fund’s readiness, having locked down custody providers and market makers ahead of launch. The ETF structure mirrors that of the Bitcoin and Ethereum spot products, offering investors a simplified and regulated way to trade crypto exposure. The move could unlock new liquidity for XRP, inviting participation from both retail and institutional sides. Some analysts even suggest that the XRP ETF might replicate the kind of market enthusiasm seen with Bitcoin ETFs earlier this year.

Technicals Point Toward Momentum

Market analyst ChartNerd shared that XRP recently broke free from a massive 7-year symmetrical triangle formation—a breakout that’s stirred up chatter among traders. On the XRP/TetherUS chart, a clear falling wedge pattern flipped bullish, signaling potential upward momentum. As of now, XRP trades near $2.51, with short-term targets sitting around $2.66, $2.51, and $2.42, all drawn from Fibonacci retracement zones. The coin’s consolidation above prior resistance hints at renewed confidence, possibly fueled by the ETF buzz.

The Bigger Picture: XRP’s Path Forward

The introduction of a spot XRP ETF could reshape how traditional markets engage with altcoins. By offering regulated, transparent access to XRP, Canary Capital is effectively bridging two financial worlds—crypto and conventional finance. While short-term success will depend on volume and investor sentiment, the long-term implications are hard to ignore. November 13 might just mark the beginning of XRP’s next evolution, paving the way for future altcoin ETFs down the line.