- XRP sees significant inflows to Binance, with 470 more deposits than withdrawals over 30 days.

- Increased inflows may signal retail investor profit-taking amid a 54% weekly rally in XRP price.

- Whales remain less active in netflows, suggesting retail-driven movements without immediate major market disruptions.

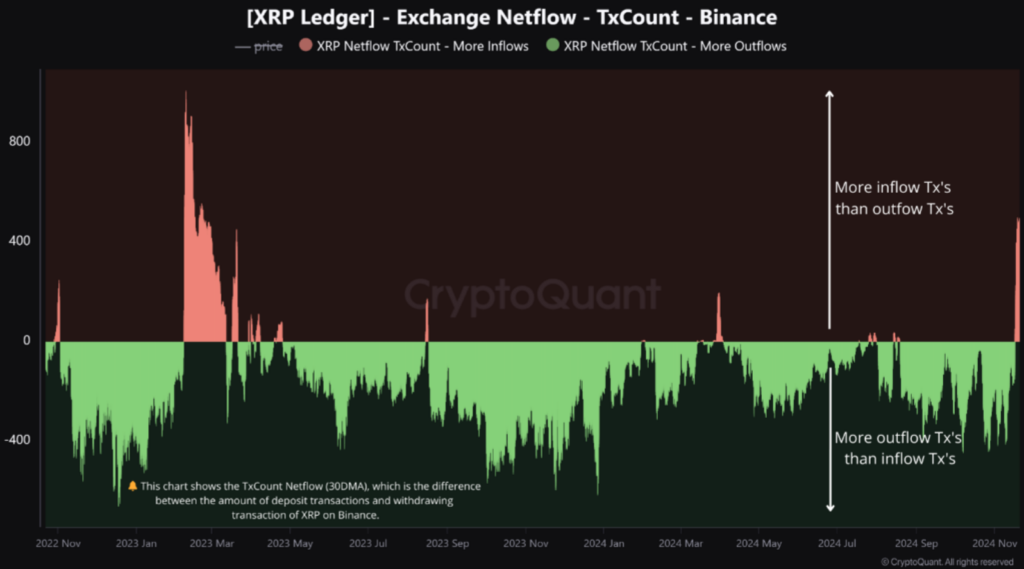

XRP has experienced a surge in inflows to Binance, with the netflow indicator reflecting heightened deposit activity. This shift follows a sharp 54% rally in the token’s value over the past week, lifting its price to $1.09.

Retail Investors Drive Binance Inflows

Data from CryptoQuant reveals that the 30-day moving average of XRP’s netflow on Binance recently spiked, marking a notable departure from the norm. Over the past two years, withdrawals have typically dominated XRP activity on the platform.

The current netflow sits at 470, indicating significantly more deposit transactions than withdrawals. Analysts interpret this as a potential sign of retail investors depositing XRP with intentions to secure profits from the recent price gains.

Source: CryptoQuant

Limited Whale Activity Despite Inflows

The spike in Binance netflows is primarily attributed to retail activity, as smaller investors tend to generate multiple transactions. In contrast, whales, who move large quantities of assets, typically minimize transaction frequency. While this reduces the immediate risk of a sharp price correction, the possibility of a few significant whale transfers cannot be ruled out.

Market Outlook

XRP’s recent rally, outpacing much of the market, has attracted attention from investors. Whether these netflow dynamics translate into further price volatility or sustained momentum will depend on the behavior of both retail and larger holders in the coming days.