- XRP’s monthly chart mirrors Bitcoin’s breakout setup—some are eyeing $10.

- Technicals + Elliott Wave theory support a short-term move toward $4–$5.

- Institutional demand, PayPal integration, and escrow management all help stabilize the path forward.

Lately, XRP’s been turning heads—and not just because it’s been climbing. Technical analysts are now tossing around some pretty bold targets, hinting that the altcoin could be on the verge of pulling a Bitcoin-style breakout. Yeah, you heard that right.

So far, XRP’s holding strong above key daily and weekly levels. And if the chatter’s to be believed, some folks think we could see a run toward $4… maybe even $10 by early September. Sounds nuts? Maybe. But let’s unpack it.

Déjà Vu? XRP Chart Starts Looking A Lot Like Bitcoin

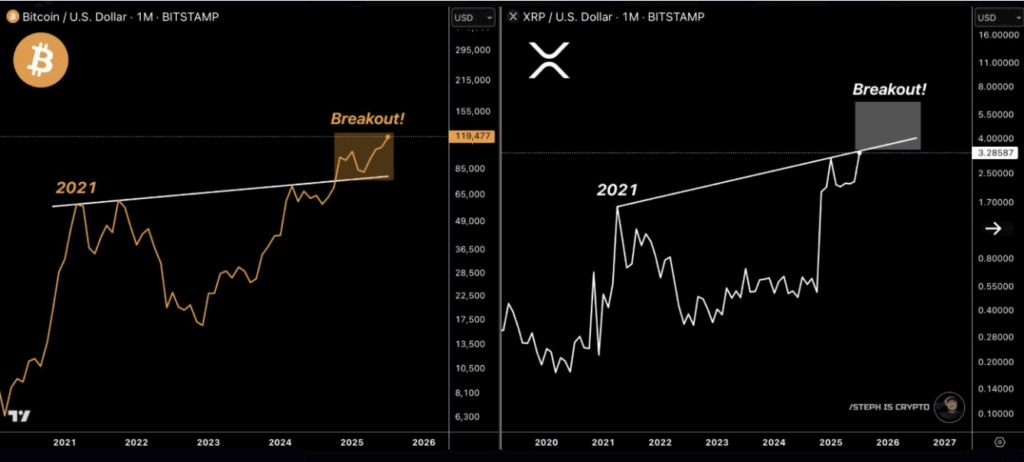

A well-known analyst, Steph Is Crypto, tossed up a chart on X (Twitter, whatever), showing how XRP’s monthly chart is lining up almost eerily with Bitcoin’s big 2021 breakout. Basically, BTC broke out past its 2021 highs recently—touched $119K, dipped slightly to $117K—and XRP is now flirting with a similar resistance.

The chart showed XRP still tucked under its diagonal trendline (drawn from the 2021 cycle high). That’s the line to watch. If it breaks, the thinking is… we’re in business.

Just like Bitcoin’s breakout zone sent it flying, analysts are mapping a similar path for XRP, projecting a move toward the $10 range. Yep. Double digits.

Short-Term Targets? Think $4 to $5

Over on YouTube, analyst Zach Rector dropped a video with a bullish case that XRP’s already “turned the corner.” His key takeaway? The weekly candle closed above $3.24—pretty significant if you follow Fibonacci levels.

Rector thinks this confirms that selling pressure’s easing up. He’s now eyeing $4–$5 as early as mid-August. His chart analysis? Elliott Wave Theory. According to that, we’re now possibly in Wave 3, which tends to be the most explosive.

He didn’t stop there—upper targets point to $7… even $15 by early September if momentum holds. Yeah, a bit aggressive maybe, but he’s basing it on cycle theory and historical wave patterns. He even suggests this run could extend into Q4.

Institutions, Laws, and… PayPal?

It’s not just technicals. Regulatory shifts and institutional plays are also helping XRP’s case. The GENIUS Act has XRP on a shortlist of assets being evaluated by U.S. agencies for reserve infrastructure. That’s a big deal.

Then there’s PayPal, which recently launched a new crypto payment service. It slashes international fees by up to 90% and supports over 100 tokens. XRP’s on the list. So we’ve got fresh utility and more eyeballs on the asset.

That kind of real-world use? It’s the kind of thing institutions like. And they’re already sniffing around.

Escrow Activity and OTC Sales Keep Volatility in Check

One last thing—on-chain behavior’s been pretty controlled. Ripple’s set to release 1 billion XRP from escrow on August 1, as usual. But most of it (roughly 700–800M) gets locked back up. The rest gets sold via OTC—so, not dumped on exchanges.

This method’s helped XRP avoid the wild dumps you see in other unlock events. And since Q3 2019, demand from institutional buyers has stayed solid. Basically, XRP can offload large volumes quietly, without nuking the price.

That’s a rare structural edge. And if momentum sticks, it might just be the rocket fuel for a big move up.