- EGRAG Crypto projects a 244% surge for XRP, possibly reaching $5.50–$6.00.

- Historical trends show smaller crashes each cycle, hinting at growing stability.

- Analysts expect a short-term correction before XRP resumes its upward climb.

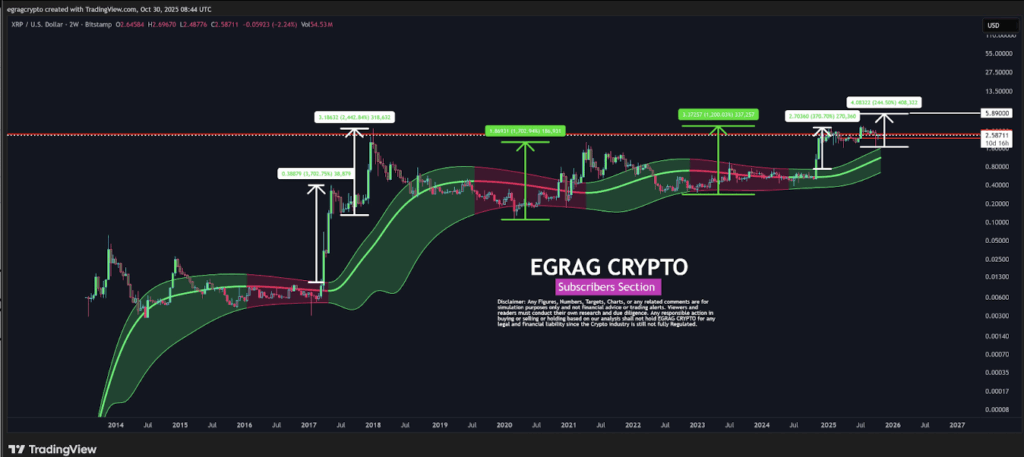

Market analyst EGRAG Crypto thinks XRP still has plenty of room to run before this bull cycle hits its peak. Using the Gaussian Channel, he’s projecting a possible 244% jump from current prices, which would completely flip the idea that the rally is already done. XRP, along with most of the market, tried to push higher earlier this week but ran into resistance. Even so, it’s managed to stay afloat—up a modest 2% over the past seven days—while other top assets slipped into red territory.

EGRAG’s Gaussian Channel Forecast

In his latest breakdown, EGRAG turned to the Gaussian Channel—a tool that tracks trend direction and momentum—to map out XRP’s long-term path. He compared today’s setup to the 2017–2018 bull run, when XRP surged roughly 3,700% and hit about $0.39 before cooling off. By comparison, the current cycle’s rally sits around 370%, barely a tenth of that move. If history rhymes, his model hints at another massive leg up, possibly sending XRP into the $5.50 to $6.00 range.

EGRAG doesn’t buy into the idea of “diminishing returns,” where each market cycle supposedly yields smaller gains. He pointed out that XRP climbed nearly 1,700% during the 2021 cycle—even with the SEC lawsuit hanging over it. With better tech, more adoption, and improving sentiment, he believes the next explosive move could easily take XRP beyond $5 in the months ahead.

Shrinking Losses and Signs of Maturity

Looking back at previous bear markets, EGRAG noticed something interesting—XRP’s crashes are getting smaller. The first major downturn wiped out 96% of its value, the next dropped 86%, showing a steady improvement. If that trend keeps up, the next correction might only reach around 76%, suggesting a maturing market that’s becoming more resilient. Based on this pattern, he estimates that if XRP hits $5–$6 at the top, the next bear market could bottom around $1.20–$1.40.

Even in a softer scenario—say XRP peaks at $3.65—EGRAG’s model points to a correction near $0.87, still consistent with long-term recovery cycles. For investors who bought in under $0.50, this setup looks favorable no matter how choppy the short-term price action gets.

Mixed Short-Term Views, Bullish Long-Term Tone

Other analysts share EGRAG’s bullish long-term stance, though they see possible turbulence ahead. DustyBC, for instance, expects a small corrective phase before XRP starts a third major wave up, targeting between $2.00 and $2.40 for the next key level. Similarly, trader Casi Trades marked $2.68 as the resistance that recently rejected price action, noting support zones around $2.42, $2.03, and $1.65. A drop below $2.42 could stretch the correction toward $1.65, which matches the 0.618 Fibonacci level—often seen as a strong reversal point.

Despite the short-term uncertainty, the bigger picture still leans positive. EGRAG’s Gaussian Channel model paints a setup where XRP could rally past $5, possibly higher, if its historical rhythm continues. For now, the general agreement is that this cycle still has fuel left, and XRP’s structure keeps improving as the market matures.