- XRP selling pressure has increased after a sharp price drop, but overall exchange supply continues to decline.

- Most XRP wallets hold very small balances, while a large portion of supply remains locked or illiquid.

- Rising entry costs and reduced liquidity could tighten the market quickly if demand returns.

Ripple’s XRP is often criticized for having a massive supply, but that headline number doesn’t tell the full story. In reality, most of that supply isn’t easily accessible or actively traded. Millions of wallets hold tiny balances, while the amount of XRP that can actually move freely through the market keeps shrinking.

That imbalance matters. If selling pressure eases and demand even slightly returns, the gap between what exists on paper and what’s actually liquid could start to show up in price, fast.

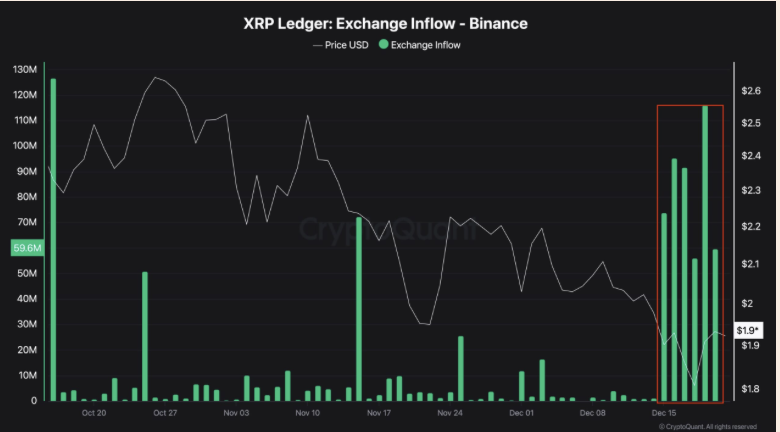

Selling Pressure Spikes After Sharp Drop

XRP has been under heavy selling pressure following a steep decline. Price has fallen nearly 50%, sliding from highs around $3.66 down to roughly $1.85. That kind of move tends to shake confidence, and the on-chain data shows it did exactly that.

Exchange inflows jumped, especially toward Binance, which handles the largest share of XRP trading volume. After a relatively calm stretch, transfers picked up around December 15. Daily inflows ranged between 35 million and 116 million XRP, a clear signal that more holders were moving coins with the intent to sell.

What’s interesting, though, is that even with this activity, the total amount of XRP held on exchanges continues to trend lower. Exchange balances now sit near 1.5 billion XRP. In other words, traders are selling into weakness, but the overall pool of XRP available on exchanges is still shrinking.

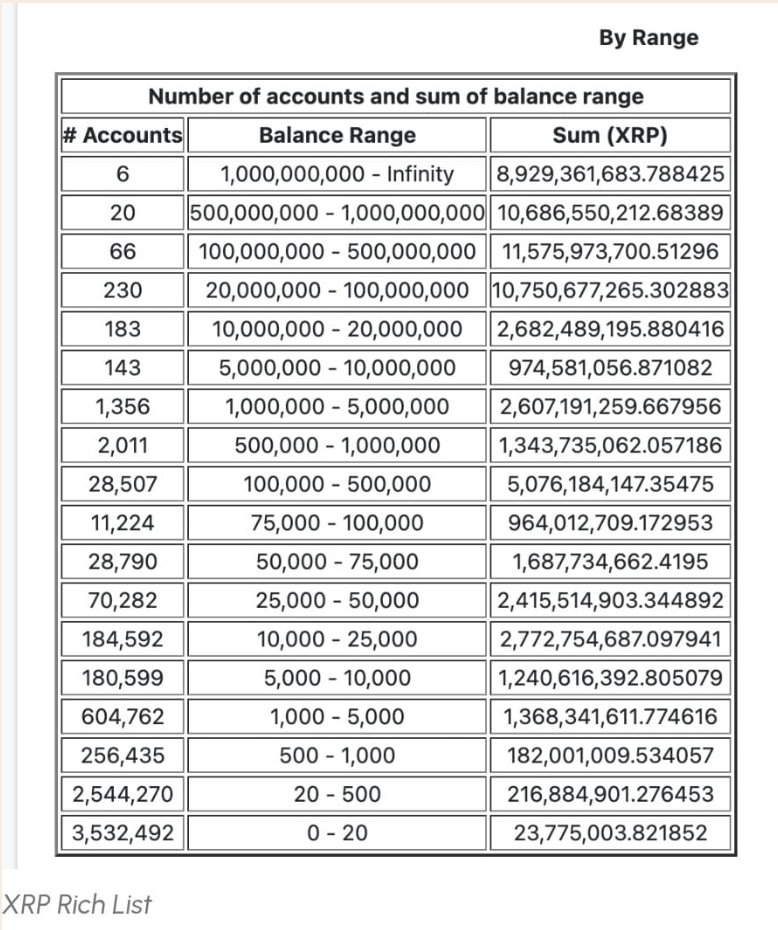

Retail Holds Less While Costs Rise

XRP’s distribution helps explain why this pressure feels uneven. Data shows that more than six million wallets hold 500 XRP or fewer, placing the vast majority of participants firmly in the small-holder category. On the other end, a much smaller number of wallets control millions of XRP each, accounting for a significant share of supply.

This means XRP’s circulating supply looks large on paper, but in practice, far less of it is actually liquid. A growing chunk of XRP is escrowed or effectively locked due to account reserves, ledger mechanics, and protocol-level requirements. That supply isn’t hitting the market anytime soon.

At the same time, XRP has become meaningfully more expensive to accumulate. Buying 1,000 XRP now costs around $1,750, compared to roughly $500 just over a year ago. That jump in entry cost limits how aggressively retail can buy dips, even when price pulls back hard.

A Tight Market Can Form Quickly

Put it all together, and a clear gap starts to form. Retail wallets hold less, buying requires more capital, and a sizable portion of XRP simply isn’t free to trade. While selling pressure is high right now, the structure underneath is tighter than it appears at first glance.

If demand returns, even modestly, it wouldn’t take much to stress available supply. With fewer coins actually moving and fewer participants able to accumulate size, the market could tighten faster than many expect. That’s the quiet setup forming beneath the noise.