- XRP dropped 13.6% alongside BTC’s 5% slide, losing the $3 support which now acts as resistance.

- Bearish momentum remains strong, but the $2.60 zone could offer support and a possible bounce.

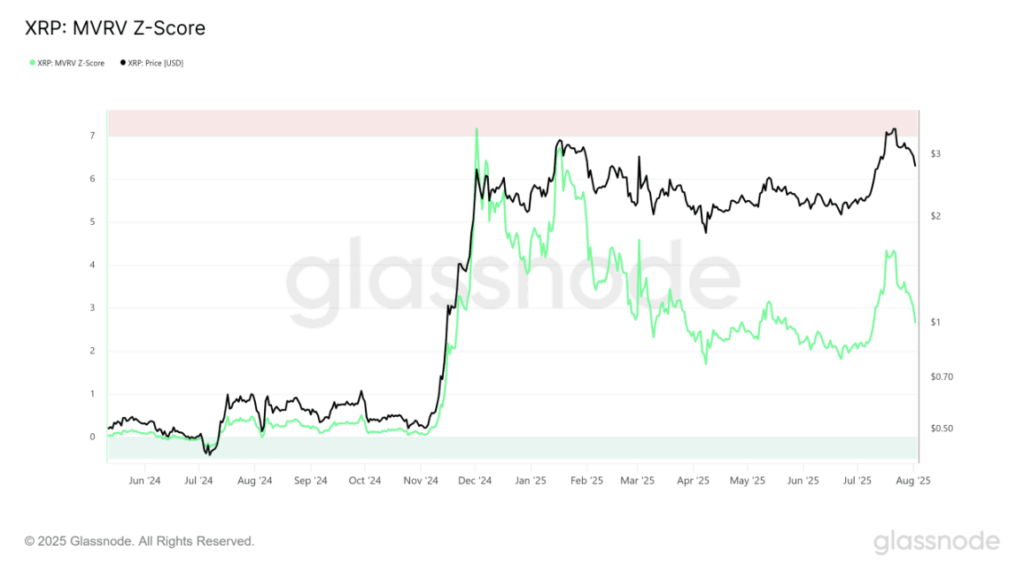

- Despite the dip, valuation metrics show XRP is not overbought, hinting at long-term upside.

It’s been a tough few days for Ripple’s XRP, with the token falling nearly 14% just as Bitcoin started tumbling from its recent highs near $119.8K. Since July 28, BTC has dropped about 5%, and XRP? Well—it’s been hit a bit harder.

One of the biggest red flags? XRP slipped below the psychological $3 barrier, which bulls had been defending like crazy earlier in July. Now that level’s flipped from support into resistance, and climbing back over it might be a heavier lift than it seems. Sellers are in no mood to hand it back.

Momentum’s Fading… But the Downtrend’s Still Got Teeth

On the 12-hour chart, the setup doesn’t scream “reversal” just yet. The Accumulation/Distribution (A/D) line is sloping lower—yep, that means folks are selling. And the Awesome Oscillator? Still flashing red with bearish momentum.

The Directional Movement Index (DMI) paints the same story. With the -DI and ADX both sitting above 20, it’s clear the market’s still leaning bearish, at least for now.

That said, there is a spot to watch. The $2.60 zone is looking like a solid candidate for a bounce. It overlaps with an old Fair Value Gap (FVG) and lines up with former range highs. So, yeah—some traders might start nibbling there.

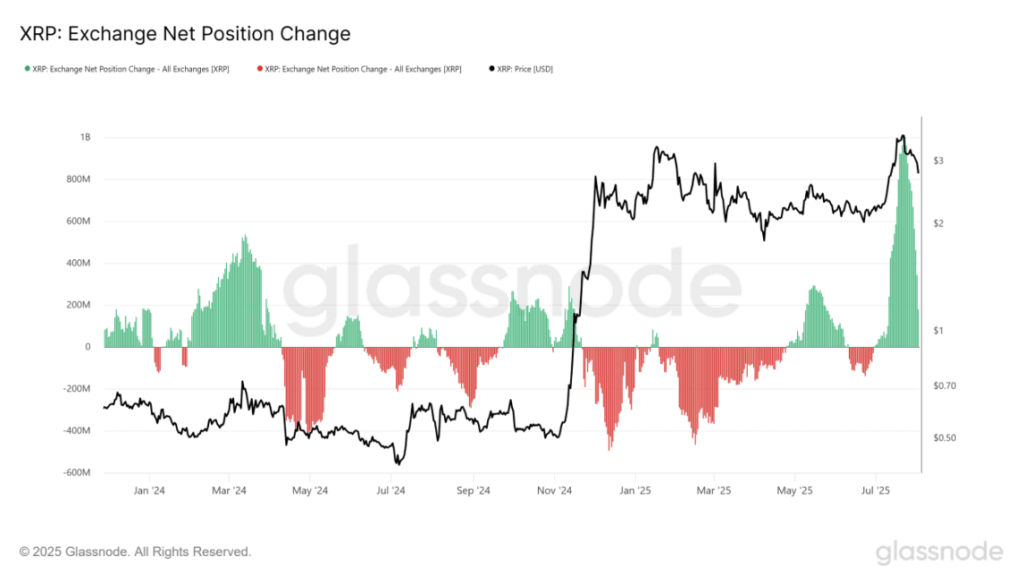

Exchange Inflows Easing—Selling Pressure Cooling Off?

Back on July 23, XRP holders moved a huge amount of tokens onto exchanges, signaling major sell pressure. But recently? That trend’s mellowed out. The Exchange Net Position Change remains slightly positive, which means the panic may be calming down.

The other thing worth noting: over 90% of XRP’s supply was still in profit, even after the pullback. That explains why so many were eager to take profits—but it also means that much of the pressure might’ve already been released.

Valuation Metrics Say XRP Still Has Room to Run

Here’s the interesting part. The MVRV Z-Score, a metric that compares market value to realized value, is still sitting comfortably below historical top levels. Translation? XRP doesn’t look super overvalued right now.

If price drops toward $2.60 and holds, that could end up being a solid entry point—especially for longer-term bulls who aren’t scared off by a little volatility.

For now, XRP’s cooling off… but if support holds and sentiment turns, this might just be a breather before the next leg.