- XRPL has released its first formal specification for the Payment Engine, documenting existing transaction logic

- The work introduces formal verification, a standard used in high-stakes financial and safety-critical systems

- The focus is on long-term reliability, auditability, and infrastructure maturity rather than short-term price impact

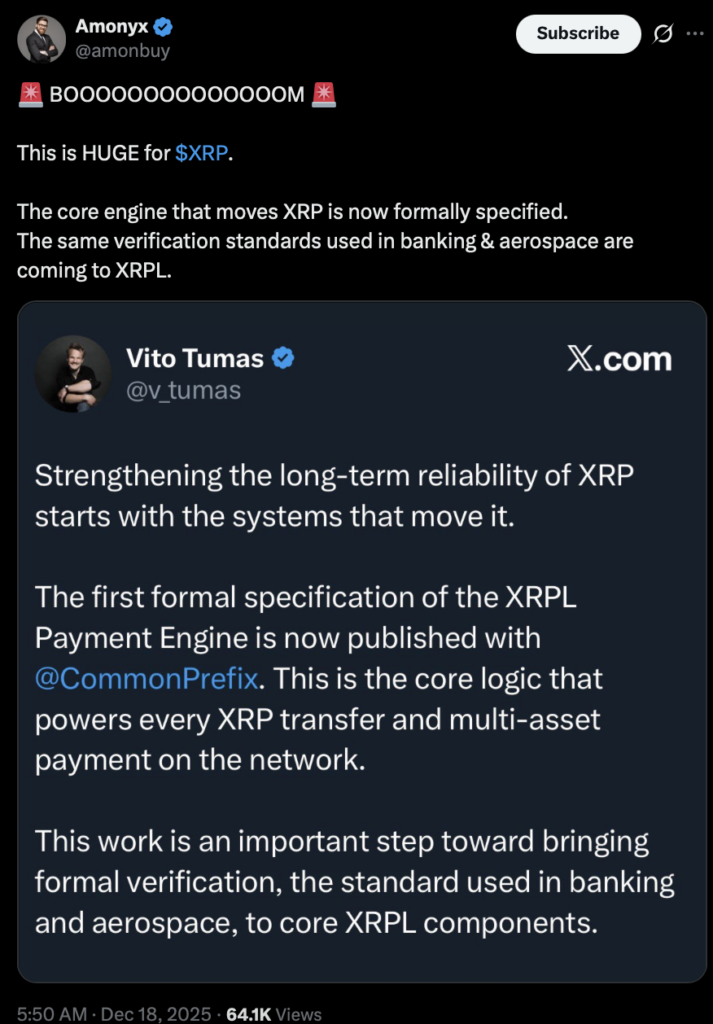

An XRP community member known as Amonyx recently highlighted a development that has nothing to do with charts, candles, or short-term sentiment. Instead, the update zeroes in on the XRP Ledger itself, specifically how transactions are executed under the hood.

The key change is the release of the first formal specification for the XRPL Payment Engine. This engine is the core system that processes XRP transfers and routes multi-asset payments across the network. It’s not a new feature, and it doesn’t change how users interact with XRP day to day. What it does is make the existing logic explicit, documented, and verifiable, which is a big deal in infrastructure terms.

What the XRPL Payment Engine Specification Actually Does

The payment engine has always been there, quietly enforcing rules, validating paths, and making sure transactions behave correctly in every scenario. Until now, that behavior lived mostly in code and developer knowledge.

By formally specifying the engine, XRPL developers are locking in how it is supposed to behave under all conditions. This reduces ambiguity, removes guesswork, and gives everyone, from developers to auditors, a shared reference point. In simple terms, it turns “this is how it works in practice” into “this is how it works by definition.”

Formal Verification Enters the XRP Ledger

Amonyx noted that this work is being done alongside Common Prefix, a firm known for formal methods and system verification. Formal verification isn’t trendy crypto jargon. It’s a discipline used in banking systems, aerospace software, and other environments where errors are unacceptable.

Applying this approach to the XRPL means the logic behind XRP payments can be mathematically proven to behave as intended. That’s different from testing, which checks for known issues, or code reviews, which rely on human judgment. Formal methods aim to prove correctness, even in edge cases most systems never think about.

This adds another layer of resilience. It also makes the ledger easier to reason about as it grows, especially when new implementations or integrations come into play.

Why This Matters for Long-Term Reliability

The tone of the discussion wasn’t about adoption headlines or quick wins. It was about durability. Financial infrastructure, especially in regulated environments, needs more than speed and low fees. It needs predictability, auditability, and guarantees about behavior.

A formally specified payment engine helps XRPL move closer to that standard. It also lowers the barrier for external developers. Instead of reverse-engineering behavior from source code, builders can rely on a clear, written specification. Over time, that clarity can support a healthier and more diverse development ecosystem.

Community Reaction and the Bigger Picture

Some community members reacted with a mix of surprise and cautious optimism. One commenter, TafTrader, pointed out how quickly XRP’s underlying infrastructure seems to be advancing, even if the market hasn’t caught on yet.

That response fits the moment. This kind of work rarely shows up immediately in price. It’s slow, unglamorous, and foundational. But it’s exactly the kind of progress that tends to matter later, when networks are judged not by narratives, but by how well they hold up under real-world demands.

The formal specification of the XRPL Payment Engine doesn’t change XRP overnight. What it does is quietly reinforce the idea that the ledger is being built for serious, long-term financial use, not experimentation.