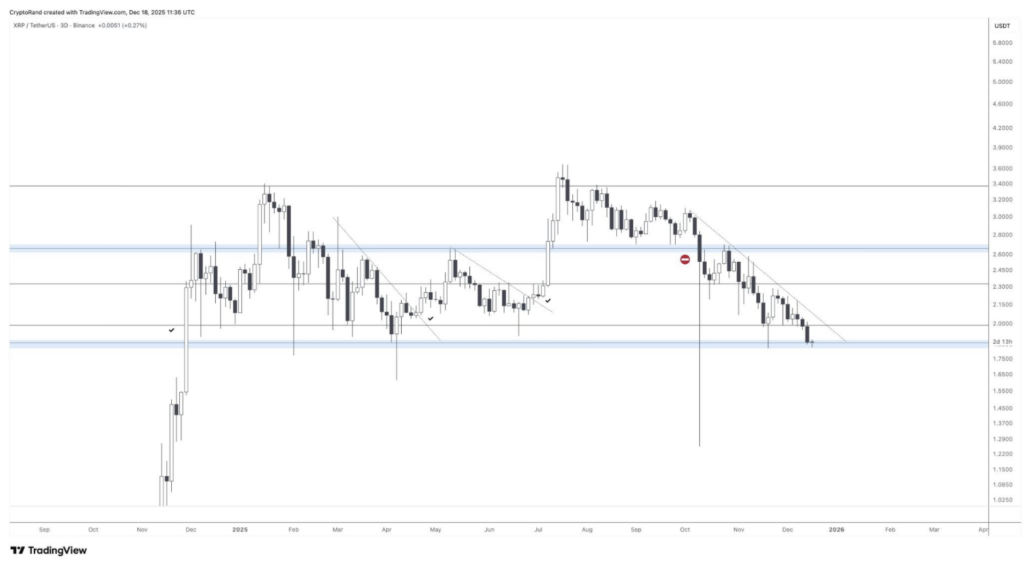

- XRP is sitting directly on a major $1.85 support zone after months of lower highs and fading momentum

- Repeated weak bounces and a descending trendline show bears still control the short-term structure

- A clean hold could trigger a relief bounce, but a breakdown opens the door to much lower prices

XRP is back in a spot traders really don’t enjoy revisiting. After months of fading momentum and a steady pattern of lower highs, price is now sitting right on top of a major support zone near $1.85. The short-term structure leans bearish, and sellers still have the upper hand.

As CryptoRand put it on X, XRP is “literally at the verge of the cliff.” And honestly, that’s not much of an exaggeration. At this point, the chart boils down to one uncomfortable question: does price bounce here, or does the floor finally give way?

From a distance, XRP doesn’t look chaotic. But when you zoom out and let the higher timeframes breathe, the pressure becomes harder to ignore.

A long trading range starts to feel tired

For most of the year, XRP moved inside a wide, well-defined range. Support lived around $1.85–$1.90, while resistance sat higher near $2.60–$2.70. Traders grew comfortable fading moves back and forth, and for a while, it worked.

Lately though, price has drifted back to the lower edge of that range again. This area has held multiple times in the past, but each bounce has looked weaker than the one before it. That’s usually not a great sign. When support keeps getting tested without strong follow-through, it often means sellers are slowly tightening their grip.

One thing that stands out is XRP’s inability to reclaim the mid-range zone around $2.30–$2.40. Instead of building higher lows, price keeps rolling over, forming a descending trendline that caps every relief rally.

Bears still control the short-term structure

On the most recent chart shared by CryptoRand, XRP is clearly trending lower beneath a downward-sloping resistance line. Every attempt to push higher gets sold into early, often before price can even threaten the $2.10–$2.15 area.

That kind of structure signals control, not balance. Bears don’t need to force price lower aggressively when sellers are already stepping in ahead of resistance. As long as XRP remains below that descending trendline, upside moves look more like bounces than actual reversals.

Another subtle warning sign is the lack of strong bullish candles near support. Instead of sharp reactions off $1.85, price is drifting sideways. That usually points to hesitation, not confidence, from buyers.

Support is holding, but it’s getting thin

To be fair, XRP hasn’t broken down yet. The $1.85 zone is still holding, at least for now, and that alone keeps the door open for a short-term bounce. This is where traders start watching closely for any hint of demand stepping in.

A clean reaction from this level could push price back toward $2.10 and possibly into the middle of the range again, assuming sentiment improves. But even then, the descending trendline looms overhead as the next major obstacle.

If $1.85 fails, though, the chart opens up quickly. Below this level, there isn’t much structure until significantly lower prices, which is why the “cliff edge” description fits so well.

XRP sits at a clear decision point

Right now, XRP isn’t offering much room for indecision. Either buyers defend the $1.85 area and force a bounce, or bears finally crack support and shift the broader picture lower.

The chart doesn’t scream panic yet, but it does show vulnerability. Until XRP can reclaim lost levels and break out of its downward structure, risk remains skewed to the downside.

For traders, this is one of those moments where patience actually pays. The next move likely won’t be subtle, and whichever side wins the fight around $1.85 will probably decide where XRP heads next.