- XRP ETFs give traditional investors an easy, regulated path into XRP exposure, creating fresh demand that doesn’t rely on crypto-native users.

- XRP price didn’t spike at launch because ETF inflows settle slowly — real XRP purchases appear only after share creation cycles kick in.

- Long-term, institutional access through ETFs could support steady accumulation, giving XRP a new foundation for future price growth.

For years, the whole idea of an XRP ETF felt kind of distant, almost like one of those things people talked about but didn’t expect to actually happen anytime soon. And yet here we are — the first wave of XRP ETF products has finally launched, and the reaction was loud enough to get everyone asking the same question on repeat: Alright, so what does this actually mean for XRP’s price?

Even analysts at the Working Money Channel jumped right into the numbers, breaking down how these ETFs function and what kind of pressure (or lack of it) they might put on XRP in the early days.

XRP ETF Opens the Door for a Brand New Crowd

One of the biggest points the analyst made is simple but important: ETFs bring in people who never wanted to mess with wallets, exchanges, or crypto storage headaches. Suddenly, traditional investors can get XRP exposure the same way they buy stocks or gold ETFs.

And the early numbers? Pretty surprising.

In the first hours, XRP ETF trading volume was strong enough to beat out several well-known crypto ETFs. That doesn’t usually happen unless there’s real curiosity beyond the regular crypto crowd.

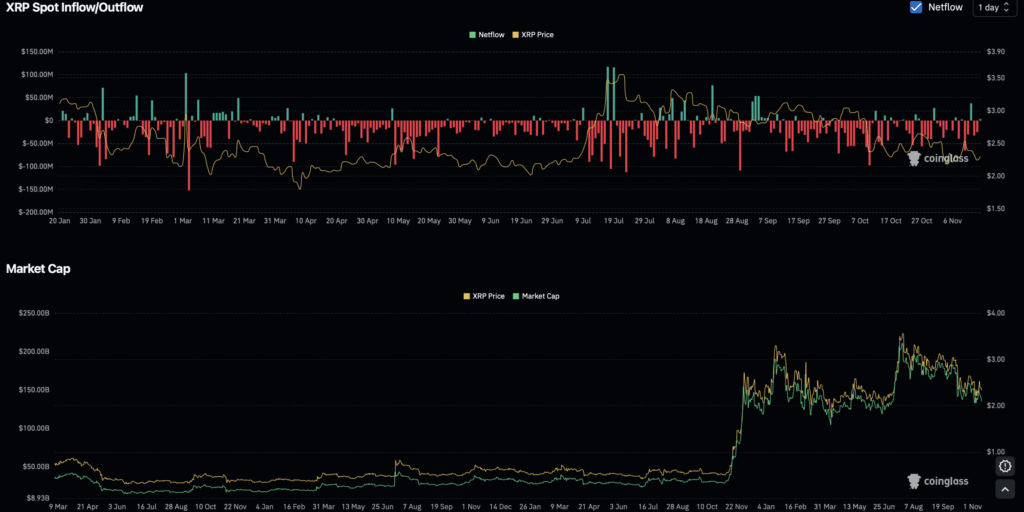

It feels a bit like the early Bitcoin ETF moment — the price didn’t explode instantly, but the tone of the conversation changed almost overnight. And because XRP ETFs require issuers to actually hold physical XRP, this creates steady demand over time instead of one big spike that fades away.

That’s why the analyst believes the real impact on XRP price won’t show up immediately, even if the excitement did.

Why XRP Didn’t Pump Right After ETF Launch

A lot of people expected XRP to moon the minute the ETF went live… and then felt confused when nothing happened. The analyst breaks this down pretty clearly:

ETF inflows don’t instantly convert into XRP buys.

Funds need time to settle. Authorized participants create new ETF shares. Those shares then need real XRP backing — but that part often happens the next business day, not the same minute the ETF starts trading.

So what you see in early hours is mostly ETF shares moving around, not actual XRP being bought on the open market. That’s why XRP can look so calm while ETF volume is “wow-level.”

Bitcoin did the same thing back when its ETFs launched. Price dipped at first, then gradually lifted as real inflows finally kicked in. XRP seems to be following that same slow-burn pattern.

Institutional Money Moves Slow — But It Moves Big

Something else the analyst pointed out is the “second wave effect.” Early ETF volume usually comes from retail traders, but big institutions take longer.

Funds and corporate investors need:

- compliance checks

- internal approvals

- risk reviews

- allocation meetings

That can take weeks. Sometimes months.

Which means real institutional inflows might start after the noise dies down — not before.

And for big money players, ETFs are a perfect solution because they avoid the messy stuff like:

- storing XRP

- managing private keys

- navigating exchange risks

- dealing with internal crypto policies

A regulated ETF is clean and easy. That convenience alone could support a slow but steady upward pressure on XRP over time.

What an XRP ETF Means Going Forward

The analyst’s final takeaway was pretty balanced: don’t expect fireworks in the first hour. XRP’s reaction will probably come in waves — settlement cycles, inflows, share creation, and then maybe a shift in price once the structure stabilizes.

This mirrors how Bitcoin ETFs behaved. Early dip… then a steady climb once capital actually started flowing into the underlying asset.

And while XRP often moves in Bitcoin’s orbit during speculative periods, the ETF could introduce a unique catalystthat XRP hasn’t had before:

a brand-new stream of institutional money entering the asset through regulated channels.

Does it guarantee new highs? No.

Does it create a powerful new pathway for adoption? Absolutely.

For investors who never bought crypto before — and never planned to — the XRP ETF is their first real doorway into the XRP ecosystem.