- Vincent Van Code says holding XRP long-term takes either extreme conviction or “a bit of madness.”

- He compares it to early Bitcoin holders who sold too soon, showing how emotional pressure drives decisions.

- Staying invested through crashes isn’t about timing—it’s about emotional endurance few investors truly possess.

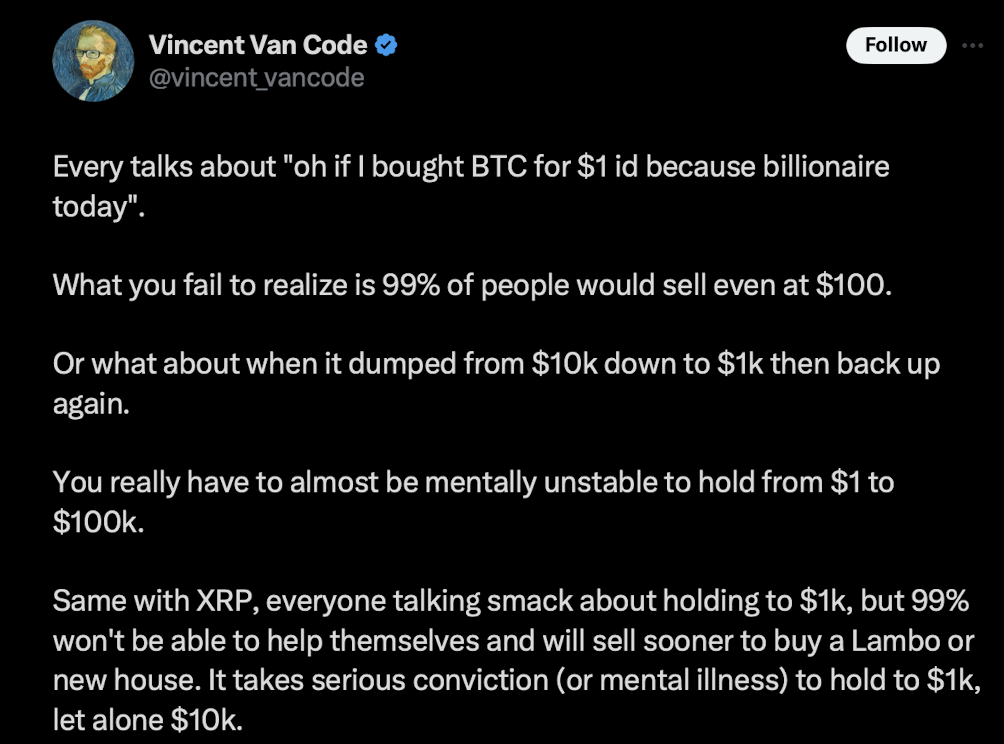

Software engineer and XRP supporter Vincent Van Code has stirred up some strong reactions again, this time with a brutally honest take on what it really takes to hold volatile assets like XRP through thick and thin. In a post that quickly went viral among crypto circles, he joked that staying invested in XRP for years—despite constant market swings—requires either “unshakable conviction or just a bit of mental instability.” Behind the humor though, lies a serious truth about the psychological cost of long-term investing in unpredictable markets.

The Mental Marathon of Long-Term Holding

Van Code argued that most investors think they can handle the stress of long-term holding… until volatility actually hits. He said that people love to believe they’d stay patient through every dip, but when prices soar or crash hard, emotion always wins. Many end up selling the moment they see a life-changing profit, even if a bigger move is still ahead.

He used Bitcoin as a perfect example—how few people could’ve imagined its journey from less than $1 to over $110,000. “Most of the ones claiming they’d have held from the start would’ve probably sold at $100,” he wrote. And he’s not wrong. Over the years, countless early BTC holders have sold after long dormancy, taking huge profits but missing out on far larger potential returns. And of course, who can forget the guy who spent 10,000 BTC on two pizzas?

According to Van Code, surviving brutal corrections—like Bitcoin’s past 80% crashes—requires more than just belief.It takes serious emotional resilience, a kind of mental toughness that very few investors actually have.

Could Anyone Really Hold XRP Until $1,000?

The engineer then turned his thoughts to XRP, asking if anyone could truly hold until the token hit $1,000 or more. “People love to say they’ll never sell,” he noted, “but when their wallets show numbers that could change their entire lives, most would hit the sell button without a second thought.”

While predictions of XRP reaching $1,000 have been floating around for years—some even saying by 2040 under ideal conditions—it’s easier said than done. With XRP still under $3 today, holding for over a decade would test anyone’s sanity, especially given how wild crypto cycles can get. Van Code pointed back to 2018, when XRP crashed over 95% after peaking near $3, saying that kind of drawdown “makes even the most confident investors question everything.”

The Reality of Emotional Discipline

Another longtime XRP holder, known online as TheXFactor33, backed Van Code’s view. He admitted that staying invested through endless downturns demands what he called “an unhealthy amount of stubbornness.” Having held XRP for more than eight years, he said emotional discipline—not market knowledge—is what separates survivors from sellers.

Van Code later shared that he’s already mentally detached from his holdings. “The money doesn’t exist to me anymore,” he said, explaining that even if XRP hits $10,000 someday, he has no plans to sell. For him, it’s about long-term purpose—something bigger than short-term profits. “Maybe it buys property for my kids one day,” he added.

His outlook sums it up perfectly: in crypto, the hardest part isn’t picking the right asset—it’s surviving the mental strain of watching it swing wildly for years. Holding through fear, greed, and doubt isn’t a skill most investors master. It’s a test of psychology more than anything else.