- XRP ETFs absorbed more than 506 million tokens in under a month.

- Two major chart patterns point to upside targets between 14 and 15 dollars.

- Analyst expects XRP could accelerate toward 10 dollars in 2026 if inflows continue.

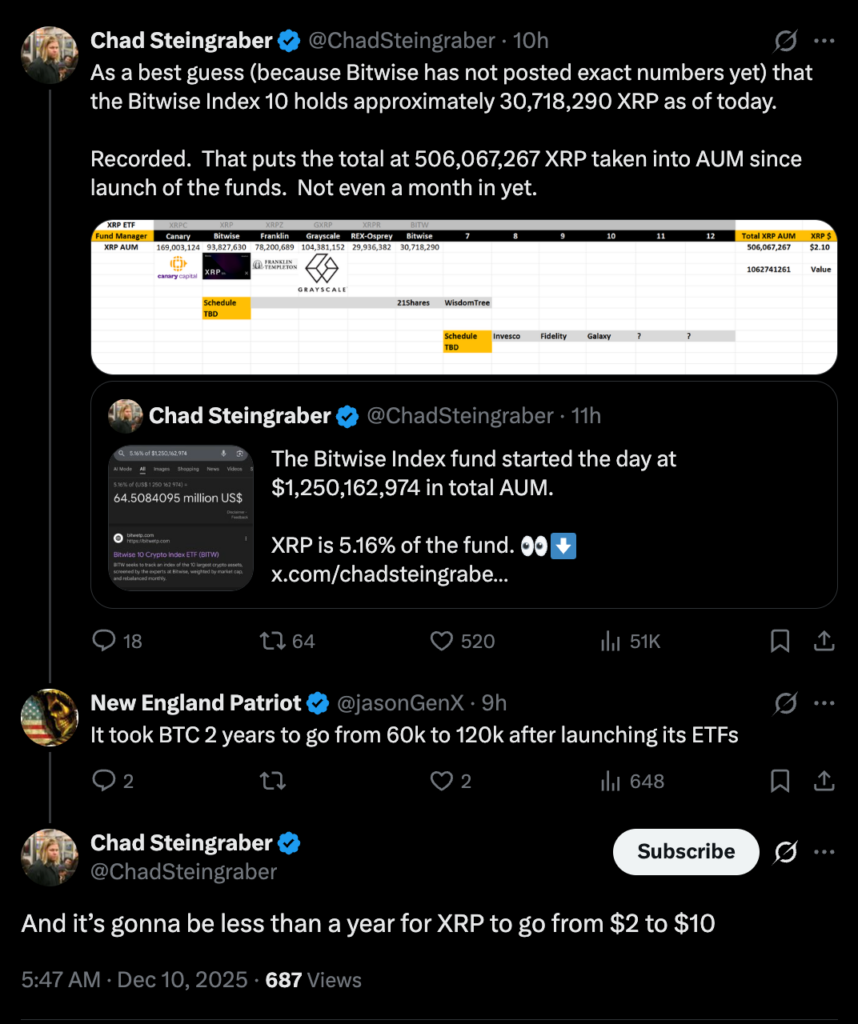

XRP may be preparing for a rapid repricing phase, according to analyst Chad Steingraber, who believes the asset could move from 2 dollars to 10 dollars in under a year. His outlook follows the strong early demand for XRP exchange-traded funds, which launched in mid-November and have already absorbed more than 944 million dollars worth of XRP. These inflows represent over 506 million XRP entering ETF custody in less than a month, now accounting for roughly 0.74 percent of all circulating supply.

Institutional Allocation Adds Fuel to the Rally Setup

XRP’s inclusion in the new Bitwise Crypto 10 ETF, which opened with more than 1.25 billion dollars in assets, further strengthens the institutional narrative. XRP represents 5 percent of the fund, and early estimates suggest more than 30.7 million XRP have been added to its portfolio. Steingraber argues that if ETF adoption continues at this pace, XRP could mirror the performance of Bitcoin following its ETF debut and accelerate toward the 10-dollar region in 2026.

Chart Patterns Point Toward the $14–$15 Price Targets

From a technical perspective, XRP has broken above a multimonth symmetrical triangle on the two-week chart, signaling a potential shift into a new trend phase. The measured move from this pattern points toward the 14 to 15 dollar range. A second formation, a bull flag developing on higher time frames, reinforces the same targets. If buyers maintain control and confirm a breakout above upper resistance, the technical landscape suggests room for a major rally in the coming months.