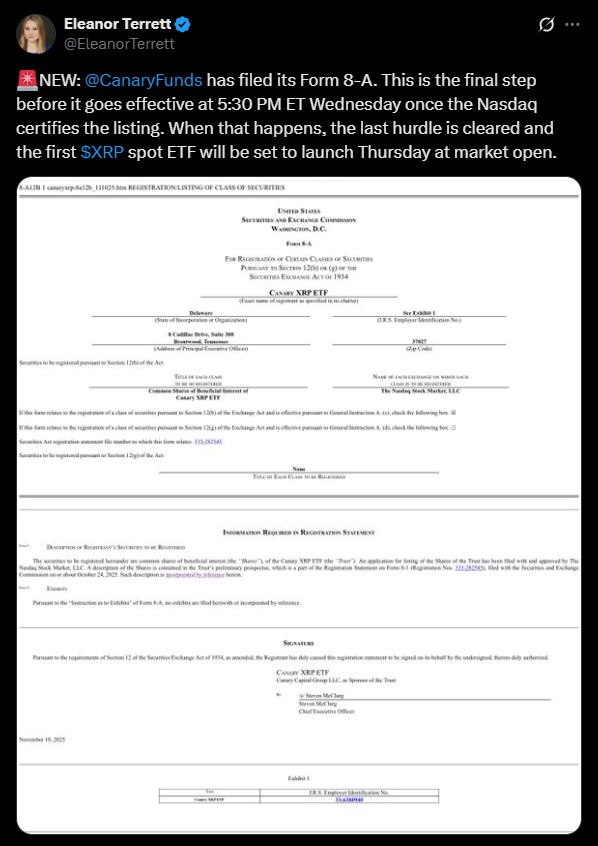

- Canary Capital has filed its Form 8-A for Nasdaq certification, signaling that a spot XRP ETF could launch as soon as Thursday after years of anticipation.

- Despite the bullish ETF milestone, XRP is still down on the day, 14-day, and monthly time frames, though it remains up 7% on the week and nearly 296% since November 2024.

- With Ripple’s SEC case resolved, the first XRP ETF approaching, and the Fed cutting rates again, XRP could see stronger institutional flows ahead and has a real shot at targeting new all-time highs if sentiment flips risk-on.

According to prominent crypto journalist Eleanor Terrett, Canary Capital has filed its Form 8-A with Nasdaq, a key final step before the institution’s potential spot XRP ETF launch on Thursday. For investors who’ve been waiting years for an XRP ETF, this move signals that the long wait may finally be coming to an end and that XRP is about to join Bitcoin and Ethereum in the US ETF club.

Despite how bullish that sounds on paper, the market’s immediate reaction hasn’t fully matched the excitement just yet.

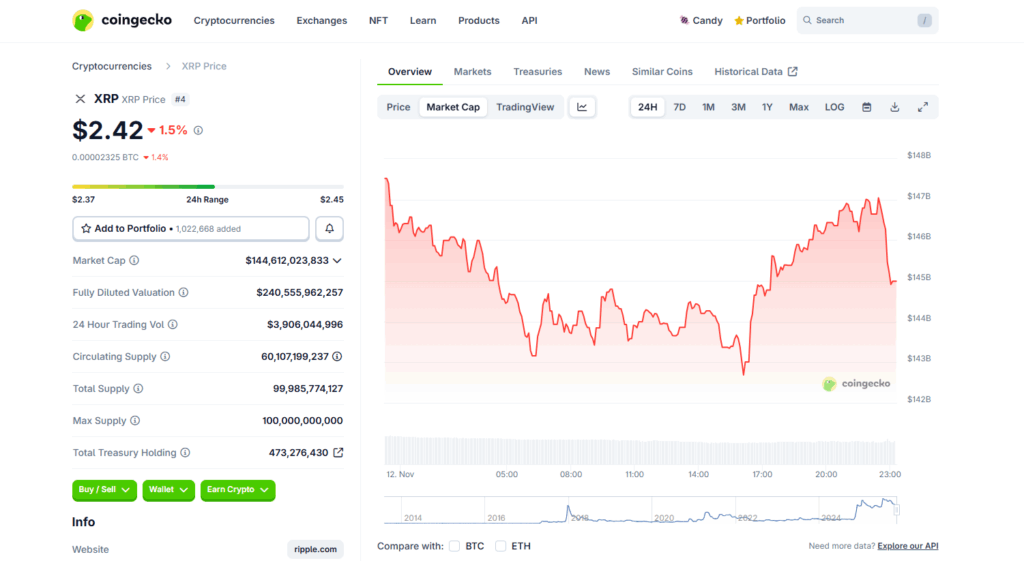

XRP Price Action Looks Cautious Ahead of Launch

According to CoinGecko data, XRP was down more than 5% earlier today on the 24-hour chart before staging a mild recovery. It’s still down around 3.1% over the same period, showing that traders are far from going all-in on the news.

The softness extends across higher timeframes as well, with XRP down 8.4% over the last 14 days and 6.8% over the past month. Yet when you zoom out, the broader trend is still firmly positive: XRP has rallied 7% in the last week and a massive 295.5% since November 2024. So while near-term price action looks hesitant, 2025 overall remains a strongly bullish year for the token.

Will XRP Follow Bitcoin’s Playbook or Ethereum’s?

A key question now is what post-ETF pattern XRP might follow. Crypto-based ETF products first hit the US market in early 2024 with the launch of several Bitcoin (BTC) and Ethereum (ETH) spot ETFs, and their paths could not have been more different.

Bitcoin reacted almost immediately. Following ETF approval, BTC went on to hit multiple new all-time highs throughout 2024 and into 2025, with ETF flows reinforcing its blue-chip status. Ethereum, by contrast, had a much slower response. After its own spot ETF launch, ETH mostly chopped sideways for months, and it took nearly a full year before it finally broke to fresh highs.

Right now, it’s unclear which script XRP will adopt. It could explode higher like Bitcoin if inflows and sentiment align quickly, or it could grind and consolidate for months like Ethereum did before eventually repricing higher once the market digests the new product.

Legal Clarity, ETF Momentum, and Macro Support

What’s clear is that 2025 has been structurally bullish for XRP. Ripple finally settled its lawsuit with the SEC, removing a long-running legal overhang that had scared off some institutions and created uncertainty around XRP’s regulatory status in the US. That alone has been a major psychological and practical tailwind.

Now, with the first XRP ETF lining up for launch, the token is on the brink of potentially unlocking significant institutional capital. ETFs provide a familiar, regulated wrapper for funds and wealth managers who can’t or won’t hold spot crypto directly. If even a fraction of that capital rotates into XRP, it could meaningfully change liquidity, volatility, and price structure over the medium term.

On top of that, the Federal Reserve recently cut interest rates by another 25 basis points, which generally improves conditions for risk assets over time. Lower rates tend to encourage investors to move further out on the risk curve, and crypto often benefits from that shift, especially when there’s a fresh narrative—like a new ETF launch—to latch onto.

In the very short term, XRP may stay choppy as traders position around the rollout and debate whether this is a “buy the rumor, sell the news” moment. But if ETF flows are solid and macro conditions stay supportive, XRP has a realistic shot at using this launch window as a stepping stone toward a new all-time high in the months ahead.