- XRP slid 6% Tuesday, extending a 13% weekly decline as whales sold off 460M tokens.

- Despite losses, over 93% of supply remains profitable, raising risk of profit-taking on bearish shocks.

- XRP broke below key support levels, with $2.78 and $2.60 eyed as the next lines of defense.

XRP took a sharp hit on Tuesday, tumbling 6% as big-money holders started unloading tokens while sitting on hefty profits. The sell-off comes just days before Federal Reserve Chair Jerome Powell’s speech at Jackson Hole, which has investors on edge. In less than a week, XRP has dropped 13%, signaling nerves across the market as traders brace for any macro shock from Powell’s words.

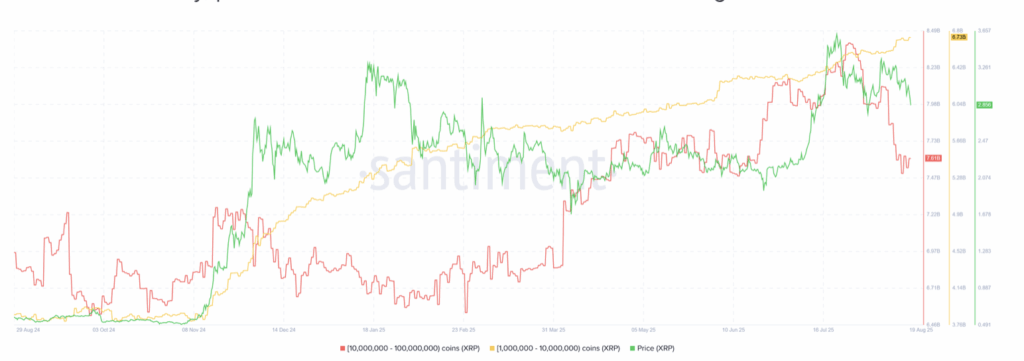

Data shows wallets holding between 10–100 million XRP cut back roughly 460 million tokens over the past seven days. Interestingly though, smaller whales—those in the 1–10 million XRP bracket—went the other way, scooping up an additional 130 million tokens. The divergence hints at mixed expectations, but historically, prices tend to follow the direction of the largest holders, which makes their move all the more significant.

Profits Remain High Despite Sell-Off

Even with the recent pullback, most XRP holders are still deep in the green. More than 93% of circulating supply has been in profit since mid-July, with average profit margins staying above 90%. In fact, the token hasn’t seen average profits dip under 80% since November’s uptrend following Trump’s election victory. That kind of extended profitability often acts as a double-edged sword—it builds confidence, but it also tempts traders to take money off the table if sentiment shifts.

XRP has also benefited from clearing one of its biggest overhangs: Ripple’s lengthy SEC battle finally ended after four years, combined with a wave of friendlier regulatory moves under Trump’s administration. Those catalysts provided strong tailwinds, but with them largely priced in, investors may be quicker to lock in profits if Powell’s speech spooks broader markets.

Technical Breakdown Signals More Weakness

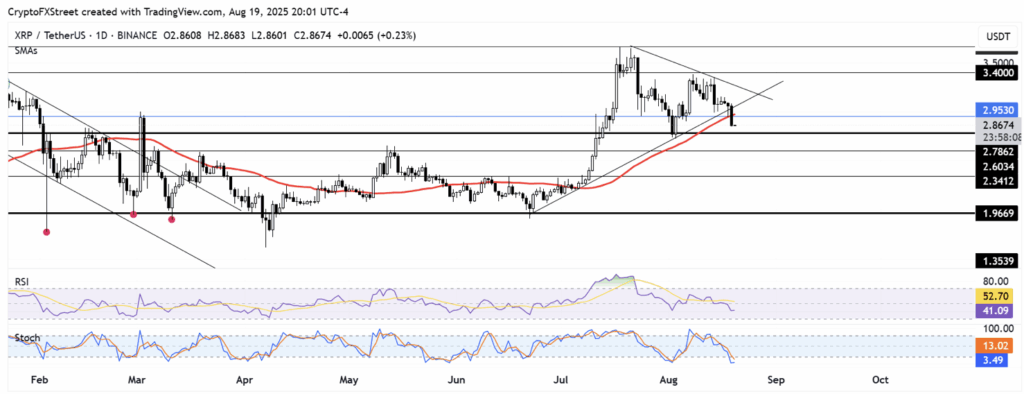

On the charts, XRP slipped below some key levels in the last 24 hours. The token fell out of a symmetrical triangle pattern, lost its $2.95 support, and dipped under the 50-day Simple Moving Average (SMA). If it can’t recover that SMA soon, the next big support lies at $2.78, with $2.60 further down as a possible cushion if selling pressure accelerates.

Momentum indicators point to continued bearish pressure. The Relative Strength Index (RSI) has slid under its neutral line, confirming sellers are in control. At the same time, the Stochastic Oscillator has dropped into oversold territory. That mix suggests bearish momentum dominates for now, but it also leaves the door open for a short-lived relief bounce if buyers step back in.