- XRP secured a 19.88% weight in ARK Invest’s new CoinDesk 20 Crypto ETF

- The allocation places XRP alongside Bitcoin and Ethereum as a core holding

- The move signals growing institutional comfort with XRP in regulated products

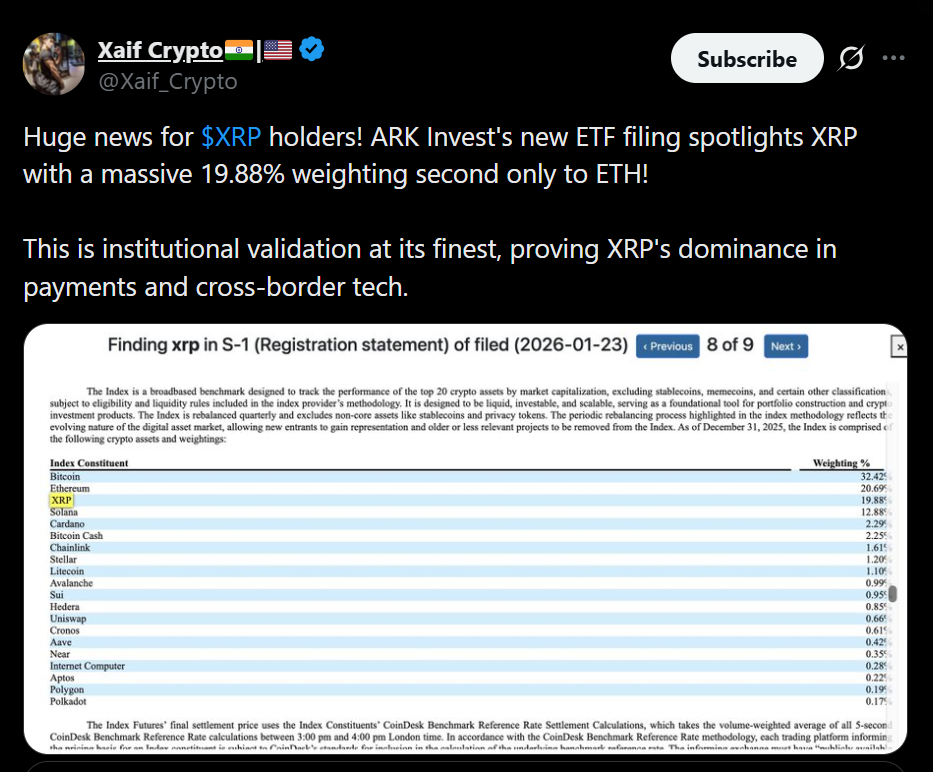

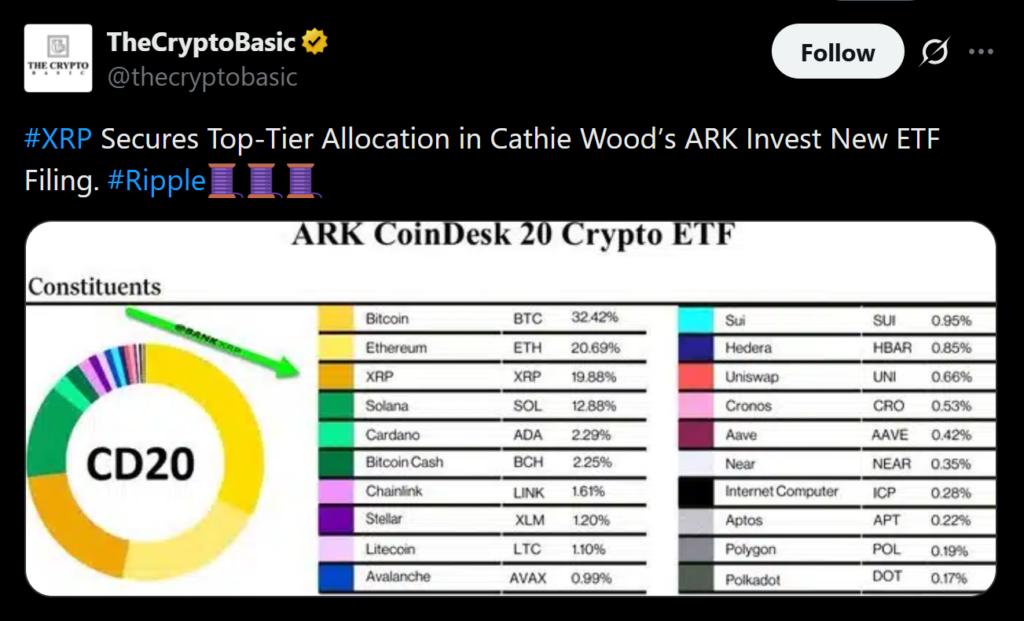

XRP just secured a major institutional vote of confidence after landing a 19.88% allocation in ARK Invest’s newly filed CoinDesk 20 Crypto ETF. The filing, submitted to the SEC on January 23, 2026, positions XRP as a core holding alongside Bitcoin and Ethereum, signaling a clear shift in how regulated crypto funds now view the asset. For traditional investors, this move frames XRP less as a speculative token and more as a trusted, large-cap digital asset.

Inside ARK’s XRP Allocation Decision

The CoinDesk 20 Index that underpins the ETF gives Bitcoin the largest weight at 32.4%, followed by Ethereum at 20.69%, with XRP coming in third at 19.88%. That puts XRP ahead of networks like Solana and Cardano, a notable outcome given the competition for institutional capital. Allocations of this size are typically reserved for assets with deep liquidity and the ability to absorb large inflows without extreme price volatility, both of which XRP has demonstrated across global markets.

Why Asset Managers Are Comfortable With XRP

This allocation reflects more than simple market cap math. XRP’s long-standing role in cross-border payments and settlement infrastructure gives it a utility profile that resonates with institutions seeking durability rather than hype-driven upside. The post-litigation environment has also removed much of the regulatory hesitation that previously limited XRP’s inclusion in traditional investment products, opening the door for larger, regulated exposures.

What This Means for Regulated Crypto Funds

ARK’s filing excludes stablecoins, memecoins, and privacy-focused assets, narrowing its focus to scalable, liquid networks. Including XRP at nearly 20% reinforces its status as institutionally viable and sets a benchmark for how future diversified crypto funds may allocate capital. If approved, the ETF would allow investors to gain XRP exposure through a familiar, regulated structure, lowering operational and compliance barriers for wealth managers and pension funds.

XRP’s Growing Footprint in Institutional Products

This allocation builds on XRP’s expanding presence in U.S.-listed crypto funds. Over the past year, XRP has become a standard component in several major index-style ETFs, and it has also seen growing traction through single-asset spot products. Together, these developments suggest XRP is moving from the margins of institutional portfolios into a more central role within diversified crypto strategies.