- XRP has dropped to $1.90, losing 19% this month as Bitcoin and Ethereum fall sharply.

- Weak jobs data and rising unemployment are pressuring global markets and delaying Fed rate-cut hopes.

- Analysts warn XRP may not have bottomed yet as macro volatility continues.

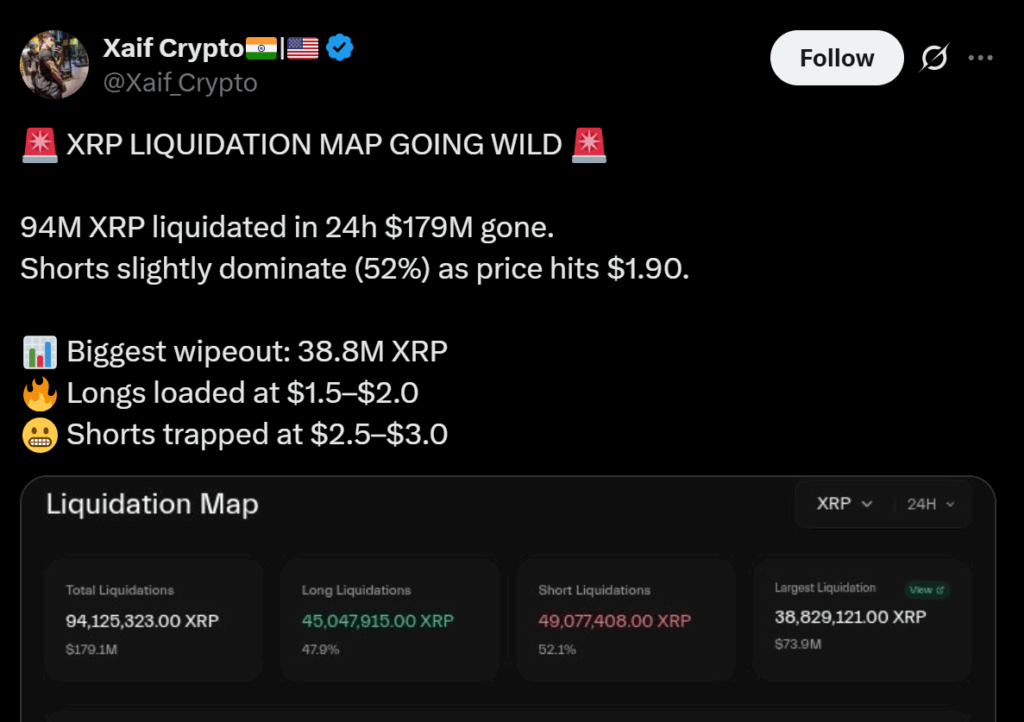

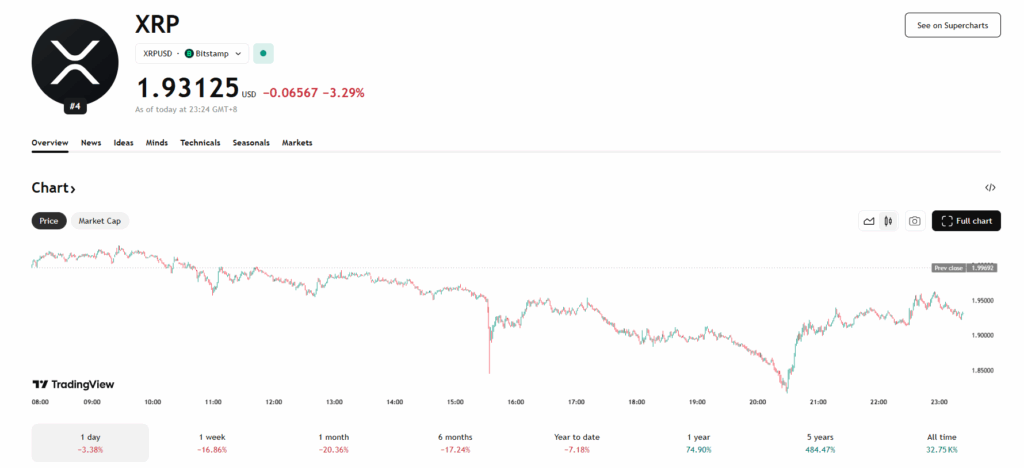

XRP plunged to the $1.90 zone on Friday, falling nearly 8% in a single day and wiping out 19% of its value over the past month. The drop comes as Bitcoin collapsed into the $85,000 range and extended its multi-week downturn. With Ethereum slipping below $3,000 and hovering near $2,800, the entire crypto sector is pulling back sharply — and XRP is moving in lockstep with the broader market.

Macro Pressure Hits Every Asset Class

This week’s pain isn’t isolated to crypto. Global markets are flashing red across the board. The total crypto market cap has now fallen 31% since peaking in October, while equities faced a brutal sell-off as well. The Nasdaq shed 486 points on Thursday, the Dow fell 386, and the S&P 500 dropped 103.

Much of the fear stems from fading expectations of a third interest-rate cut by the Federal Reserve. Fresh jobs data shows the U.S. economy added just 44,000 jobs last quarter — a sign of stagnation — while unemployment has climbed to 4.4%, its highest level since 2021. With macro conditions weakening and uncertainty rising, risk assets like XRP are facing sustained downside pressure.

Could XRP Fall Even Lower?

XRP’s current drop isn’t simply a crypto-specific move — it’s part of a larger macro-driven correction. Analysts warn that the altcoin may not have reached its bottom yet. With investors losing confidence in a near-term Fed rate cut and volatility increasing across markets, XRP could still face deeper selling.

For now, the safer approach for traders may be caution. Waiting for signs of stabilization before taking new positions protects capital and avoids catching a falling knife in an uncertain macro landscape.