- Bitcoin still grappling with downside liquidity, but a snap reversal toward $126K–$141K remains possible.

- Ethereum’s chart looks weaker, with liquidity clusters below, hinting at risk of near-term reversion.

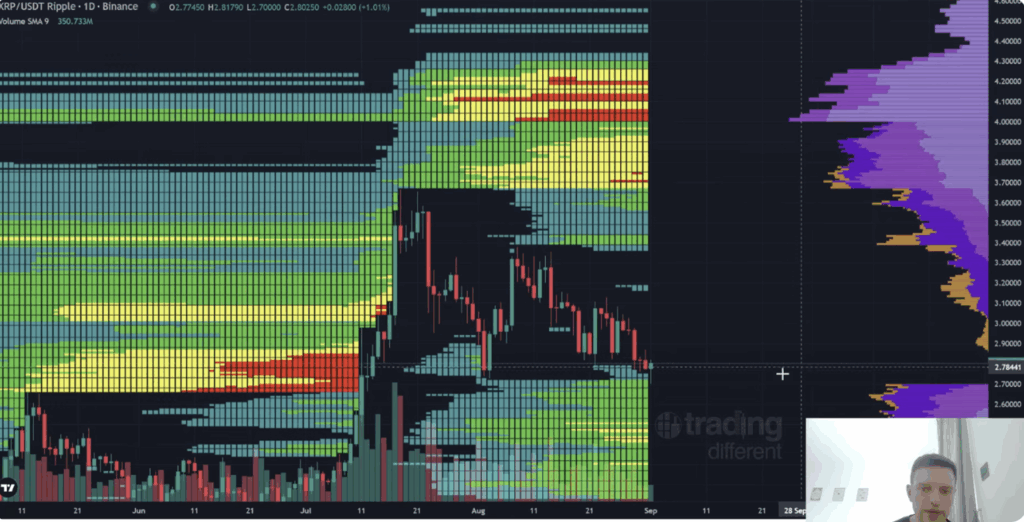

- XRP stands out with overhead liquidity and a flipped support zone, positioning it to potentially lead the next breakout.

Crypto analyst CryptoInsightUK is making the case that XRP might lead the next big leg higher in crypto, even outpacing Bitcoin and Ethereum in the short run. In a fresh video breakdown, he pointed to liquidity heatmaps and structural divergences that show XRP sitting in a much stronger spot compared to BTC and ETH.

Bitcoin Still Wrestling With Downside Liquidity

On Bitcoin, he explained that price has been dragged toward downside pools sitting around $106K, and that these areas remain a magnet in the short term. Still, he noted there’s room for sharp reversals: if BTC flips momentum, it could quickly sprint back toward $126K–$128K, and maybe even push into the $141K zone. He warned that when it does, “it’s going to be pretty aggressive and catch people off guard,” since a lot of traders are leaning the wrong way.

Ethereum Looks Softer, Risk of Mean Reversion

Ethereum’s chart, by contrast, looked weaker. According to him, ETH has already tapped some heavy liquidity overhead, leaving denser pools below recent lows. Liquidity is clustered in the $4,000–$4,450 range, which makes ETH more vulnerable to mean reversion before any new push higher. He described ETH’s setup as “a bit hands off,” especially since the US holiday could throw intraday reads out of balance.

Why XRP Stands Apart

XRP, though, appears to be ahead of the curve. On shorter timeframes, it’s already swept downside liquidity and now has the “main liquidity above,” a setup he argues is more favorable for an upside breakout. He also pointed to the XRP/BTC pair on the 4-hour chart, where a prior resistance zone has flipped to support. Oversold wicks on momentum indicators have been met with constructive reactions, suggesting resilience.

On higher timeframes, XRP still has more overhead liquidity to chase, which he framed as fuel for continuation once buyers step in. Compared to Bitcoin, which still needs to clean up downside levels, and Ethereum, which is sitting in a more fragile spot, XRP looks structurally stronger.

CryptoInsightUK was careful to say his work isn’t a personal prediction but a mapping of liquidity. Still, he stuck to his broader thesis: “I’ve said for the whole cycle, I think XRP is leading.” Whether or not XRP really front-runs the altcoin market, he believes the next few weeks will reveal if this divergence is the start of XRP’s leadership as the crypto cycle matures.