- XRP and Solana led altcoin ETP inflows last week, pulling in $6.71M and $6.44M respectively.

- Ethereum saw $86M in outflows, dragging down overall altcoin performance.

- Bitcoin reversed its five-week losing streak with $724M in inflows, boosting total digital asset sentiment.

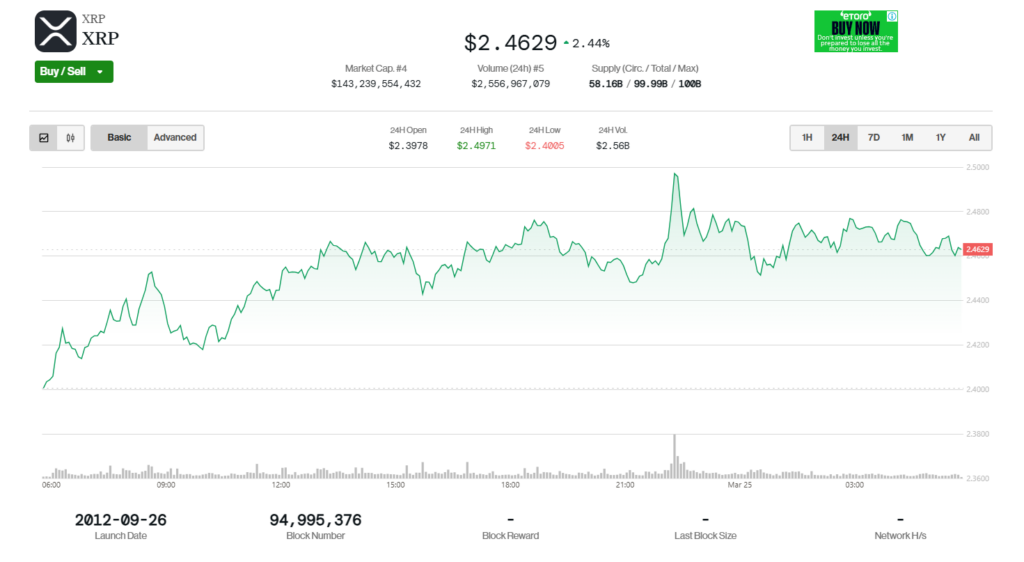

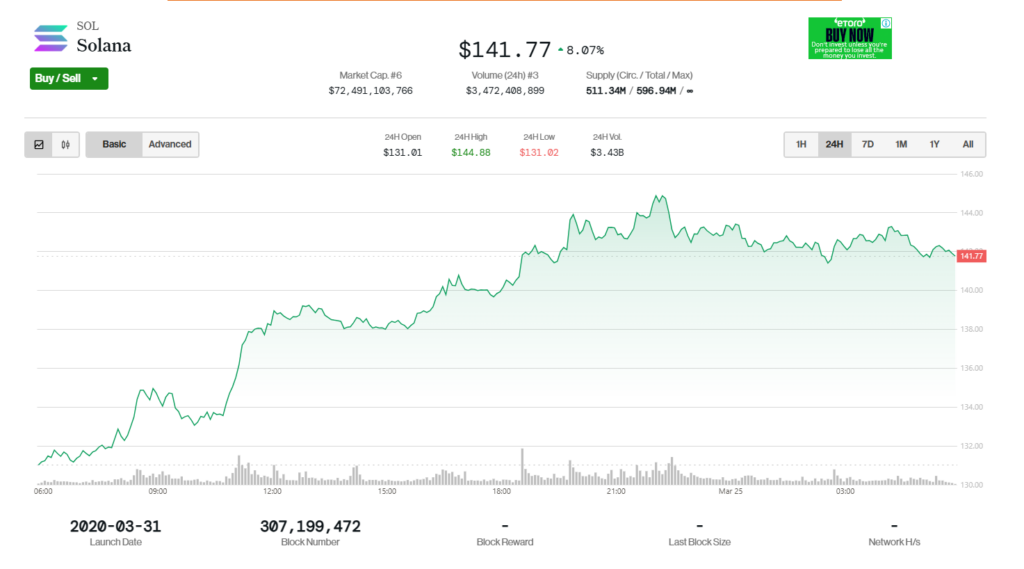

In a week full of ups, downs, and the usual crypto mood swings, XRP and Solana managed to steal the show. According to CoinShares, XRP pulled in $6.71 million while Solana wasn’t far behind with $6.44 million in exchange-traded product (ETP) inflows during the week ending March 21.

Other altcoins? Not quite as exciting. Polygon (MATIC) saw a modest $400,000, and Chainlink squeaked in with $200,000. Decent, but nothing to write home about.

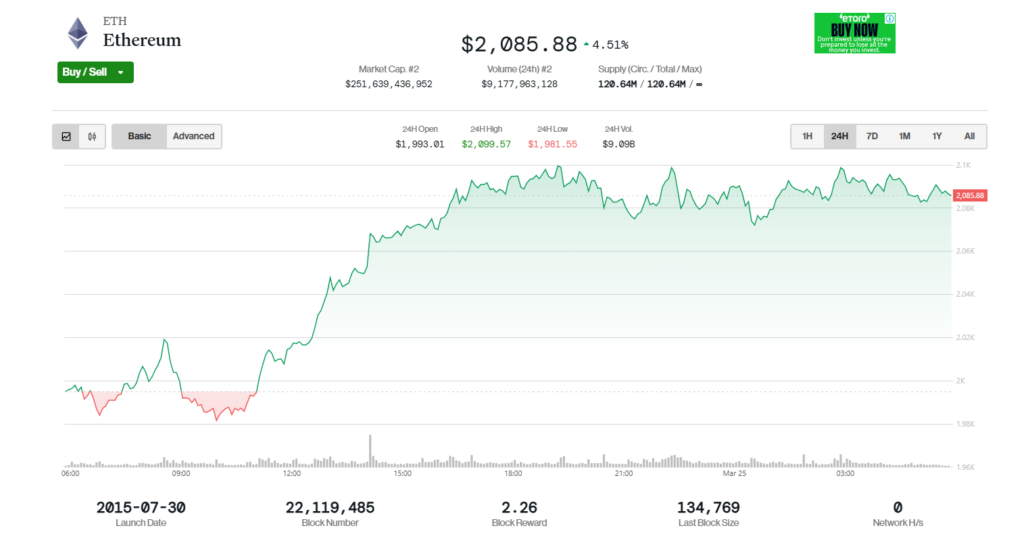

Ethereum, on the other hand, had a rough time—again. The second-largest crypto saw another $86 million head out the door, making it four straight weeks of net outflows. That kind of drag didn’t help the altcoin space as a whole either. Other notables heading in the wrong direction included Sui and Polkadot, each down $1.3 million, and Tron, which lost $950,000.

Still, the week wasn’t all doom and gloom. Digital assets as a whole finally snapped a five-week losing streak, bringing in $644 million in net inflows. And who carried the team? Yep—Bitcoin. It raked in $724 million, marking its biggest net gain since January. That alone helped tilt the overall numbers back into the green.

So yeah, Ethereum’s dragging, but Bitcoin’s back—and it brought some friends.

CoinShares also pointed out that most of the inflows came from the United States, which contributed a massive $632 million, mostly thanks to BlackRock’s iShares Bitcoin Trust (IBIT). But the optimism wasn’t just American. Switzerland led international gains with $15.9 million, followed by Germany at $13.9 million, and Hong Kong with $1.2 million.

Not everywhere was feeling the love, though. Canada and Sweden led the outflows, showing that sentiment is still pretty split globally.

Solana and XRP: The Stars of the Altcoin Show

Despite the bigger altcoin picture being weighed down by Ethereum, Solana and XRP were clear standouts. Solana in particular is building momentum, with the U.S. reportedly preparing to launch its first Solana futures ETF—which could open the door for a spot ETF down the line. That’s a big deal if it actually happens.

XRP, meanwhile, got a boost from the latest twist in its long battle with the SEC, which officially dropped its lawsuit against Ripple Labs. That legal weight coming off XRP’s shoulders might just explain the sudden investor interest.

Bitcoin’s ETF Story Continues to Shape the Market

Let’s not forget how we even got here. Bitcoin’s own ETF journey was a rocky one. Futures-based ETFs were the first to get greenlit because they relied on the CME (Chicago Mercantile Exchange)—a regulated market that gave regulators some peace of mind. But the delay in approving spot ETFs stirred frustration across the board.

That changed after a pivotal lawsuit from Grayscale, which forced the SEC to re-evaluate its position. The end result? Approval of spot Bitcoin ETFs, something investors had been waiting on for years.

Now, that momentum is spilling over into other assets like Solana and XRP, as traders and institutions eye what might be next.

Bottom Line

Bitcoin’s roaring back, Ethereum’s struggling, and a few altcoins—mainly Solana and XRP—are managing to hold their own. ETP flows are starting to shift again, and the global outlook is mixed but cautiously optimistic. If this trend keeps up, we could be in for another interesting few weeks.