- The U.S. government is prioritizing Bitcoin as a long-term reserve asset while treating altcoins as disposable.

- XRP, Cardano, and Ethereum are part of a sellable Digital Asset Stockpile, frustrating their investor communities.

- Over $500 million in Ethereum has left exchanges, signaling continued accumulation despite its exclusion from the Strategic Reserve.

The U.S. government has finally revealed its digital asset strategy, and while Bitcoin (BTC) is getting the red-carpet treatment as a long-term reserve asset, the fate of altcoins like XRP and Cardano has left some investors unimpressed.

The Strategic Bitcoin Reserve vs. The Digital Asset Stockpile

At the core of the plan is the Strategic Bitcoin Reserve, a locked stash of BTC, mainly sourced from the infamous 2016 Bitfinex hack. No selling, no liquidations—just a long-term hold. Government departments are even encouraged to find creative, budget-neutral ways to stack more Bitcoin without burdening taxpayers.

Then there’s the U.S. Digital Asset Stockpile, which is where everything else—XRP, Cardano (ADA), Solana (SOL), Ethereum (ETH), and other confiscated digital assets—ends up. But unlike BTC, these tokens aren’t getting the same VIP treatment. The Treasury has been given explicit authority to sell them off whenever it deems necessary.

Altcoin Investors Left Wanting More

This distinction has ruffled feathers. Pro-crypto legal expert James “MetaLawMan” Murphy noted that the message is clear: Bitcoin is a strategic asset, while everything else is disposable. Many had hoped this move would signal broader institutional recognition for altcoins, but instead, it reaffirms Bitcoin’s dominance in the government’s eyes.

A Step Back for XRP and ADA?

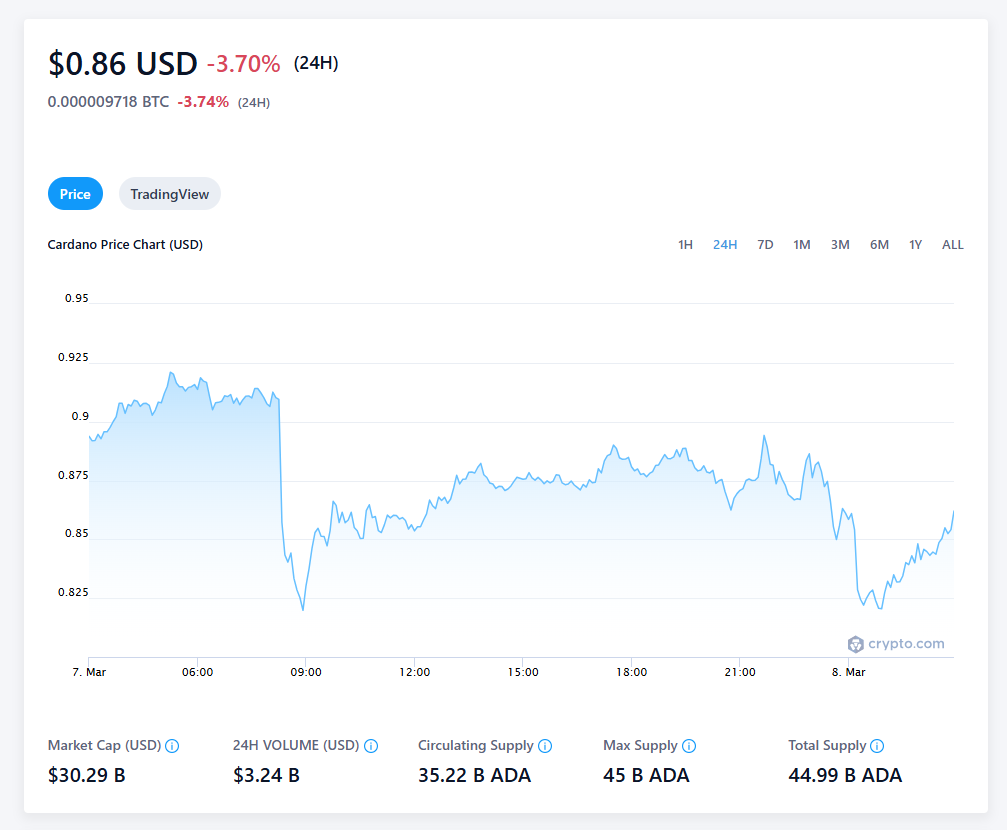

For the XRP and Cardano communities, this feels like a snub. The idea that their assets might gain equal footing with Bitcoin in a U.S. reserve has quickly faded. Instead, their tokens are lumped into the “sell when convenient” pile.

Economist Peter Schiff chimed in, doubling down on his stance that the government will never buy XRP or SOL, arguing that only Bitcoin has proven itself as a true digital reserve asset.

Ethereum Whales Keep Accumulating

Meanwhile, Ethereum is seeing some action of its own. Over $500 million in ETH has exited exchanges this week, with whales shifting funds into cold storage. CryptoQuant suggests this could indicate heavy accumulation, despite Ethereum being included in the Digital Asset Stockpile rather than the Strategic Reserve.

So, what’s next? Will the U.S. hold firm on its Bitcoin-first approach, or could policy shifts bring altcoins into the reserve conversation? For now, Bitcoin is in the vault—everything else remains up for grabs.