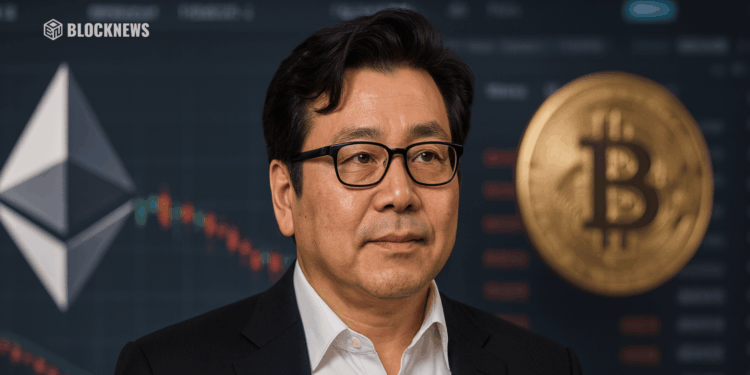

- Bitmine chair Tom Lee says the digital asset treasury “bubble has burst.”

- DAT firms now trade below their crypto holdings’ value, signaling overreach.

- Lee still sees Ethereum as a long-term leader despite short-term turbulence.

In a striking admission from within the industry, Tom Lee, chair of Bitmine, warned that the boom in digital asset treasury (DAT) companies may have already peaked. Speaking on Fortune’s Crypto Playbook, Lee said the sector’s rapid growth and market saturation have driven valuations beyond sustainable levels — and many of these firms are now trading below the value of their own crypto holdings. “If that’s not already a bubble burst,” Lee remarked, “how would that bubble burst?”

The Rise and Overreach of Digital Asset Treasuries

DATs have become one of the defining trends of the current bull cycle. These companies acquire and hold large crypto reserves — from Bitcoin to Ethereum — and issue publicly traded shares that give investors indirect exposure. The concept was popularized by MicroStrategy’s Michael Saylor, who turned Bitcoin accumulation into a corporate strategy. Now, with more firms replicating the model, Lee believes the industry has expanded too quickly, with too many low-quality entrants chasing speculative momentum.

Bitmine’s Position in the Market

Despite Lee’s caution, Bitmine remains one of the largest institutional holders of Ethereum, with over three million ETH — around 2.5% of total supply — valued at more than $15 billion. Lee’s goal is to reach 5% of all Ethereum as Bitmine transitions from mining to becoming a “crypto treasury giant.” He still views Ethereum as “the blockchain of Wall Street,” citing its dominance in tokenization, stablecoin infrastructure, and financial applications. But even with its strength, he warns that the wider DAT space may face a painful correction as projects struggle to justify valuations without new inflows.

Are DATs the Next Bubble to Burst?

Lee’s comments echo concerns across the market that digital asset treasuries may be the latest speculative phase in crypto. As more companies attempt to mimic MicroStrategy’s success, their shares often trade below net asset value, suggesting investor skepticism. Analysts note that with dozens of DATs launching in quick succession, consolidation or failure is likely. For now, Lee’s statement signals that even insiders see turbulence ahead — and that the once-hot DAT sector may be heading for its first real stress test.