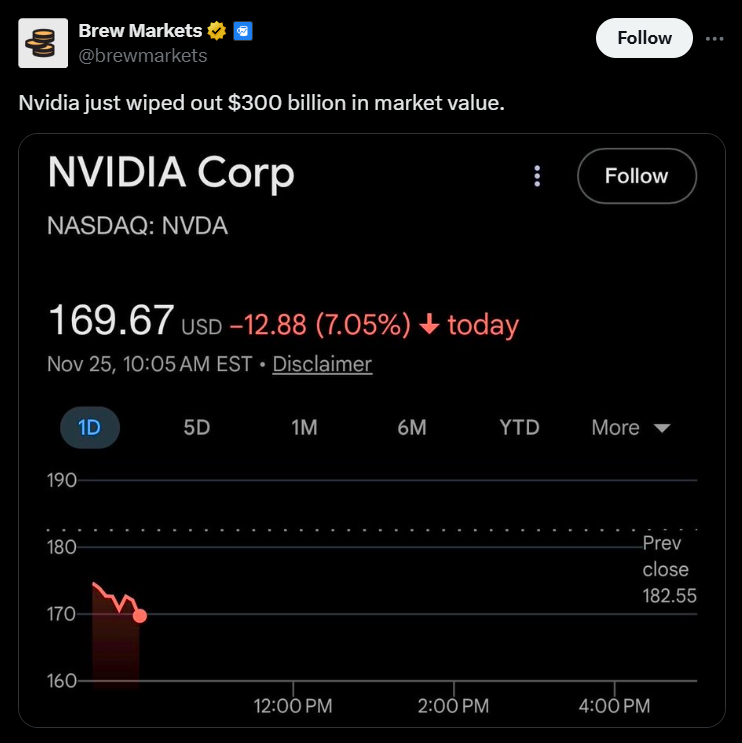

- Nvidia fell 6% after reports that Meta may adopt Google’s AI chips in future data centers.

- Semiconductor stocks broadly declined as the market reassessed AI leadership.

- Alphabet surged, boosted by growing confidence in its AI hardware strategy.

Nvidia isn’t the only heavyweight in the AI hardware race anymore — and Tuesday’s market reaction made that painfully clear. Shares of the world’s most valuable company fell 6% after a report suggested Meta could shift a meaningful portion of its future AI infrastructure spending toward Google’s custom chips. Alphabet stock, meanwhile, jumped as much as 4%, signaling that investors are quickly recalibrating expectations around who dominates the next phase of AI growth.

Meta May Spend Billions on Google’s TPUs

The Information reported that Meta is evaluating Google’s tensor processing units (TPUs) for its data centers. The social media giant could begin renting Google’s chips as early as next year, with multi-billion-dollar purchases potentially following in 2027 and beyond. Meta has already said it may spend up to $72 billion on capital expenditures next year, a massive chunk of which is expected to flow into AI infrastructure.

Alphabet responded by saying demand for both its custom TPUs and Nvidia’s GPUs is accelerating, adding that it will continue supporting both. The response was enough to reassure investors that Google is gaining momentum in a market long considered Nvidia’s turf.

Chip Stocks Sink as Market Reprices AI Assumptions

Nvidia wasn’t alone in the sell-off. AMD plunged nearly 10%, Micron and TSMC lost about 3% each, and Intel slipped 1%. Broadcom — which helps Google design and manufacture TPUs — was the lone standout, extending Monday’s 11% surge as traders rotated into names directly benefiting from Google’s AI expansion.

By mid-morning, the Nasdaq fell 1%, outpacing declines in the Dow and S&P 500. Investors appear increasingly cautious as competition intensifies and concerns about an AI-driven bubble resurface.

Nvidia Faces Renewed Scrutiny

The stock’s decline also comes as Nvidia battles broader skepticism. Shares initially rallied after blockbuster Q3 earnings but rolled over as analysts — including “Big Short” investor Michael Burry — warned about frothy valuations and overheating in AI-related equities. Nvidia is now down 12% from its late-October top, though still up an impressive 32% year-to-date.

Alphabet, meanwhile, has been one of the strongest performers in the sector. The company’s improved AI positioning helped propel its stock 18% higher over the past month and 67% year-to-date, making it one of 2025’s standout mega-caps.