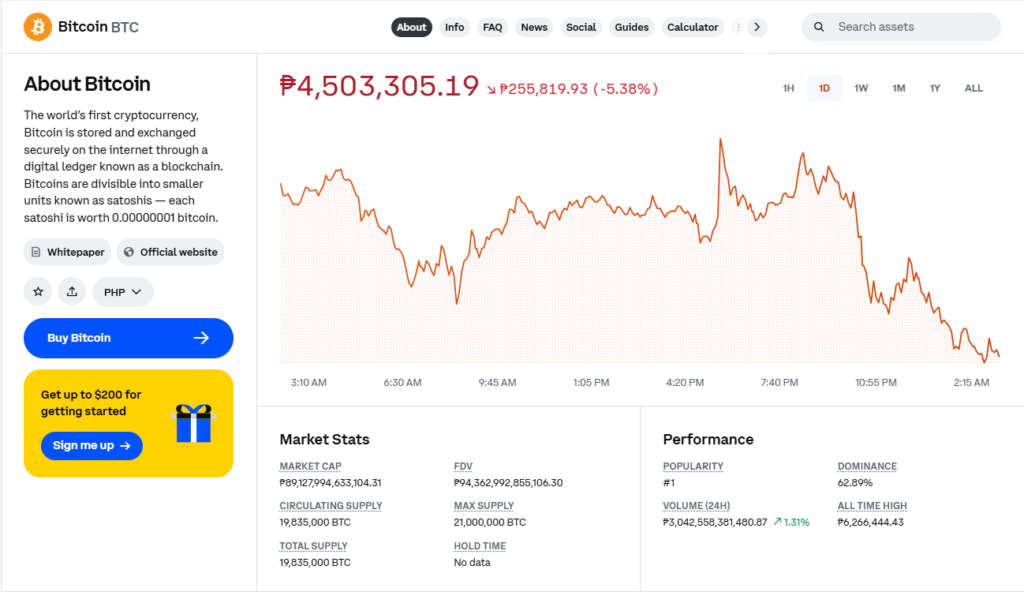

- Bitcoin has dropped below $80,000, down 27% from its all-time high, despite Trump’s pro-crypto policies.

- The Strategic Bitcoin Reserve announcement disappointed some investors who expected new BTC purchases, not just seized assets.

- Analysts warn Bitcoin must stay above $90,000 to avoid a potential drop toward $70,000, amid global economic uncertainty.

The price of Bitcoin (BTC) continues to fall, even as President Donald Trump rolls out pro-crypto policies—including the much-hyped Strategic Bitcoin Reserve announced at the White House last week.

Bitcoin dipped below $80,000 on Monday, now down 27% from its all-time high of $109,000 back in January, the day of Trump’s inauguration.

Other major cryptocurrencies, including Ethereum (ETH) and XRP (XRP), also slid as broader market uncertainty weighed on digital assets.

Market Jitters Overshadow Pro-Crypto Policies

Initially, Trump’s pro-crypto stance fueled optimism, driving digital assets higher post-election. However, that enthusiasm has since been dampened by macroeconomic concerns—including fears over the U.S. economy and Trump’s unpredictable trade policies.

“While the early crypto sell-off in January and February wasn’t macro-driven, the last two weeks have been entirely dictated by the equity market’s downturn,” said Jeff Dorman, CIO at crypto asset manager Arca.

Bitcoin Reserve Announcement Fails to Impress

Despite last week’s announcement of a Strategic Bitcoin Reserve, some in the crypto industry were underwhelmed. Many had hoped for government purchases of new digital assets, rather than merely stockpiling Bitcoin already seized in legal cases.

“The market reaction reflects a reset in expectations,” said Haider Rafique, CMO at OKX. “The reserve cements Bitcoin’s legitimacy, but it doesn’t immediately create new demand.”

Could The U.S. Have Held More Bitcoin?

Trump’s crypto czar David Sacks revealed that the U.S. government currently holds around 200,000 BTC, worth over $17 billion, after selling off nearly half of its previous holdings over the past decade.

Had the government never sold any Bitcoin, its reserves would be worth $17 billion more today.

Sacks made it clear that once Bitcoin enters the reserve, it will not be sold—describing it as a “digital Fort Knox”.

What’s Next for Bitcoin?

With equity market turmoil, macroeconomic uncertainty, and shifting investor sentiment, Bitcoin remains volatile. Some analysts believe BTC needs to hold above $90,000 to prevent a deeper pullback toward $70,000.

Meanwhile, the global impact of the U.S. reserve decision remains uncertain, but some—including Coinbase CEO Brian Armstrong—predict that other nations may soon follow America’s lead in stockpiling Bitcoin.

“If the U.S. government is now a Bitcoin holder—and maybe even a buyer—other G20 nations will take that as a signal,” Armstrong said. “Bitcoin is the new gold standard.”