- Bitcoin’s fixed supply makes it a long-term hedge against fiat debasement, though not a perfect crisis hedge

- BTC remains the core asset of crypto, with most market cycles still revolving around its moves

- ETFs have made Bitcoin easier to hold in traditional accounts, expanding long-term institutional ownership

Bitcoin is one of those assets people love to argue about, but it’s also one of the few in crypto that’s earned a permanent seat at the table. Even if you’re not a full-on believer, holding a small amount can make sense for a lot of portfolios. And for some investors, a larger allocation, even up to 5%, is still justifiable.

Not because Bitcoin is perfect. It isn’t. But because it offers a mix of scarcity, market leadership, and accessibility that’s honestly hard to replicate anywhere else in crypto.

Bitcoin can hedge inflation, but only in the long-term sense

Inflation is one of those slow problems that quietly eats portfolios over time. And Bitcoin’s appeal here is simple: the supply can’t be expanded. There will only ever be 21 million BTC, and close to 20 million have already been mined. No central bank can decide to “print more Bitcoin” because the rules don’t allow it.

That said, calling Bitcoin an inflation hedge without qualifiers is sloppy. Bitcoin doesn’t behave like gold in every environment. In periods where purchasing power is being squeezed and inflation is the main story, Bitcoin often acts like a hedge. But in outright crisis conditions, where markets panic and liquidity dries up, it can trade like a risk asset and drop hard. We saw that during the early pandemic, when Bitcoin didn’t protect portfolios the way traditional safe-havens typically do.

So the better framing is this: Bitcoin is more like long-term insurance against fiat currency debasement, not a month-to-month shield against inflation. It’s simply too volatile to play that role consistently, and pretending otherwise sets people up for disappointment.

Bitcoin is still the core asset of the entire crypto market

Within crypto itself, Bitcoin remains the reference asset. Everything else revolves around it, whether people want to admit it or not. It’s worth around $1.4 trillion out of a roughly $2.5 trillion total crypto market cap, which makes it the anchor of the entire sector.

In most crypto cycles, when Bitcoin rises or falls sharply, the rest of the market tends to follow with a lag, and usually with extra drama. That’s why owning some BTC is one of the simplest ways to gain broad exposure to crypto. You don’t have to gamble on a basket of smaller altcoins, you don’t have to chase narratives, and you don’t need to pretend you can predict which ecosystem wins next.

Bitcoin is the base layer of the market’s psychology. If you own BTC, you own the asset the entire sector reacts to.

Bitcoin is easier than ever to hold through ETFs and brokerage accounts

Another major shift is accessibility. Today, it’s easier than ever to buy and hold Bitcoin through regulated products like Bitcoin ETFs. That means you don’t need to set up a wallet, manage private keys, or worry about custody headaches just to get exposure.

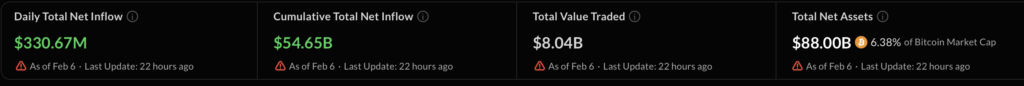

This also lowers friction for institutions and companies. It’s not just retail anymore. A growing portion of the supply is now held by countries, corporations, ETFs, and other conservative entities that are far less likely to sell impulsively. In fact, more than 4 million BTC are currently held by these large holders, which changes the market structure over time.

If you buy and hold Bitcoin, you’re not just betting on retail hype. You’re benefiting from the growing number of businesses and institutions treating BTC like a long-duration scarce asset. And if those entities continue holding for scarcity over time, the long-term price bias tends to tilt upward.

Bitcoin isn’t perfect, but it’s still hard to ignore

Bitcoin doesn’t need to be a flawless asset to be worth owning. It just needs to keep doing what it already does: remain scarce, remain liquid, remain the market’s reference point, and stay increasingly accessible through traditional finance.

That combination is rare. And in crypto, it’s basically the closest thing the market has to a “core holding.”