- Avalanche hit $31B DEX volume in September, alongside a 201% jump in transactions and 22% growth in active wallets.

- Real-world asset tokenization on Avalanche surged to $726M TVL, backed by big names like Scaramucci’s Skybridge and Mirae Capital.

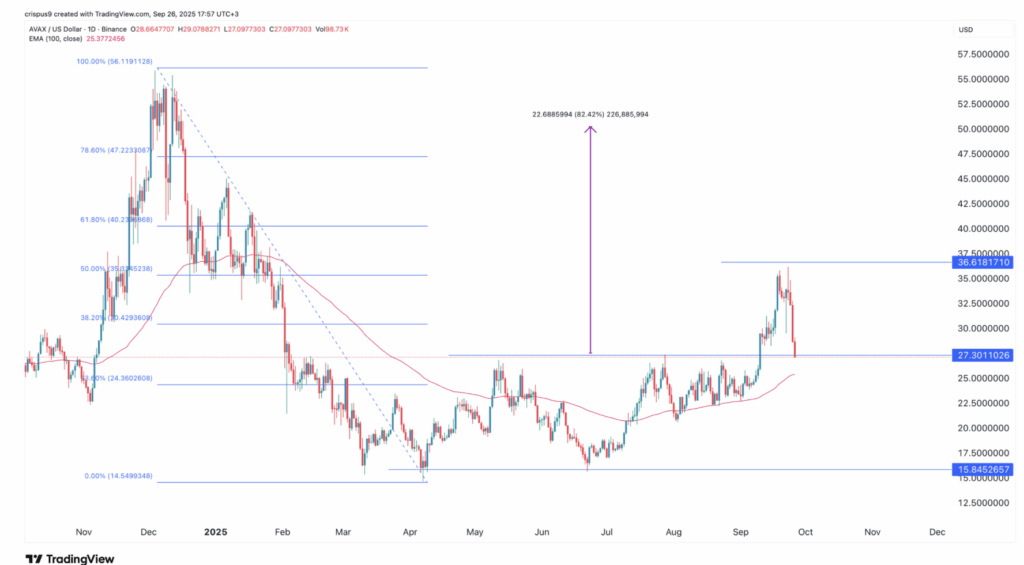

- Technicals show a double-bottom breakout with a target near $50, though $20 remains the critical support to watch.

Avalanche just wrapped up one of its biggest months to date, posting eye-popping numbers across multiple metrics. In September 2025, the network clocked in over $31 billion in DEX trading volume, making it one of the busiest blockchains in the market right now.

The momentum wasn’t limited to trading alone. Transactions on the Avalanche chain surged by more than 200% over the past 30 days, with nearly 50 million processed. That’s a massive leap in activity, putting the network in the ranks of the fastest-growing players. On top of that, active wallets jumped 22%, reaching more than 753,000 unique addresses, showing that actual user adoption is keeping pace with the volume.

Weekly DEX trades also spiked to $4.2 billion, the highest level seen in three years. That kind of consistency suggests it’s not just short-term hype—institutions and retail traders alike are fueling the growth. Yet despite all these strong fundamentals, AVAX’s token price dipped 18% in late September, trading near $27. Analysts chalk this up to shaky liquidity and weaker support levels in the market.

Real-World Assets Push Avalanche Into Top 4

Beyond trading, Avalanche is carving out a serious name for itself in real-world asset tokenization. The total value locked in RWA products surged 50% to $726 million, placing it fourth overall behind Ethereum, ZkSync, and Polygon.

Institutional players are taking notice. Anthony Scaramucci’s Skybridge Capital is prepping a $300 million allocation into Avalanche, while Mirae Capital Management—overseeing $316 billion in assets—recently inked a partnership with the network. These moves expand Avalanche’s credibility in traditional finance circles.

Even outside of finance, companies are moving in. AgriFORCE Growing Systems, previously focused on agriculture tech, announced plans to raise $550 million through the AVAX One project. Backed by Scaramucci and Hivemind Capital, the initiative is aimed at tokenizing traditional assets on Avalanche—another strong sign of institutional belief in the platform.

Technical Setup Hints at Breakout Potential

On the charts, Avalanche is flashing bullish patterns. A double-bottom formed at $15.84 with resistance (the neckline) near $27. AVAX broke through that neckline earlier this month and then retested it successfully—a textbook move that often precedes bigger breakouts.

The token is holding above its 100-day EMA, a technical marker many traders see as a sign of sustained bullish momentum. If this pattern continues to play out, upside targets point toward the $50 region, nearly double from current prices.

Still, the downside risk can’t be ignored. A break below $20 would invalidate the bullish outlook and open the door for steeper declines. Traders are keeping close watch on that zone as the “line in the sand.”

ETF Buzz and Institutional Accumulation

Adding to the bullish case, the U.S. SEC is reviewing multiple applications for spot AVAX ETFs. If approved, these could attract fresh capital inflows similar to what happened with Bitcoin and Ethereum earlier this year.

At the same time, companies have started stacking AVAX in their corporate treasuries, a sign of growing institutional trust. Combined with Avalanche’s push into DeFi, NFTs, and now RWAs, the ecosystem looks increasingly positioned for long-term relevance.

While the market remains volatile, Avalanche’s fundamentals are pointing in the opposite direction: adoption is climbing, usage is scaling, and technicals are lining up with bullish targets. If buyers defend key supports, the next leg up could be just around the corner.