- Brian Armstrong used Davos to challenge bank influence over crypto regulation.

- He argues stablecoins and exchanges deserve equal treatment under the law.

- The debate highlights growing tension over who controls the future of finance.

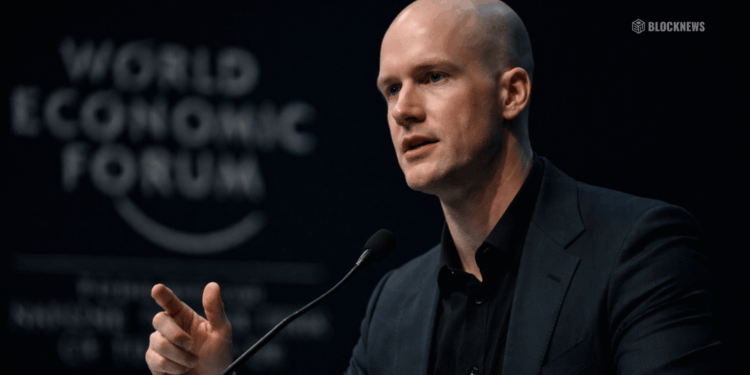

When Brian Armstrong took the stage at the World Economic Forum in Davos, he wasn’t there to blend in. He used the moment to directly challenge the idea that traditional banks should automatically control the future of finance. Instead, Armstrong framed crypto — especially stablecoins and exchanges — as practical tools for expanding financial access, not speculative gimmicks. Making that argument in a room dominated by legacy finance was very intentional.

Why Armstrong Keeps Calling Out Banks

Armstrong has been increasingly vocal about what he sees as banks using regulation to protect their own turf. His criticism centers on how banking interests have pushed to restrict stablecoin rewards, arguing that those limits are less about consumer protection and more about preventing deposits from leaving traditional institutions. In his view, this isn’t paranoia or theory — it’s a structural fight over who gets to compete in the next version of finance.

Stablecoins as Infrastructure, Not a Threat

To Armstrong, stablecoins represent something simple but powerful: access. He argues they can offer faster payments, lower costs, and better financial tools to people who have historically been locked out of quality banking products. That’s why he keeps pushing for regulatory frameworks that treat crypto companies and banks by the same standards, rather than designing rules that quietly preserve the status quo.

Why This Moment Is Bigger Than Davos

Bringing this argument to Davos wasn’t accidental. It signals that crypto companies are no longer content to operate on the sidelines while rules are written without them. Armstrong’s stance reflects how much is currently at stake in US crypto legislation, particularly around market structure, stablecoins, and exchange oversight. The outcome will shape who gets to innovate — and who doesn’t.

A Direct Message to Legacy Finance

Whether critics agree with him or not, Armstrong is forcing an uncomfortable conversation. His message is blunt: banks can’t claim moral authority while lobbying to block competition. By taking that position on one of the world’s most influential financial stages, he made it clear that crypto isn’t asking for permission anymore. It’s asking for fair rules, and it’s not backing down.