- Bitmine is investing $200 million into MrBeast’s Beast Industries.

- The deal ties crypto capital directly to mainstream media and youth audiences.

- It could redefine how digital finance reaches non-crypto-native users.

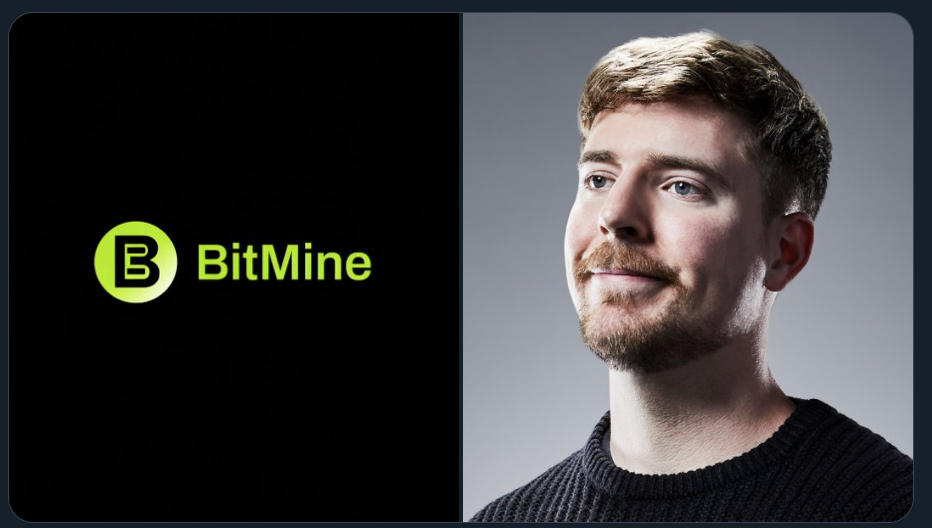

Bitmine Immersion Technologies just made one of the more unconventional moves in crypto this year, committing $200 million to Beast Industries, the media and consumer products company built by YouTube star MrBeast. Best known as one of the largest Ethereum treasury firms, Bitmine isn’t just parking capital — it’s stepping directly into mainstream culture. The deal, expected to close around January 19, 2026, places crypto-backed capital inside an entertainment empire with hundreds of millions of highly engaged followers.

Why Creator Reach Changes the Crypto Equation

MrBeast’s audience isn’t niche, speculative, or technically inclined by default — and that’s exactly the point. His reach spans Gen Z and Millennials at a scale few crypto companies could ever replicate on their own. Instead of trying to onboard users through exchanges or DeFi dashboards, this partnership puts digital finance in front of people through content they already trust and consume. Bitmine isn’t selling crypto ideology here, it’s buying attention where attention already lives.

Where Crypto Meets Consumer Finance

Beast Industries has already hinted at expanding into financial services tied to its brand, including possible banking and crypto-related offerings. Bitmine’s Ethereum-heavy balance sheet and infrastructure could quietly power those efforts behind the scenes. That would represent a different form of adoption — not DeFi apps marketed to insiders, but blockchain-enabled finance wrapped inside a creator-led consumer platform. If executed well, users may interact with crypto rails without ever needing to think about wallets or protocols.

A Strategic Shift, Not Just an Investment

This move signals something broader about how crypto firms are thinking in 2026. Bitmine isn’t simply diversifying assets or chasing yield. It’s aligning digital finance with cultural distribution, betting that mainstream adoption comes through familiarity, not technical education. If the partnership succeeds, it could become a reference case for how crypto integrates into everyday media ecosystems rather than staying confined to crypto-native environments.