- Uniswap pioneered decentralized trading with AMMs, processing $3T+ in volume since 2018.

- Upgrades like Uniswap v4 and Unichain aim to cut costs, boost speed, and expand adoption.

- UNI could see a strong comeback if protocol fees go live and institutional adoption grows.

Uniswap, the protocol that turned crypto trading on its head, has become the beating heart of decentralized finance. It has dismantled the walls of centralized gatekeeping, processed trillions in volume, hundreds of millions of trades, and redefined how liquidity flows on-chain.

With a core commitment to non-custodial, permissionless access and continuous iteration through smart contract innovation, Uniswap is not just a protocol—it is an infrastructure layer that has inspired an entire DeFi generation. So, let us take a closer look at what makes Uniswap one of the most important projects in crypto.

What Is Uniswap?

Launched in 2018 by Hayden Adams, Uniswap is an Ethereum-based decentralized exchange (DEX) protocol that allows users to swap tokens directly from their wallets. Built on the foundational concepts proposed by Ethereum co-founder Vitalik Buterin, it introduced the Automated Market Maker (AMM) model, removing the need for centralized intermediaries and traditional order books.

The protocol operates through smart contracts that autonomously execute trades, manage liquidity pools, and ensure pricing efficiency. With no KYC, no accounts, and no middlemen, Uniswap allows anyone with an Ethereum wallet to interact directly with financial markets. From a simple ETH-token pair in its first iteration to today’s multichain deployment and concentrated liquidity mechanics, Uniswap’s trajectory has been marked by aggressive innovation and unparalleled adoption.

What Problems Does It Solve?

Uniswap eliminates multiple pain points that plague traditional finance and centralized exchanges. First, it eliminated custodial risk. Users do not deposit funds into Uniswap; they trade directly from their wallets. This removes the threat of hacks, freezes, and mismanagement that plague centralized exchanges.

Second, it shattered access barriers. No accounts, no KYC, no geographic restrictions. Anyone with a wallet and internet connection can trade, provide liquidity, or launch a token. This democratized access to financial markets and gave rise to a new wave of grassroots crypto projects.

Third, it solved the liquidity problem in decentralized trading. Traditional DEXs struggled to match buyers and sellers efficiently. Uniswap’s AMM model created continuous liquidity by allowing users to pool assets and earn fees. This innovation turned every user into a potential market maker.

Finally, it tackled transparency and composability. Every transaction, pool, and fee is visible on-chain. Other DeFi protocols can plug into Uniswap’s liquidity and trading functions, creating a modular ecosystem of financial tools.

How Does It Work?

Uniswap operates on an Automated Market Maker (AMM) model. It does not match buyers and sellers. Instead, trades are routed through token pairs in liquidity pools governed by smart contracts.

Every pool is formed by liquidity providers (LPs) who deposit equal values of two tokens—say ETH and USDC. In exchange, LPs receive LP tokens, representing their share of the pool and any fees accrued. The pricing mechanism follows a constant product formula:

x * y = k,

where x and y are token reserves, and k is a fixed constant.

As users swap tokens, the ratio between x and y changes, and the price moves accordingly. This ensures continuous, automated pricing and trading. There is no order book, no matching engine, no need to wait for counterparty confirmation. Every swap is executed instantly by the protocol.

Uniswap v3 further optimized this model through concentrated liquidity, allowing LPs to specify the exact price range within which they want to provide liquidity. This unlocked dramatically higher capital efficiency while giving LPs control over fee exposure and risk. Multiple fee tiers were introduced—0.05%, 0.3%, and 1.0%—allowing markets to tailor themselves based on volatility and trading behavior.

Utility and Offerings

Uniswap offers a suite of tools and opportunities that empower users, developers, and institutions. This includes:

Token Swapping

Uniswap’s core function is frictionless token swapping. Users connect their wallets and instantly trade thousands of ERC-20 tokens, all without giving up custody. No registration, no lock-ups, and no centralized approval. This trustless simplicity is a game-changer in markets often dominated by closed ecosystems.

Liquidity Provision and Yield Generation

Anyone can become a liquidity provider by depositing token pairs into a pool. In return, they earn a share of the fees generated by trades. For stable pairs, this can provide a steady source of yield; for volatile assets, it becomes a high-risk, high-reward play. With v3, liquidity provisioning became a professional-grade toolset. LPs can fine-tune their capital deployment across price ranges and fee tiers, giving them more control over returns and impermanent loss.

Governance via UNI Token

Uniswap’s governance is governed by the UNI token, which was airdropped to early users in 2020. Holders of UNI can vote on proposals that affect the protocol—upgrades, treasury spending, cross-chain deployments, and governance framework updates. The governance process has been central to strategic decisions, including the protocol’s expansion to other chains and the establishment of the Uniswap Foundation.

Developer Integration and Composability

Uniswap’s contracts are fully open-source and widely composable. Developers can integrate liquidity pools into DeFi apps, wallets, and aggregators. Whether powering lending protocols or DEX aggregators, Uniswap’s contracts function as public infrastructure available to any Ethereum-compatible application.

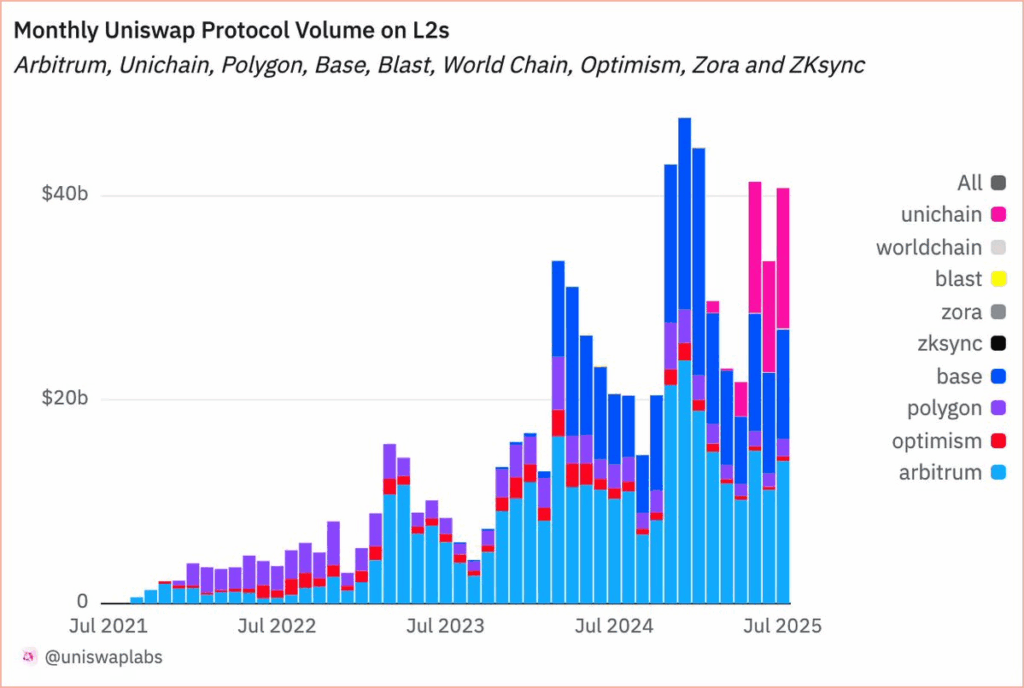

Multichain Availability

Recognizing Ethereum’s scaling limitations, Uniswap has expanded to multiple Layer 2 and alternative blockchains, including Arbitrum, Optimism, Polygon, Base, and BNB Chain. This dramatically reduces gas costs and increases accessibility for smaller traders and high-frequency users.

Unichain

Unichain officially launched in early 2025 as a Stage 1 Optimistic rollup built on the OP Stack. It offers one second block times and gas costs up to 95% lower than Ethereum mainnet.

Ecosystem Highlights

Uniswap’s growth has been explosive, and its influence is unmatched. Some key milestones that highlight its growth include:

- Volume and Adoption – Uniswap has processed close to $3 trillion in cumulative volume and more than 450 million trades. It consistently ranks among the top DEXs by volume and liquidity.

- Multichain Expansion – To reduce gas costs and improve access, Uniswap has deployed on Arbitrum, Optimism, Polygon, Base, BNB Chain, Avalanche, and more. These expansions were approved by UNI governance and have broadened Uniswap’s reach across the crypto landscape.

- Institutional Interest – Uniswap has attracted attention from institutional players. The protocol’s transparency, liquidity depth, and non-custodial design make it appealing to funds, traders, and infrastructure providers.

- Performance Highlights – In 2024, Uniswap averaged a 0.046% price improvement over leading aggregators. Its deep liquidity and efficient pricing have made it competitive with centralized exchanges, even for large trades.

- Security Track Record – Despite phishing attacks and exploits in related protocols, Uniswap’s core smart contracts have never suffered a major exploit. Its code is battle-tested, audited, and trusted across the industry.

Roadmap and Plans Ahead

Uniswap is preparing for one of its most ambitious evolutions yet with its upcoming suite of protocol upgrades, ecosystem expansions, and governance-led strategies. This includes core technical innovations, new infrastructure layers, and long-term positioning within the shifting regulatory and market landscape. isn’t standing still. Its roadmap is ambitious, and its vision is expansive.

Uniswap v4

Slated to launch after Ethereum’s Cancun-Deneb upgrade, Uniswap v4 will unlock modular liquidity through “hooks,” letting developers create dynamic fee models, on-chain limit orders, and automated rebalancing. It also introduces a singleton architecture and flash accounting, drastically reducing gas usage. v4 is set to reshape DeFi composability and make liquidity provisioning far more customizable.

Unichain Expansion

With the mainnet launched, the next phase for Unichain includes expanding its validator set, introducing sub-second “flash blocks,” and evolving toward a permissionless rollup infrastructure. This would reduce latency, increase throughput, and bring Uniswap closer to its goal of building the fastest, most capital-efficient DEX environment natively optimized for its own ecosystem.

Strategic Phases

Looking ahead, Uniswap plans to go deeper into wallet development, fee economics, and ecosystem coordination. The Uniswap Wallet will gain advanced routing, multichain bridging, and staking integration. Governance may soon vote on activating the long-discussed protocol fee switch, potentially transforming UNI into a yield-bearing asset and increasing treasury sustainability for ecosystem grants.

Regulatory Navigation

Facing a tightening regulatory climate, Uniswap is investing in proactive legal research and lobbying via the Uniswap Foundation. Future plans involve building flexible frontend architectures that support compliance while keeping the underlying protocol decentralized and permissionless.

Final Thoughts

In conclusion, Uniswap continues to prove why it remains at the center of decentralized finance. With a focus on innovation, scalability, and permissionless access, it’s building not just tools—but infrastructure that powers the broader DeFi economy. And with Uniswap v4, Unichain expansion, and protocol-level governance evolving, the project is well-positioned to define the next phase of crypto trading.