• SynFutures is a decentralized derivatives DEX merging AMM innovation with on-chain transparency.

• Its Oyster AMM, on-chain order book, and $F token ecosystem drive modular, high-speed trading.

• Backed by Pantera and SIG, the project is expanding into wealth management, AI tools, and multi-chain liquidity.

SynFutures, a rising force in decentralized finance, is reshaping how traders and liquidity providers interact with derivatives on-chain. Built around transparency, automation, and accessibility, the platform is a full-fledged infrastructure designed to unify the worlds of perpetuals, spot trading, and wealth management.

Backed by institutional investors and a record of consistent innovation, SynFutures blends the performance of centralized exchanges with the trustless architecture of DeFi. So, let us take a closer look at how this project is charting the next phase of digital trading evolution.

What Is SynFutures?

SynFutures is a decentralized exchange specializing in derivatives trading. It allows users to create and trade perpetual futures contracts on a wide range of assets, including cryptocurrencies, NFTs, tokenized real-world assets, and indices. Founded in 2020 by Rachel Lin and Matthew Liu, both veterans of traditional finance and blockchain, the platform is built on a permissionless model that enables anyone to list any asset with a reliable price feed.

At its core, SynFutures is designed to be modular, composable, and chain-agnostic, with a mission to democratize access to derivatives and bring institutional-grade tools to retail users. The platform has processed over $330 billion in cumulative volume and supports more than 350 trading pairs. Moreover, it is backed by top-tier investors including Pantera Capital and SIG, and headquartered in Hong Kong.

Core Components

At the heart of SynFutures lies a suite of architectural innovations that make it uniquely suited for derivatives trading. This includes:

Oyster Automated Market Maker (AMM)

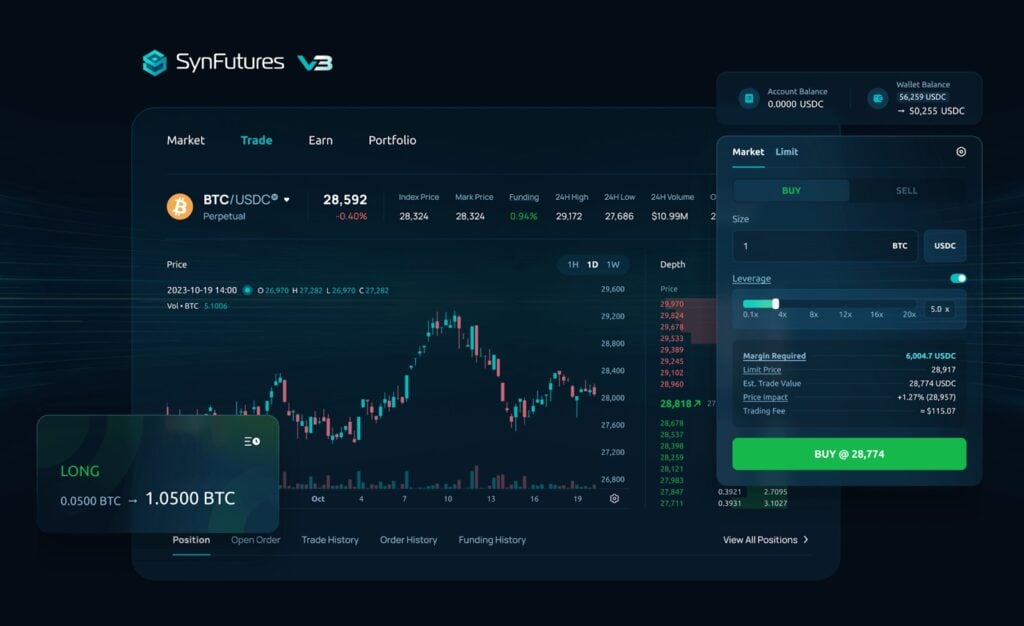

At the heart of SynFutures lies its Oyster AMM, an advanced hybrid mechanism that merges the best features of automated market makers with the precision of on-chain order books. The model introduces concentrated liquidity and single-token provisioning, allowing liquidity providers to deploy capital within specific price ranges using only one asset. This design increases returns, reduces exposure, and streamlines participation for both institutional and retail users.

By incorporating margin management and liquidation mechanics directly into the AMM, SynFutures tailors liquidity provision specifically for derivatives rather than spot markets. The result is a system that can handle leveraged positions, deliver tighter spreads, and reduce slippage, all while maintaining full decentralization.

On-Chain Order Book

Unlike traditional DEXs that rely solely on AMMs, SynFutures integrates a native, permissionless on-chain order book. This mechanism allows traders to place limit and market orders in a transparent environment without the need for external keepers or off-chain relayers. Every order is processed directly through smart contracts, ensuring censorship resistance and verifiable execution. This hybrid model creates a unified liquidity system, combining the flexibility of AMMs with the efficiency of centralized exchange-style trading.

Stabilization and Risk Management System

SynFutures V3 introduces a sophisticated set of mechanisms designed to stabilize markets and protect users. The protocol uses exponential moving averages (EMA) to smooth price fluctuations and prevent manipulation from flash loans or oracle attacks. A dynamic penalty fee system further discourages traders from executing transactions that deviate significantly from fair value, maintaining price integrity. Each pool operates in isolation, meaning that an exploit or liquidation in one pair cannot affect others. This risk isolation framework forms the backbone of the platform’s reliability and resilience.

Perp-Native Architecture

SynFutures is evolving into a perp-native protocol, optimized for high-speed perpetual trading. This upgrade includes a complete backend rewrite that targets on-chain order execution speeds near five milliseconds, matching the responsiveness of top centralized venues. The result is a trading experience that retains DeFi’s openness while achieving the efficiency expected by professional traders.

What Problems Does It Solve?

SynFutures addresses several critical pain points in both traditional and decentralized derivatives markets. This includes:

- Access Barriers – Derivatives have historically been reserved for institutions and professionals. SynFutures opens the door to retail users, allowing anyone to trade futures on any asset.

- Capital Inefficiency – Traditional AMMs require dual-token liquidity and suffer from high slippage. Oyster AMM introduces concentrated, single-token liquidity with leverage, dramatically improving capital efficiency.

- Market Fragmentation – Spot and derivatives markets are often siloed. SynFutures is building a unified liquidity layer that aggregates across spot, perp, and vaults.

- Transparency and Trust – Off-chain order books and centralized matching engines introduce opacity and risk. SynFutures’ fully onchain infrastructure ensures transparency, auditability, and censorship resistance.

- Risk Exposure – Flash loan attacks and oracle manipulation plague DeFi. SynFutures uses EMA-based mark prices, dynamic penalties, and isolated pools to mitigate these risks.

Utility and Offerings

SynFutures is a comprehensive financial ecosystem that delivers a broad suite of tools designed to empower traders, liquidity providers, and passive investors alike. Its goal is to build a fully integrated infrastructure for decentralized finance, combining efficiency, accessibility, and scalability. Key utility offerings include:

$F Token Utility

The $F token underpins the SynFutures ecosystem. It serves as a governance asset, granting holders voting power over key protocol parameters and future upgrades. Token holders can stake their $F to earn rewards, gain trading fee discounts, and participate in community-driven initiatives. With a capped supply of ten billion tokens, the $F economy is structured to incentivize long-term participation and decentralization.

Derivatives Trading

SynFutures enables futures and perpetual trading on a wide range of assets, including cryptocurrencies, NFTs, and RWAs. Its perp-native design supports leveraged trading with low slippage and deep liquidity, offering users the performance of a professional derivatives exchange in a decentralized format.

Wealth Management Vaults

Planned for early 2025, SynFutures’ wealth management vaults will allow users to passively allocate capital into protocol-driven strategies. These vaults will manage liquidity positions automatically, optimizing returns through the High Capital Boost automated market-making system. For users seeking yield without active management, these vaults represent a new opportunity to participate in professional-grade DeFi trading strategies.

Spot Aggregator and Launchpad

Beyond derivatives, SynFutures is expanding into spot markets with a DEX aggregator and a permissionless Spot Launchpad. The aggregator ensures users always trade through the most efficient liquidity routes, while the launchpad will allow new assets to be listed and traded on-chain instantly, leveraging the same Oyster AMM infrastructure that powers the derivatives markets.

Unified Liquidity Layer and AI Integration

By the end of 2025, SynFutures plans to merge its various liquidity pools—spot, perpetual, and wealth management—into a unified liquidity layer. This integration will create a single source of liquidity across the platform’s entire product suite, enhancing efficiency and yield potential. Alongside this, AI-driven agents will assist users by analyzing data, optimizing trade execution, and providing dynamic risk management recommendations in real time.

Ecosystem Highlights

SynFutures has built a robust and rapidly growing ecosystem. Key ecosystem highlights:

- Partnerships – Collaborations with Lido Finance introduced wstETH/ETH trading pairs. Router Protocol enables cross-chain asset swaps. Chainlink’s VRF ensures fair reward distribution.

- Institutional Interest – The platform raised $22 million in Series B funding led by Pantera Capital, with participation from SIG and other major players. This backing validates SynFutures’ infrastructure and growth potential.

- Adoption Metrics – Over 350 trading pairs listed and $330 billion in cumulative volume. The platform is expanding across chains and integrating with Base and Blast to become the top perp DEX in those ecosystems.

- Community Engagement – Seasonal airdrops, token reward programs, and builder initiatives foster a vibrant and participatory community. The transition to DAO governance will further decentralize control and empower users.

Roadmap and Plans Ahead

Looking ahead, SynFutures is advancing toward a full-stack onchain financial infrastructure with several key initiatives. This includes:

- Spot Aggregation Expansion — Launching a multi-network spot aggregator to deliver best-price execution and deeper liquidity across assets.

- Perpetual Upgrade — Enhancing perpetual trading with advanced tools, improved leverage control, and institutional-grade execution.

- Unified Liquidity Layer — Integrating all liquidity pools to form a single efficient trading and yield ecosystem.

- AI Agent Integration — Deploying AI assistants for trade optimization, risk management, and real-time market insights.

- Decentralized Governance — Transitioning to DAO-based control, empowering $F holders to shape future protocol decisions.

- Cross-Chain Expansion — Extending functionality to multiple blockchains for universal access and seamless asset interoperability.

Final Thoughts

In conclusion, SynFutures is constructing the technological backbone for on-chain derivatives and beyond. By merging AMM efficiency, order book precision, and unified liquidity under a single architecture, it bridges the gap between centralized speed and decentralized integrity. So, as the platform continues expanding into spot trading, wealth management, and AI-driven automation, it will be interesting to see how SynFutures redefines on-chain finance and positions itself as a leading force in the next evolution of decentralized markets.