- Fed signals two more cuts, boosting risk appetite across crypto.

- Sony applies for crypto banking charter, targeting stablecoin issuance.

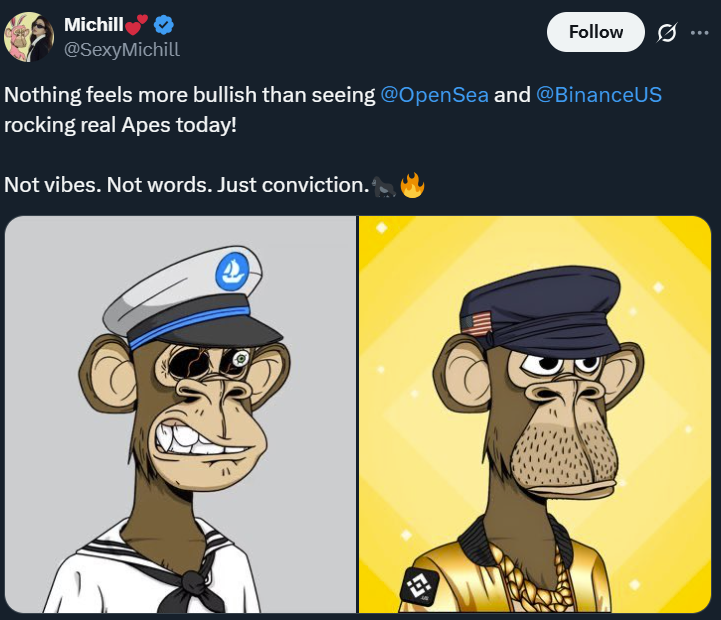

- OpenSea and BinanceUS reignite NFT buzz with Bored Ape profile swaps.

Crypto markets moved with renewed energy over the past 24 hours as macro signals, corporate ambitions, and cultural shifts collided. A fresh wave of optimism followed dovish remarks from the Federal Reserve, while major traditional players eyed digital finance more seriously. At the same time, a nostalgic spark from the NFT world stirred conversation. So, let us take a closer look at what drove the day in crypto.

Fed Hints at Softer 2025, Markets Lean Risk-On

The Federal Reserve’s tone shifted decisively as Governor Michelle Bowman revealed expectations for two more rate cuts in 2025, potentially lowering the Federal Funds rate to around 3.75 percent by year-end. Her comments pointed to a cooling labor market and contained inflation as key drivers of further easing, marking a turning point in the post-tightening cycle.

Crypto traders quickly reacted to the dovish outlook, with Bitcoin hovering confidently above the 110K mark and sentiment improving after weeks of fear-driven consolidation. A lower-rate environment historically fuels risk assets, and this signal from the Fed has reignited speculation that liquidity will once again flow toward digital markets in the months ahead.

Sony Makes a Power Play for Crypto Banking

Sony is taking a major step into the crypto economy, applying for a U.S. crypto banking charter through its affiliate Connectia Trust. The move aims to position Sony as a serious contender in digital finance, with plans to issue USD-pegged stablecoins and provide secure custody solutions. This development comes as global stablecoin circulation surpasses 312 billion dollars, drawing interest from corporate heavyweights.

The timing is strategic. The recently enacted GENIUS Act has opened the door for compliant digital banking innovation, and Sony appears ready to leverage its tech pedigree to build credibility in this fast-evolving sector. If successful, the company could emerge as one of the first established global brands to bridge mainstream finance and on-chain utility in a regulated environment.

OpenSea and BinanceUS Revive NFT Buzz With BAYC Twist

In a coordinated display of nostalgia, OpenSea and BinanceUS both changed their official X profile images to Bored Ape Yacht Club NFTs, sparking an immediate surge in NFT chatter and trading activity. The timing comes as the broader market weathers volatility, and the gesture injected a flash of personality into an otherwise cautious crypto landscape.

Analysts see the move as a subtle push to rekindle community excitement around digital collectibles. BAYC trading volumes jumped following the profile swap, a reminder that cultural engagement remains one of crypto’s most enduring market drivers.

Final Thoughts

Overall, the past 24 hours underscored a clear narrative: traditional institutions are moving deeper into crypto just as monetary policy turns more favorable. And with the Fed signaling rate relief, Sony entering the banking race, and NFT icons reclaiming the spotlight, the market appears to be setting up for a dynamic close to October.