- Whales accumulated heavily around $18, signaling strong long-term confidence.

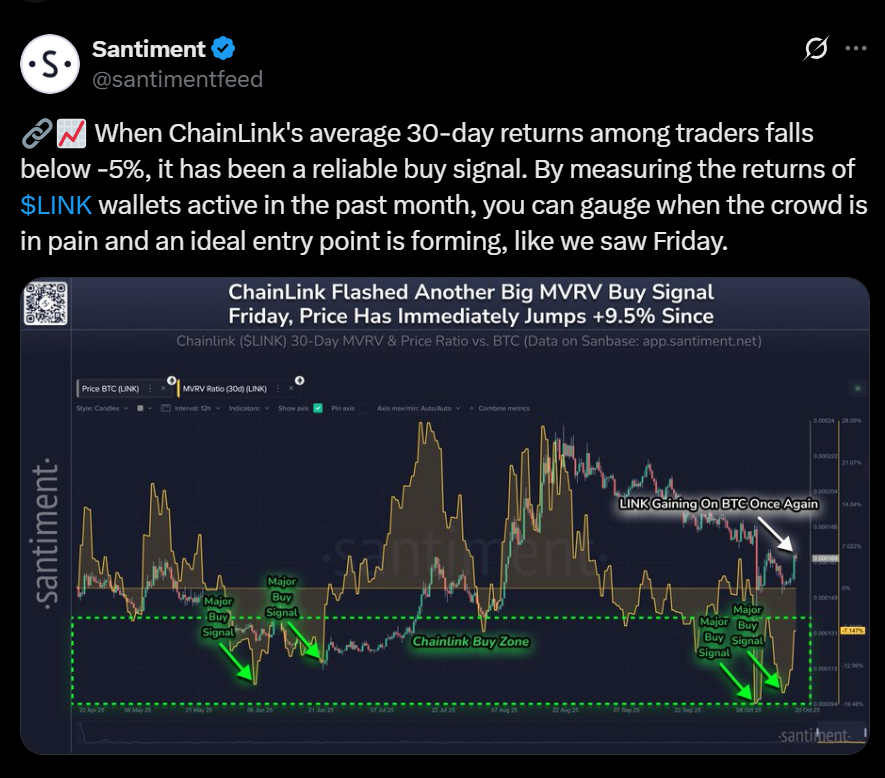

- MVRV ratio below -5% triggered a major buy signal on October 17.

- LINK’s $18 support holds firm amid rising staking participation and CCIP adoption.

Large-scale investors are ramping up Chainlink (LINK) accumulation as the token consolidates near the $18 support level. On-chain data shows a sharp uptick in whale activity, signaling renewed confidence in LINK’s mid-term outlook. The 30-day MVRV ratio fell below -5% on October 17, a level historically seen as a strong accumulation zone. Analysts now see potential upside toward $25 if buying pressure persists.

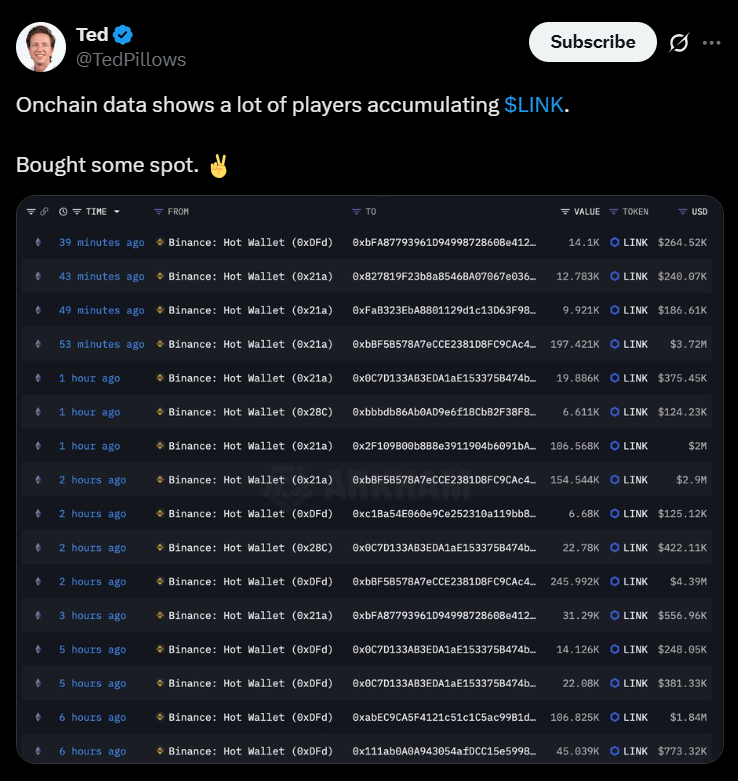

Recent Santiment data revealed that whales have been withdrawing millions of dollars worth of LINK from exchanges. Binance hot wallets alone processed over 440,000 LINK worth nearly $8 million, suggesting long-term positioning rather than short-term speculation.

Technical and On-Chain Indicators Turn Bullish

The Market Value to Realized Value (MVRV) ratio — a key sentiment metric — triggered a major buy signal as most short-term holders are currently at a loss. This environment has often marked the beginning of recovery phases. Following the signal, LINK’s price jumped 9.5% intraday, hinting that whales were actively accumulating.

Analyst Michaël van de Poppe highlighted the LINK/BTC structure, saying it “shows signs of a major breakout ahead.” Meanwhile, Chainlink’s staking upgrade has reduced token selling pressure, and adoption of its Cross-Chain Interoperability Protocol (CCIP) continues to expand across DeFi applications.

Institutional Positioning and Network Growth

On-chain trackers show heavy whale inflows during periods of LINK price compression — a sign of strategic positioning. Experts note that this mirrors past accumulation cycles when Chainlink later led altcoin rallies. Daan Crypto Trades commented that “LINK has historically outperformed the altcoin index during strong market phases,” with current metrics aligning with those setups.

Chainlink also leads in real-world asset (RWA) development, with 372 GitHub commits in the past 30 days. This fundamental growth reinforces its standing as a core infrastructure project in decentralized data and interoperability.

The Road to a $25 Breakout

If LINK maintains its foothold above $18 and network activity remains robust, analysts expect a push toward the $25–$27 range in the coming weeks. Technical models show a potential double-bottom structure forming, supported by steady whale inflows and stronger staking fundamentals.