- Wintermute moved 2.87 trillion SHIB ($36M) to Coinbase Prime from BitGo custody, sparking but quickly calming whale dump fears.

- The transfer was part of liquidity operations—not speculative selling—and had minimal impact on SHIB’s price.

- Institutional handling of large transfers like this boosts market trust and shows Shiba Inu’s growing presence in professional crypto circles.

A recent alert about a 2.87 trillion Shiba Inu token transfer — worth over $36 million — initially caused waves of speculation in the crypto space. Many mistook the movement as a whale dump during unstable market conditions, but digging deeper shows that this was actually Wintermute, a well-known market maker, shifting assets from BitGo to Coinbase Prime. This wasn’t a panic sell—it was part of routine operations for liquidity provision.

Wintermute’s Role and the Real Purpose Behind the Transfer

The transaction took place on June 4 at 21:24 UTC and was flagged by Whale Alert. However, it turned out that Wintermute had received 2.9 trillion SHIB and over 16,000 ETH from BitGo’s custody platform earlier that evening. These funds were then moved to Coinbase Prime—not for dumping—but to support market activities and ensure liquidity. Because Coinbase Prime caters to institutional clients, this points to strategic trading rather than any bearish intent.

No Panic Selling—SHIB Price Holds Steady

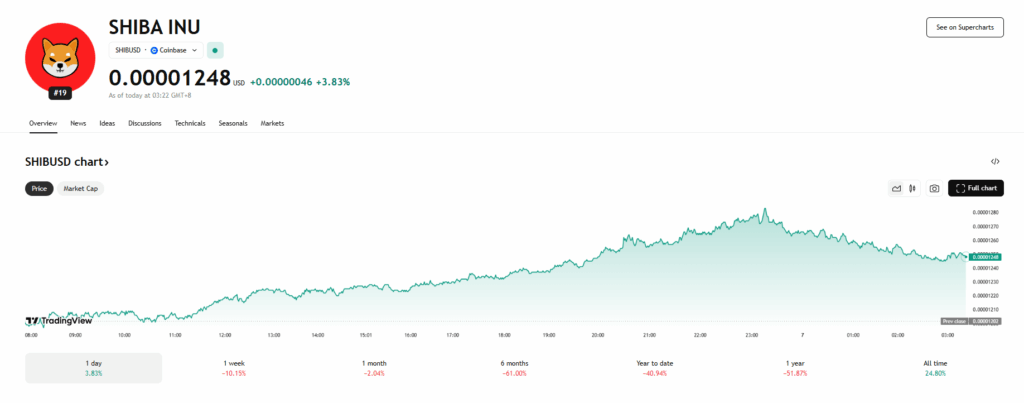

Despite the enormous volume involved, SHIB’s price remained largely unaffected. It was already slightly down for the day and didn’t see any sharp drops following the transaction. This stability reflects how professional crypto infrastructure—spanning BitGo, Wintermute, and Coinbase Prime—can handle massive movements without spooking the market.

What It Means for SHIB and Institutional Trust

Events like these highlight the difference between retail-driven panic and institutional-grade operations. Similar past movements, like Crypto.com’s massive SHIB reshuffle, didn’t rattle markets either. This latest transfer underlines that SHIB is increasingly part of the institutional crypto narrative, where big players operate calmly and securely, helping the token’s image as a more mature asset in a still-volatile space.