- Ethereum whale accumulation surged 2682% last week, and ETH-backed ETFs recorded their first net inflow in eight weeks, signaling a major shift toward bullish sentiment.

- Technical indicators show strong buying pressure, with Ethereum’s Balance of Power (BoP) positive and potential for a rally above $2,000 if momentum holds.

- Despite the bullish setup, downside risks remain, with a possible drop toward $1,385 if market sentiment turns negative.

Ethereum’s major players are making moves again. After weeks of market consolidation, it looks like some of the biggest ETH holders have decided it’s time to start scooping up coins — and they’re not doing it quietly either. On-chain data shows a clear uptick in whale activity, and for the first time in two months, Ethereum-based ETFs have flipped back to net inflows. The sentiment shift feels real — and it could mean a price surge is closer than most people think.

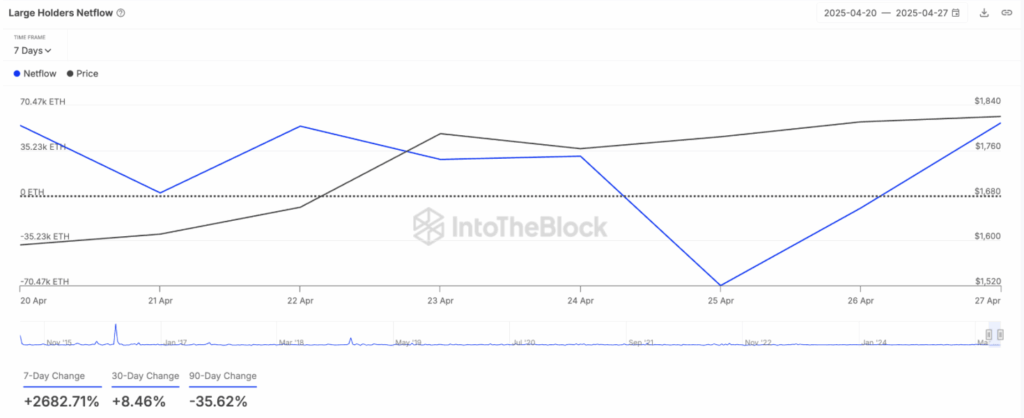

Whale Accumulation Hits Crazy Highs

According to the latest on-chain data, Ethereum’s large holders’ netflow spiked a massive 2682% over the past week. Yeah, not a typo — 2682%. Large holders are basically whale wallets holding more than 0.1% of Ethereum’s total circulating supply. When their netflow surges like this, it usually means they’re buying aggressively — not selling. Whales don’t mess around. When they start accumulating heavy, it’s usually because they’re seeing serious value at current prices… or maybe because they know something regular investors don’t.

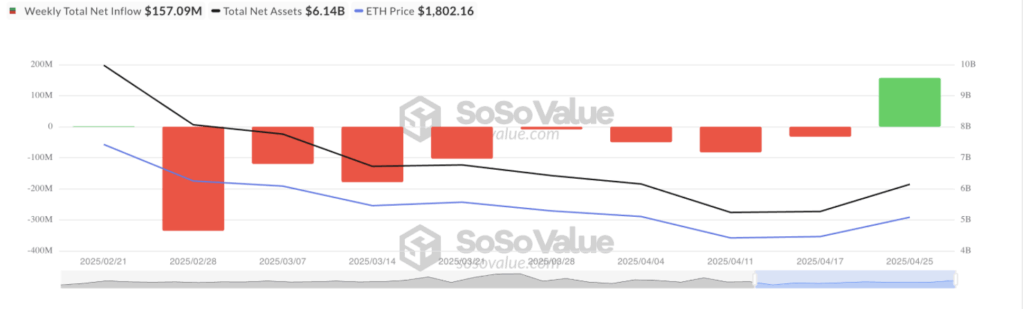

ETF Inflows Flip Positive for the First Time in Weeks

Adding even more fuel to the fire, Ethereum-backed ETFs just recorded their first net inflow in eight weeks. According to SosoValue, between April 21 and April 25, ETH-backed ETFs pulled in about $157.09 million — finally ending an ugly $700 million outflow streak. When institutional money starts coming back after weeks of bleeding out? Yeah, that’s not something you want to ignore. It’s a major shift in sentiment and could act as a launchpad for further price action.

Technical Indicators Flash Bullish

The technical side of the story is looking just as interesting. The Balance of Power (BoP) indicator for ETH is currently sitting at 0.31, which is positive. That basically means there’s more buying pressure than selling pressure right now — a bullish sign. If momentum holds, ETH could easily rally back above the key psychological level of $2,000, possibly trading up to around $2,027 in the short term. But — and it’s a big but — if market sentiment sours, Ethereum could give back those gains fast, with potential downside targets down at $1,385. So while things are looking good, it’s still smart to stay sharp.

Final Thoughts: Is ETH Preparing for Liftoff?

With whales stepping in, ETFs flipping green, and technical momentum picking up, Ethereum feels like it’s building toward a breakout. But like always in crypto — nothing’s guaranteed. Stay cautious. Stay curious. And keep an eye on those big wallets… because they might just be the ones showing us where ETH is headed next.