- Chainlink whales are monitoring key support as LINK trades above $22.

- Analysts forecast a rebound toward $30–$35 if the support zone holds.

- ETF filings and steady liquidity reinforce optimism for the next breakout.

Chainlink (LINK) has been holding firm near a critical support zone, with whale wallets quietly monitoring the next move. Analysts argue this area could act as the springboard for a bullish reversal. With fresh ETF headlines fueling optimism, LINK is entering a pivotal week where technicals and fundamentals appear to align.

Chainlink Price Prediction: Strong Support and ETF Buzz Fuel Optimism

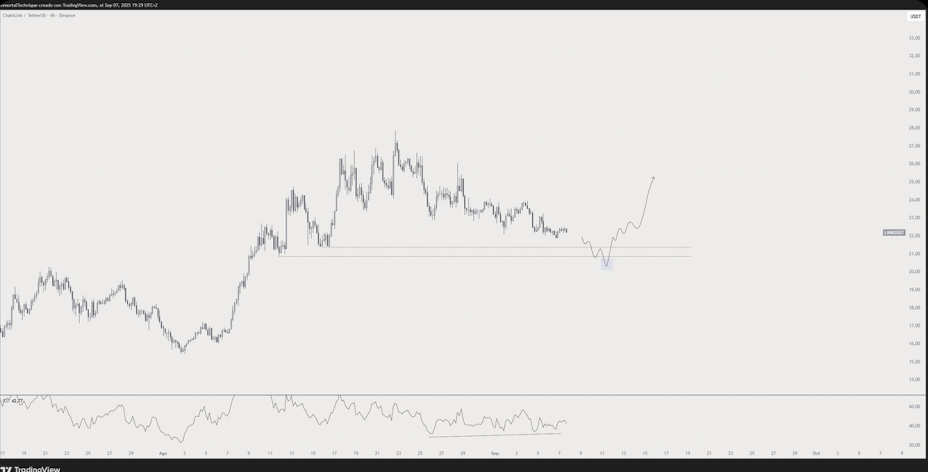

Crypto analyst Inmortal outlined a scenario where LINK dips slightly deeper into support before rebounding sharply. Such a move could mark the end of the pullback and set the stage for a rally toward the $30–$35 range. These levels coincide with previous resistance areas, making the current support zone a key make-or-break level for the next leg higher.

Adding to the bullish outlook, analyst Lark Davis highlighted Grayscale’s filing for a Chainlink ETF. If approved, institutional inflows could lift demand and push LINK further into mainstream adoption. Together, technical stability and ETF momentum strengthen the case for a potential breakout.

Chainlink Market Data Shows Resilience Above $20

According to BraveNewCoin data, LINK is trading at $22.44, up 0.81% in the past 24 hours. Its market cap sits near $15.23 billion with daily turnover of $455.6 million, confirming strong liquidity. Despite market volatility, LINK has held above $20 for weeks, a sign that selling pressure is being absorbed. Analysts see this consolidation as accumulation, suggesting the foundation for a larger move upward.

Chainlink Momentum Levels to Watch: $21 Support, $30 Target

At press time, TradingView shows LINK at $23.12, with intraday highs near $23.20 and lows at $22.23. Bollinger Bands highlight immediate resistance at $23.95 and strong support at $21.10. The Chaikin Money Flow (CMF) sits at -0.02, reflecting mild outflows but near-neutral sentiment.

If buyers defend $21 and momentum strengthens, LINK could target $26.81, $27.87, and eventually the $30–$35 range. Failure to hold support may lead to extended consolidation before another attempt higher.

Chainlink Outlook: Is LINK Ready for the Next Breakout?

Between whale accumulation, steady market data, and ETF momentum, Chainlink’s setup looks increasingly bullish. The coming days will determine whether support holds strong and launches LINK toward higher price ranges—or if the market stalls for another consolidation phase.